Roku stock has had a rocky 12 months, but a recent downturn presents a buying opportunity that ARK Invest’s Cathie Wood has eagerly embraced.

Roku [ROKU] is a streaming business that builds a variety of hardware products for TV and audio entertainment, including streaming sticks, smart TVs and speakers, as well as smart home devices such as smart lights, video doorbells and cameras.

This analysis will compare Roku’s stock, share price and fundamentals to some of its high-profile competitors in the streaming devices industry. It will then examine the bull and bear cases for investing in ROKU stock.

ROKU Stock Hit by Market Downturn

Roku’s share price had fallen 36.8% year-to-date, and 31.7% over the 12 months leading up to 14 August. It has, however, held relatively steady over the past three months, falling just 9.72% during that period.

Roku stock fell 7.41% on 24 July, as part of a broader market downturn that hit technology stocks particularly hard in the wake of weak earnings from Alphabet [GOOGL] and, especially, Tesla [TSLA].

ARK Snaps Up ROKU

The recent dip in tech share prices appears to have prompted a buying spree for Cathie Wood’s ARK Invest.

Across two ARK funds — the flagship ARK Innovation ETF [ARKK] and the ARK Next Generation Internet ETF [ARKW] — Wood bought a total of 34,681 Roku shares on 5 August, 17,676 on 7 August, and 1,154 on 9 August, totalling 53,511 shares through the week, according to data from Cathie’s Ark. These purchases amounted to a total value of $2.79m, based on the closing price of the stock on each day.

Key Fundamentals and Financial Health

Roku faces stiff competition. Streaming is an increasingly crowded market; entrants come well-equipped and, often, well-funded.

Take Amazon [AMZN]. Not only does Prime Video represent a significant player in streaming, but Amazon is a direct competitor for Roku’s devices market. Roku’s Form 10-K underlines that Amazon’s streaming devices, smart TVs and smart home devices compete with Roku’s within the ecosystem.

Alphabet [GOOGL] is another competitor mentioned in Roku’s 10-K. Its Chromecast device is regarded as one of the best streaming devices currently available, alongside Roku’s Streaming Stick 4K and Express 4K Plus, and Amazon’s Fire TV Stick 4K Max.

| ROKU | AMZN | GOOGL | |

| Market Cap | $8.13bn | $1.79trn | $1.98trn |

| P/S Ratio | 2.15 | 2.99 | 6.15 |

| Estimated Sales Growth (Current Fiscal Year) | 14% | 10.5% | 13% |

| Estimated Sales growth (Next Fiscal Year) | 12.9% | 10.7% | 11.2% |

Source: Yahoo Finance

Roku, on the face of it, looks like a well-priced investment compared to Amazon or Alphabet. It is expected to post the highest revenue growth this year and next, but is also the cheapest stock compared to current revenue out of the three.

This relatively low valuation likely reflects the fact that, unlike Amazon and Google, Roku is not profitable as of Q2 2024. It posted losses of $5.01 per share in 2023 — a widening of 38.4% compared to the previous year — and $0.24 in Q2 2024.

ROKU Stock: The Investment Case

Is Roku worth buying now given its lack of earnings? It has a high-growth sector on its side, but the competitive pressures it faces could be too intense.

The Bull Case for Roku

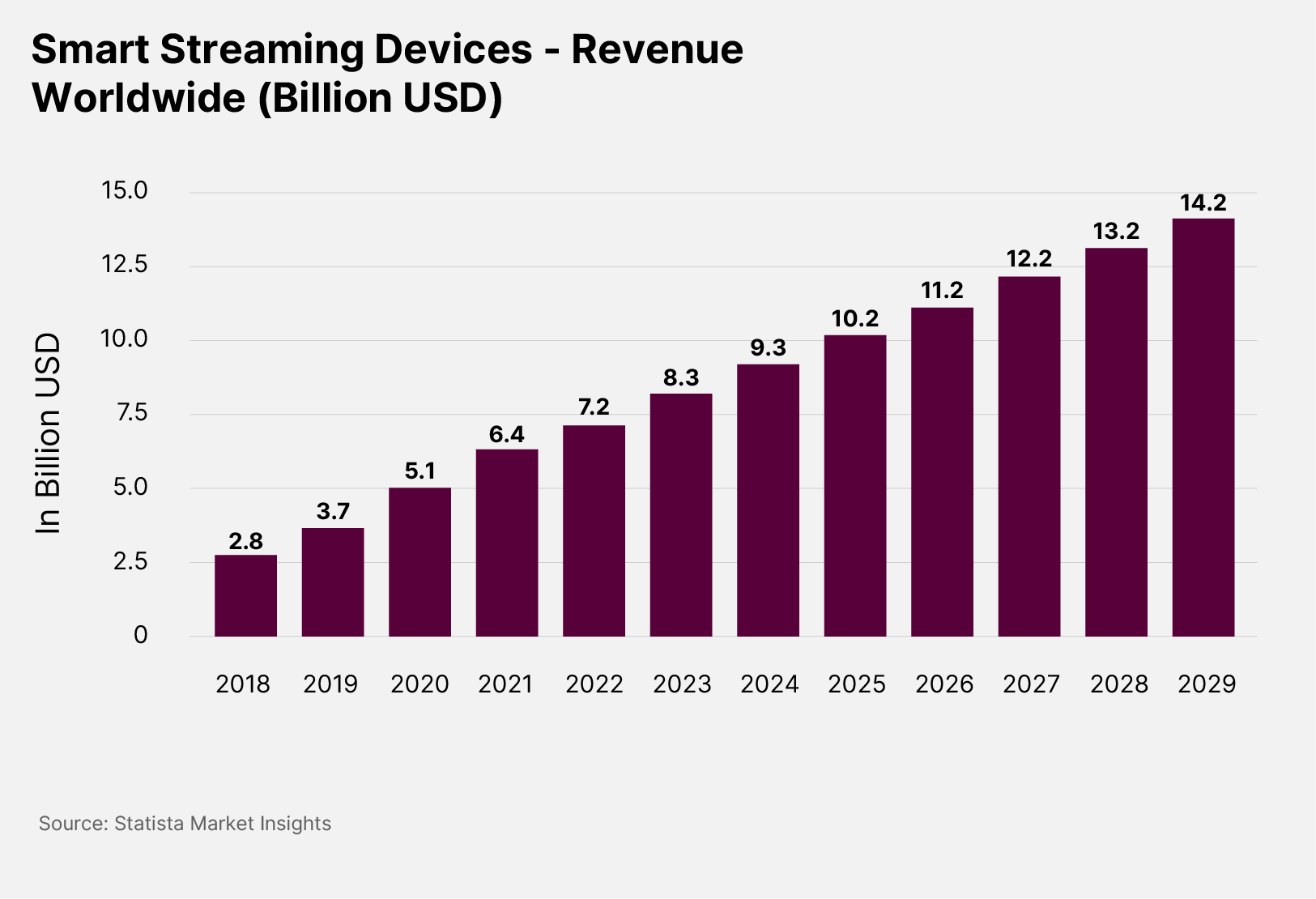

The smart streaming devices market is expected to post solid growth numbers over the coming years. Statista Market Insights data predicts the market will be worth $9.2bn in 2024, and that it will reach $14.2bn by 2029 — implying an 8.98% CAGR during the forecast period.

Roku is a leader within this market, with a 32% share of total revenue in 2022. This was more than Google and Amazon’s combined total of 22% during the year.

There is also a potential advantage in Roku’s relatively small size compared to its competitors, which are heavily diversified technology companies. Roku, by contrast, is a specialist in its field, and as such can potentially focus more clearly on developing best-in-class products for this market.

The Bear Case for Roku

The competition in Roku’s sector is intense.

As well as Amazon and Alphabet, Nvidia [NVDA] and Apple [AAPL] are active players in the streaming devices industry; in other words, Roku competes directly with four of the ‘magnificent seven’.

As Roku makes clear in its 10-K, the size and resources these competitors have relative to Roku potentially make them more attractive prospects for advertisers, and could give them greater pricing power when selling their products through traditional retailers.

Roku is also loss-making.

Its losses widened in the most recent financial year, and FactSet analysts do not expect it to post a full-year profit until 2027. By contrast, its closest competitors include some of the most profitable companies in the world. Whether their streaming devices divisions are profitable or not, these businesses may be better positioned than Roku to sustain losses over a longer period, and could potentially use this advantage to price Roku out of the market.

Conclusion

Cathie Wood appears to back the long-term investment case for Roku, but there is a great deal of uncertainty around the stock and its profit timeline. Investors should conduct thorough independent research before reaching any investment decision.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy