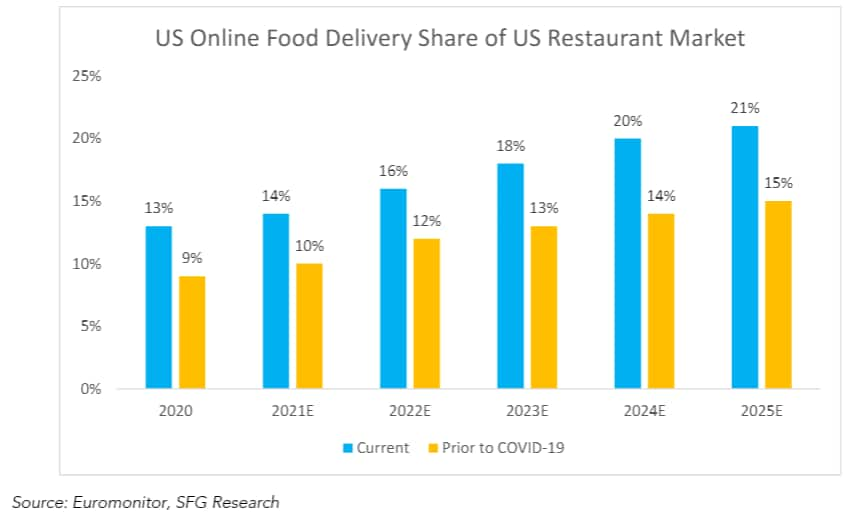

In 2020, the pandemic showed the importance of technology in the restaurant industry, as the names that had invested in digital were able to quickly adapt to the changing consumer dynamics and offset the severe sales losses that other industry players suffered.

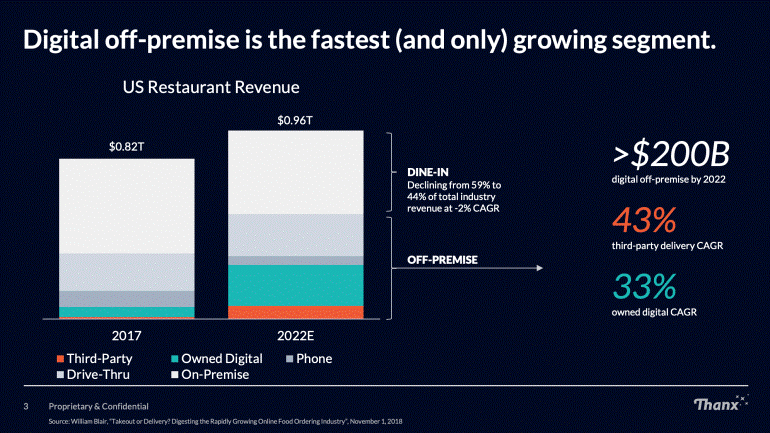

As restaurants were forced to close worldwide, it became paramount to have an application for digital ordering. Not only does this build out customer loyalty, it handles the logistics of providing takeout and delivery while in-house dining faces a volatile near-term future. It has also led to the popularity of Ghost Kitchens, professional food preparation and cooking facilities set up for the preparation of delivery-only meals.

All these elements fall under the broader Direct-to-Consumer theme basket, which incorporates a move to on-demand consumption and an overall desire for convenience. Digital Kiosks is another trend in this industry, expected to reach $30.8bn by 2024, growing around a 9% CAGR.

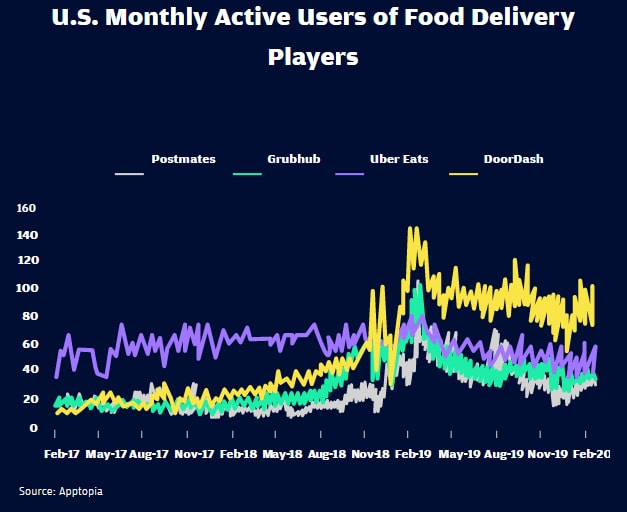

The food delivery industry has just a few large players and is fiercely competitive. We saw consolidation in 2020 with Uber [UBER] acquiring PostMates and Just Eat Takeaway [JET] acquiring GrubHub. Off-premises restaurant dining is a $300bn+ market opportunity and current penetration by the large delivery players is minimal. Doordash [DASH] recently came public and owns circa half of the US food delivery market as it takes market share in cities after already having a substantial share of the suburbs.

Doordash and others also have a long runway of opportunities to expand into new verticals like grocery (online penetration is just 2-3%) or gifts, in a push to “everything-on-demand.” Take rates are an important metric for on-demand delivery marketplaces and look to have plenty of room for expansion over time. The global online food delivery services market is expected to grow from $108bn in 2019 to $155bn in 2023 at a CAGR of 11.51%. Lyft [LYFT] is expected to make a push into food delivery in 2021.

Ghost Kitchens are quickly gaining popularity and Euromonitor says it could create a $1trn global opportunity by 2030. The firm predicts cheaper, faster and more reliable delivery could help this segment capture 50% of drive-thru service ($75bn), 50% of takeaway foodservice ($250bn), 35% of ready meals ($40bn), 30% of packaged cooking ingredients ($100bn), 25% of dine-in foodservice ($450bn), and 15% of packaged snacks ($125bn).

$1trillion

Potential Ghost Kitchen industry value by 2030

Ghost Kitchens offer a major value proposition to the industry, allowing lower costs from wages and rent to grow margins. It is potentially a major opportunity for the delivery platforms to leverage their technology to partner with key influential people or brands in order to launch concept menus without much capital risk.

Morgan Richert, senior food analyst at GlobalData, notes: "The biggest winners with these partnerships will be the delivery companies, because they're gaining loads of consumer data and eventually they're going to be able to map cities by demand points for different cuisines." The number of Ghost Kitchens is expected to grow ten-fold over the next decade.

Restaurants with a strong digital presence include Starbucks [SBUX], Domino’s [DPZ], Chipotle [CMG], and WingStop [WING]. Limited service chains stand to benefit from market share gains with a stronger digital infrastructure, lower tickers, and likely share gains from small restaurant closures. Many new restaurant openings are keeping in mind the accelerated new trend shifts and providing greater access points for drive-thru and curbside pick-up while keeping dining areas smaller.

These four names have been steadily gaining market share annually in their respective categories. Chipotle’s digital sales mix increased from 20% in the fourth quarter of 2019 to more than 60% in the second quarter of 2020. WingStop saw similar gains, jumping from 30% to nearly 65% over the same period. Research firm Incisiv finds that digital sales will make up more than half (54%) of limited-service and quick-service business by 2025.

Boston Consulting Group estimates digital orders make up more than 30% of the market currently and over $100bn in sales up for grabs. Delivery’s market share jumped from 7% in 2019 to circa 20% in 2020. They also note that in the quick-service, fast casual, and casual dining categories, purchase frequency is about 50% greater for digital customers than for non-digital customers.

$100billion

Estimated digital order sales

“The global market size in restaurant tech has been pegged around $12 billion, a number only said [sic] to grow as brands invest in providing engaging digital experiences from ordering to promotions and delivery,” QSR Magazine notes. Technology is also opening up further opportunities for restaurants to utilise personalised marketing and enhance loyalty programs which tend to lead to higher customer ordering patterns.

In closing, the restaurant industry is a massive component of the DTC theme. There are several technological shifts, accelerated by the pandemic, that are set to continue to gain penetration and provide ample growth opportunities for food delivery platforms as well as the digital leaders in the restaurant industry.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy