Despite the surging demand for the chips needed to power AI, the AMD share price has risen by only 4.5% since the start of the year. However, AMD stock could rally in the second half of 2024 as companies look for alternatives to Nvidia.

What is AMD?

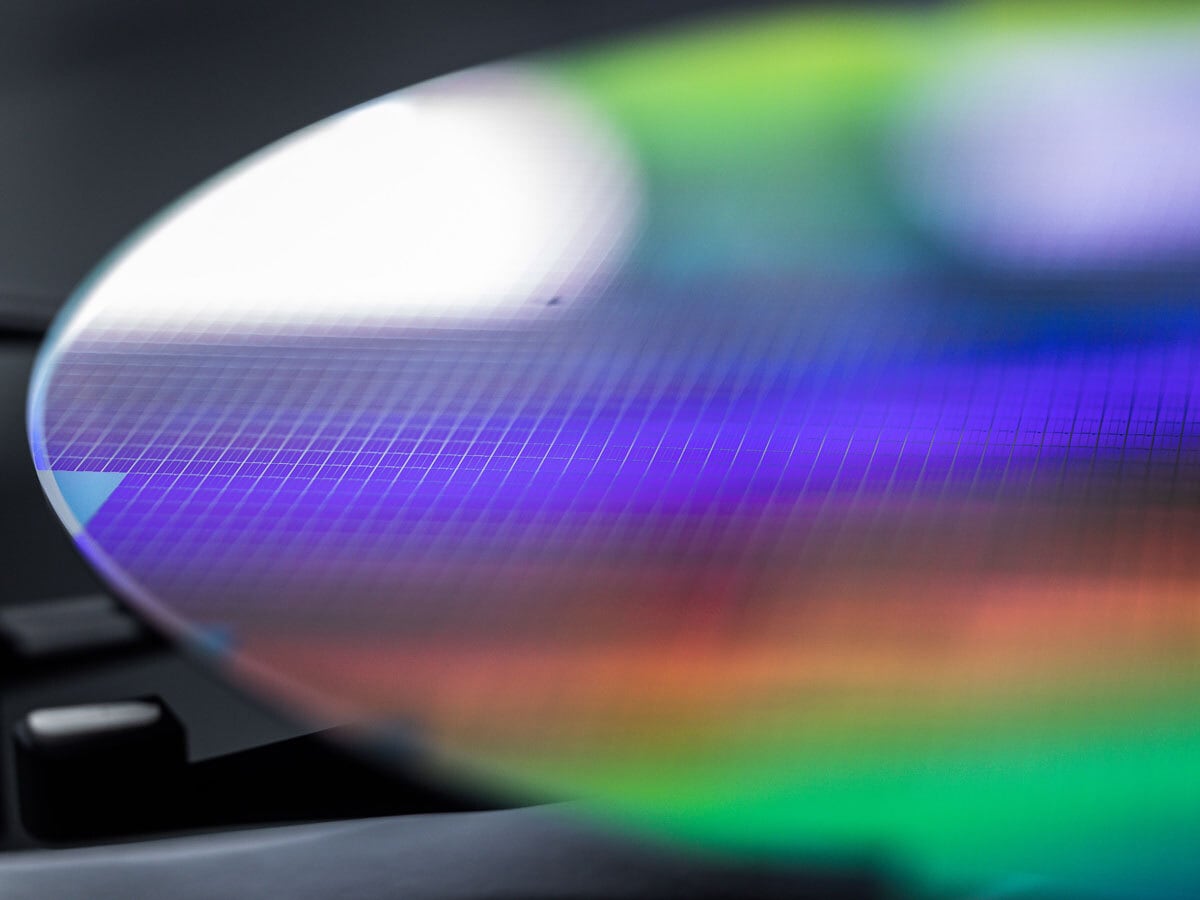

Advanced Micro Devices [AMD] is a semiconductor company based in Santa Clara, California.

The latest data shows the company is the sixth-biggest semiconductor stock by market capitalisation, behind ASML [ASML], Samsung Electronics [SSNLF], Broadcom [AVGO], Taiwan Semiconductor Manufacturing Co [TSM] and the king of chipmakers, Nvidia [NVDA].

This stock spotlight will highlight what AMD is doing to chip away at Nvidia’s dominance, especially in the artificial intelligence (AI) arena, and what this might mean for AMD stock going forward.

It will also discuss how AMD is looking to gain an edge over Qualcomm [QCOM] and Intel [INTC] in the AI PC race.

AI Moves Boost AMD Stock

Like other major chipmakers, AMD has been pushing aggressive AI strategies this year and rushing to launch new products in order to stay ahead of the competition.

In its bid to compete with Nvidia, AMD announced on 10 July that it has agreed to acquire Finnish start-up Silo AI for $665m.

The deal “will further accelerate our AI strategy and advance the build-out and rapid implementation of AI solutions for our global customers,” said AMD Senior Vice President Vamsi Boppana in a press release.

At the COMPUTEX conference held in Taipei in June, AMD introduced the MI325X accelerator, which it expects to be available from Q4 2024.

“AI is our number-one priority and we’re at the beginning of an incredibly exciting time for the industry as AI reshapes every part of the computing market,” said CEO Lisa Su in her keynote address. She also unveiled the MI350 accelerator, which AMD is planning on launching mid-2025.

Has AMD Stock Rallied Recently?

Despite being considered an AI stock, the AMD share price is only up 4.5% year-to-date as of 23 July and down 8.4% over the past six months. Compare this to Nvidia, which has rocketed 147.6% year-to-date and 105.5% over the past six months.

The AMD share price may not appear to be trading like an AI stock in 2024, but when it comes to whether the company can challenge Nvidia’s dominance, the proof will be in the pudding.

Want to invest in AMD? Download the OPTO app today.

Comparing AMD, Nvidia and Intel’s AI Chip Growth

AMD swung to a net profit of $123m in Q1 2024 from a net loss of $139m in the year-ago quarter.

Data centre revenue jumped 80% year-over-year to $2.3bn for the three months to the end of March, thanks largely to demand for its MI300 series accelerators. Su said on the Q1 earnings call that customers of MI300 chips include Meta [META], Microsoft [MSFT] and Oracle [ORCL].

AMD expects data centre GPU sales to generate $4bn in revenue in 2024, up from a previous projection of $3.5bn. Intel expects sales of its Nvidia challenger, the Gaudi 3 accelerator — which launched in Q2 — to be $500m in the current fiscal year. AMD and Intel’s numbers pale in comparison to the $100bn that analysts forecast Nvidia’s data centre chip business will generate between February 2024 and January 2025.

| AMD | NVDA | INTC | |

| Market Cap | $248.91bn | $3.01trn | $140.26bn |

| P/S Ratio | 11.02 | 38.32 | 2.53 |

| Projected Revenue Growth (2024) | 12.8% | 98.2% | 2.7% |

| Projected Revenue Growth (2025) | 27.7% | 36.4% | 12% |

Source: Yahoo Finance

While Nvidia’s revenue is projected to grow faster, the metrics show that AMD is the cheaper stock and is arguably more fairly valued.

AMD Stock: The Investment Case

The Bull Case

A number of new products are boosting AMD’s performance in the AI PC race.

The Ryzen 300 series AI chips helped AMD to gain CPU market share in Q1 2024. According to Mercury Research, it had a 23.9% share in the desktop CPU market in that quarter, up from 19.2% in Q1 2023, while its mobile CPU share came in at 19.3%, up from 16.2%.

The market share could continue to grow following the launch of its Ryzen AI 300 series chips. Multiple ASUS [ASUUY] laptops sporting these processors are being released on 28 July.

Such new releases underline the ongoing race for semiconductor supremacy. The Ryzen AI 300 Series will be able to deliver 50 TOPS, a measure of AI processing power — Intel’s Lunar Lake and Qualcomm’s Snapdragon X Elite chips boast 48 and 45 TOPS, respectively. AI PCs and laptops are expected to become extremely popular as consumers look for devices with the ability to handle AI applications and process large amounts of data at speed.

The Bear Case

Given that its AI push looks like it could help AMD stock to rally for the rest of the year, you would be forgiven for not seeing a bear case.

However, unconfirmed reports emerged last week that the Biden administration is considering introducing tougher restrictions on chip exports to China. Former President Donald Trump also made comments last week that could spook the semiconductor industry.

“Taiwan took our chip business from us,” he told Bloomberg Businessweek, adding that Taiwan should have to pay the US to defend it.

Investors will need to wait to see what transpires following November’s US presidential election and what the result could mean for AMD. The company earned 15% of its revenue in China in 2023. It should be noted, however, that this is lower than Intel (27%) and Nvidia (20%).

Conclusion

While the AI frenzy is red-hot, there is no knowing for sure when AI fatigue will hit enterprises and consumers. If the AI bubble were to suddenly burst, then AI stocks could see a sharp selloff.

As it stands, AMD does not seem to be overvalued and the company is poised to benefit from a rising demand for AI applications and AI PCs. But it is important to remember that any semiconductor stock can be subject to volatile trading, especially during periods of geopolitical uncertainty or supply chain disruptions.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy