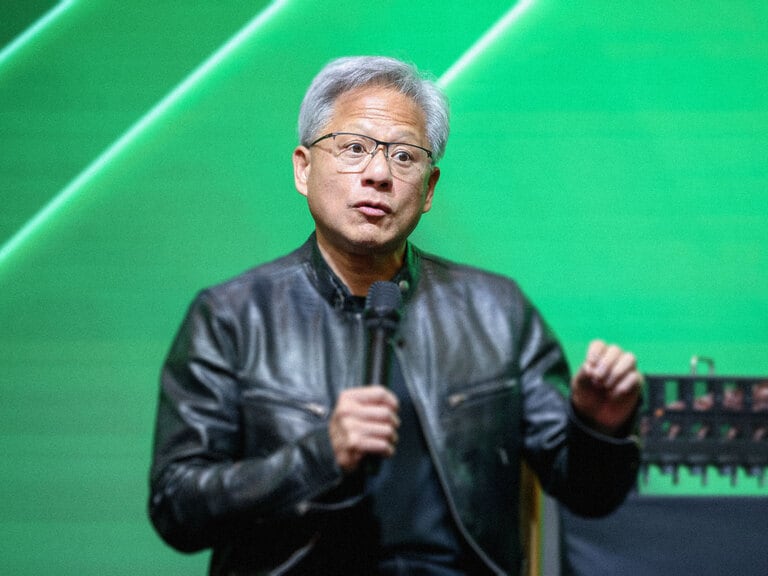

Dan Tapiero, Managing Partner, CEO and Chief Investment Officer of 1RoundTable Partners and 10T Holdings, and Anthony Scaramucci, Founder and Managing Partner at SkyBridge Capital, joined OPTO Sessions to discuss the rising popularity of cryptocurrencies in the US and the impact this is having on US presidential election campaigns.

There is little doubt that the launch of spot bitcoin ETFs in January prompted a step change in bitcoin adoption.

As Dan Tapiero, Managing Partner, CEO and Chief Investment Officer of 1RoundTable Partners and 10T Holdings, pointed out, to investors who were historically cautious about getting directly involved in cryptocurrencies via Coinbase [COIN] or Kraken wallets, ETFs offer access to the world of digital assets through a medium they consider safe and familiar.

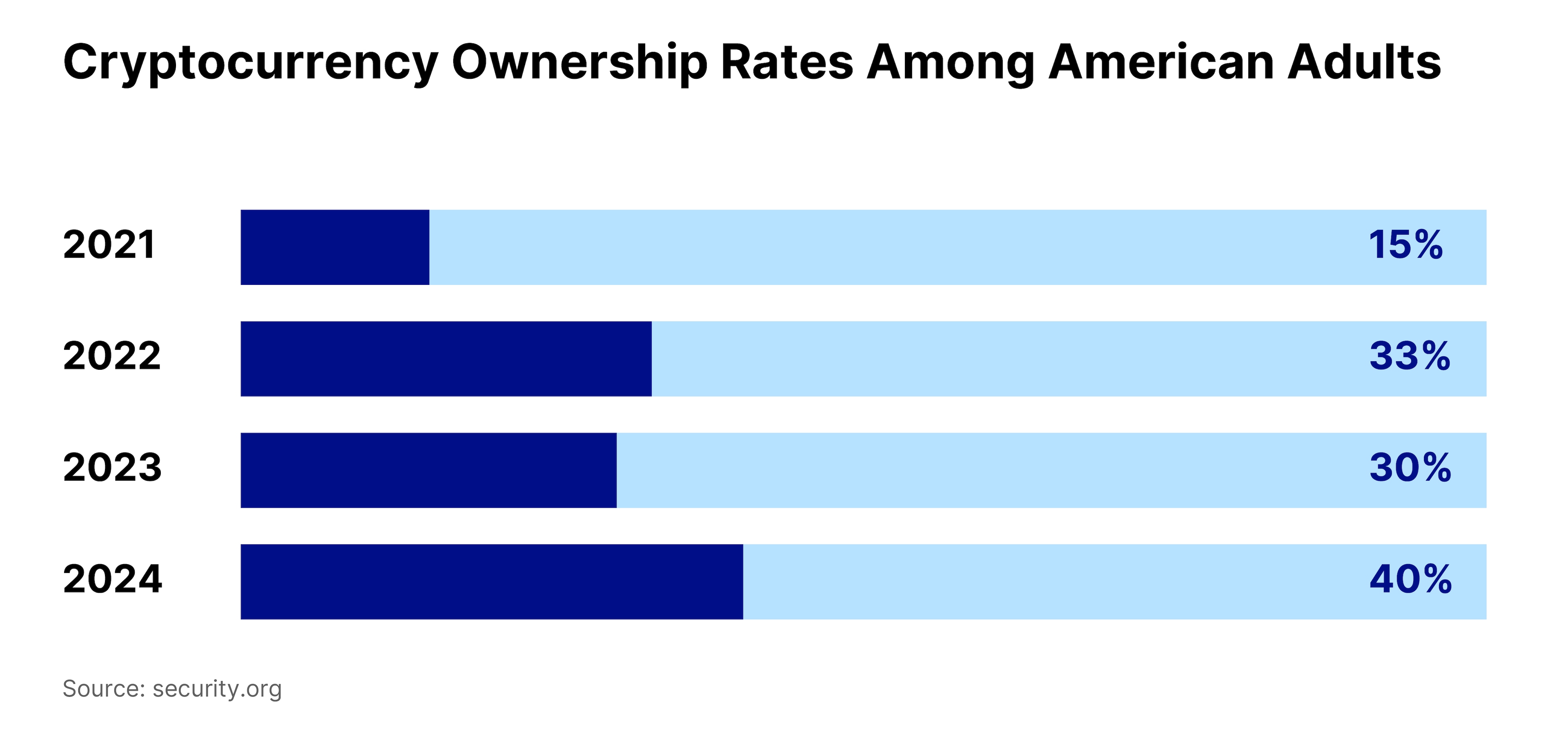

The impact of this change is already manifest. According to research from Security.org, 40% of American adults now own cryptocurrencies, up from 30% in 2023.

However, Tapiero doesn’t think that spot crypto ETFs alone will drive digital assets to the next significant phase of adoption. Over the next five years, he believes that more publicly listed crypto businesses will drive the theme’s growth.

“In five years from now, Coinbase is not going to be the only public, large crypto blockchain business in the world,” he said. A wave of public listings of the kind of companies in which his fund invests will, he believes, drive a crypto M&A cycle, and he pointed to Robinhood’s [HOOD] $200m acquisition of the Bitstamp exchange this month as an early example of this.

It is significant for Tapiero that ethereum ETFs have recently been granted the first stage of approval by the Securities and Exchange Commission (SEC). Ethereum, he said, is a more complex proposition to the traditional retail investor than bitcoin. As such, he argued that ethereum adoption will force a greater level of inquiry into broader blockchain technology — and generate the level of public interest that will enable more digital asset companies to go public.

The SEC’s ethereum ETF approval has also put an end to an inquiry into the status of ethereum 2.0, which the SEC instigated in March. The investigation was premised on the assumption that ethereum was categorised as a financial security. However, Consensys Software, which makes the MetaMask Ethereum wallet, requested a clarification from the SEC after its spot ethereum ETF approval, which was granted on the basis that ethereum is a commodity.

In a post on X, Consensys called the decision to mothball the investigation “a major win for Ethereum developers, technology providers and industry participants”.

The Politics of Crypto

“We’re through the regulatory chasm,” Anthony Scaramucci, Founder and Managing Partner at SkyBridge Capital, told OPTO Sessions.

Ahead of this year’s US presidential election, he explained that both candidates — incumbent President Joe Biden and former President (and briefly Scaramucci’s boss) Donald Trump — have shifted their stances on digital assets in a more positive direction.

“Trump is pro-bitcoin. Biden is supposedly pro-bitcoin, but Trump was against bitcoin before he was for it. It feels like Biden is pivoting, now, closer to digital assets.”

Trump restated his objective of ending “Joe Biden’s war on crypto” at a rally in Racine, Wisconsin, this week. “We will ensure that the future of crypto and the future of bitcoin will be made in America,” he told the crowd.

“We’re through the regulatory chasm.” —Anthony Scaramucci

On 17 June, Jacob Martin, Co-founder of 2 Punks Capital, told CNBC Crypto World that he and other crypto advocates have been calling for lawmakers on both sides of the political divide in the US to adopt clearer stances and friendlier policies towards crypto companies.

“Coinbase’s reach overseas is growing, mainly because it’s not really comfortable here in the US,” he said. “They keep getting sued. The SEC has gone after Coinbase repeatedly… after asking for years what the rules should be.”

The Age of Digital Assets

However, Scaramucci clearly believes that the tide is turning. He pointed out that “the average age of the people that are voting for it, Republican or Democrat, are in their 40s, while the people voting against it are in their 70s and 80s”.

This is borne out by Security.org’ s analysis, which found that ownership of cryptocurrencies is similar across age groups except in the 60+ cohort, which “were significantly less likely to hold cryptos than the younger cohort”.

Implicitly, therefore, Scaramucci believes that US policy will become more pro-digital asset over time. “Where we have to look now is use cases.”

“The money has caught up with the technology and can be delivered at the speed of light, in a way that is unbelievably secure,” said Scaramucci.

“I can email money anywhere I want in the world.”

“The code is unhackable,” added Tapiero. “That’s the innovation, that it’s completely secure.”

“This digital asset ecosystem shouldn’t be seen as a threat. It’s an opportunity for some of the old guys to adapt.” —Dan Tapiero

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy