In 2020 we saw monumental shifts to remote-working, which also triggered a surge in gig opportunities, thanks to work schedule flexibility. This is disrupting several industries, with themes like mobility and the connected economy facilitating the change. I take a look at the evolving gig economy, and the stocks set to benefit from its success.

What is a gig economy?

A gig economy is a free market system in which temporary positions are common and organisations hire independent workers for short-term commitments to suit the needs of their business. As its name suggests, it was historically used in the arts industry, with reference to musicians’ gigs, but has now spread across other industries such as Information Technology, Media, Construction, and Transportation.

The gig economy and WFH

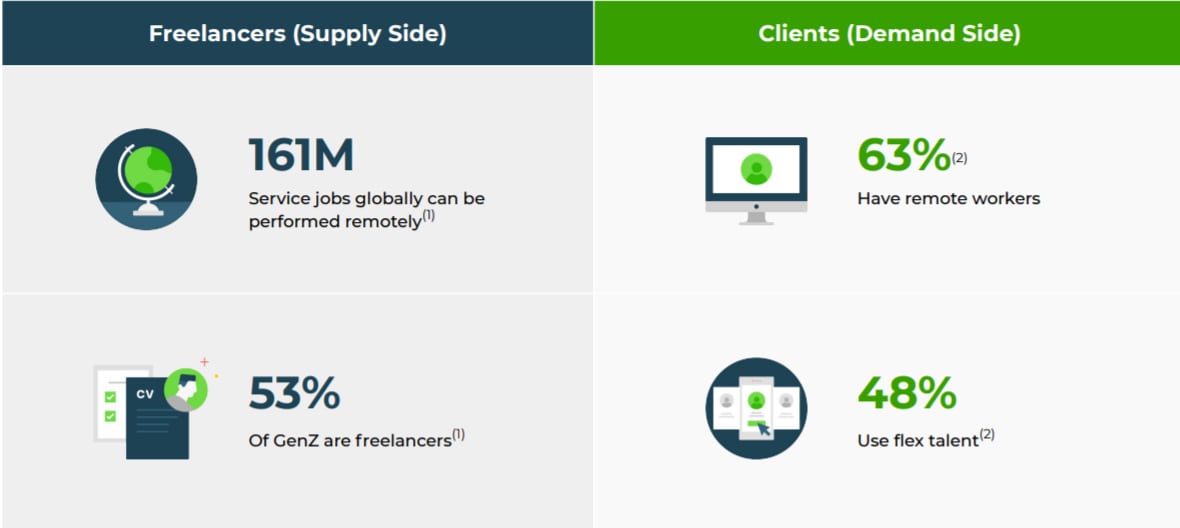

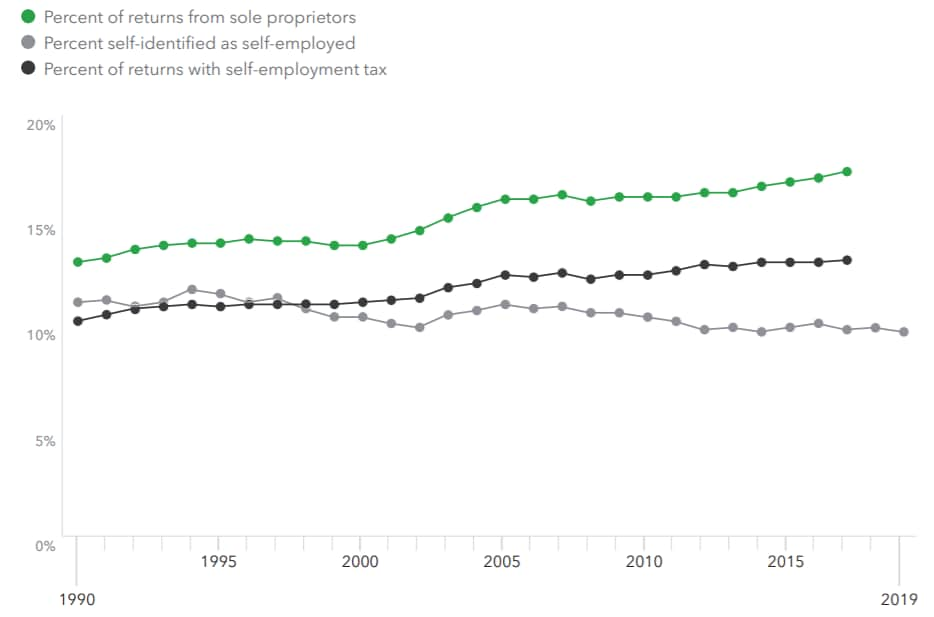

The increased popularity of technology platforms has facilitated easier transactions, transparency, and payments in the gig economy. Gig workers tend to be divided into two categories: service providers and goods suppliers. Early in 2020, ADP estimated the share of independent workers in the US stood at 16%, a fifteen percent jump from 2010, with more than six million additional gig workers today than a decade ago. The US Bureau of Labor Statistics (BLS) projects there will be 10.3 million self-employed workers by 2026, growing at a 7.9% CAGR.

The Freelancing in America 2020 report estimates more than 1/3 of the American workforce freelances, contributing $1.2trn to the US economy, a 22% rise from 2019 with an influx of younger, highly skilled professionals seeking flexible alternatives to traditional employment. As remote work gains in popularity, businesses can advertise freelancing gigs as a cost efficient way to find highly skilled workers without the need to provide full employment and the associated benefits.

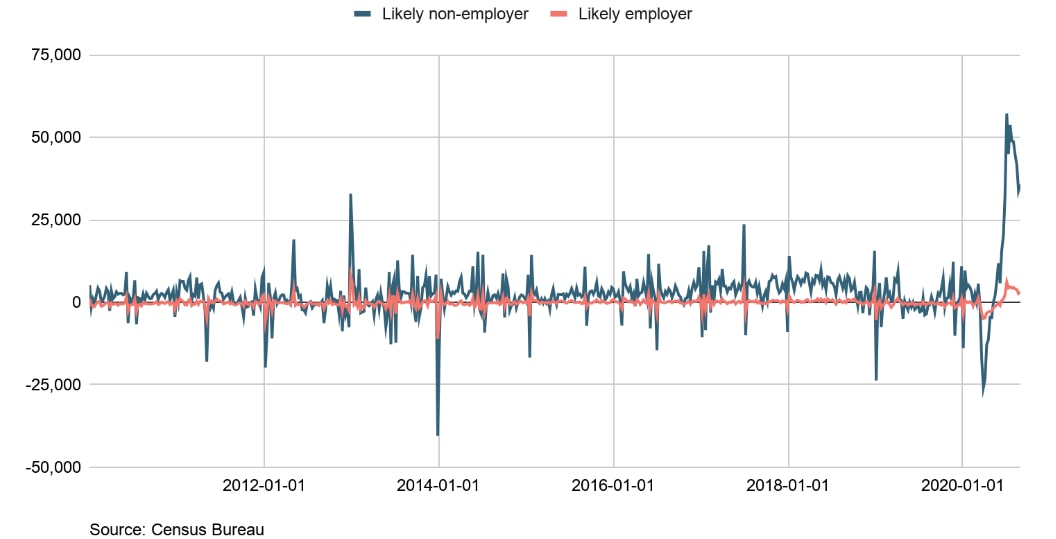

The BLS also shows non-employer business applications are skyrocketing, which points to more freelancing.

Gig workers

This new era of employment is resulting in substantial growth for several companies. Tim Robbins, VP of staffing and recruiting at Monster, believes that the pandemic-fuelled trend of using temporary workers to handle ebbs and flows in demand will continue well into 2021 — especially in certain industries.

“There’s been a strategic shift happening where employers competing in the war for skilled talent have accelerated their adoption of contingent labor,” he says. Recent research from Intuit forecasts that, by 2021, the gig economy will surge, resulting in 9.2 million Americans joining the gig workforce.

According to The Millennial Economy Report, 44% of Millennials have a side hustle to make extra cash. Intuit laid out the growing trend of self-employment amongst US workers. For 53% of casual workers aged 18-34, their work in the gig economy is their primary source of income.

The gig economy’s primary headwind is legislative, with workers’ rights to healthcare, sick leave and other benefits in focus. Having to provide these by law could increase costs and minimise the incentive for firms to hire freelance workers. McKinsey & Co. estimates that, by 2025, online talent platforms could add $2.7trn to global GDP.

The gig economy and businesses

Many of the companies seen to benefit from the gig economy are included in my Future of Work, Direct-to-Consumer and FinTech Signature Share Baskets. Freelancing is in the early stages of online penetration, with most activity still happening offline to find gig jobs.

Upwork [UPWK] and Fiverr [FVRR] are the two leading freelance platforms and each is in the nascent stages of opportunity, seeing significant growth.

Other key stocks that tie into the gig economy theme include Airbnb [ABNB] in hospitality, Etsy [ETSY] and Shopify [SHOP] retail platforms, Uber [UBER], Lyft [LYFT] and Doordash [DASH] for ride-hailing and mobility services, and Angie’s [ANGI] as a platform for providing at-home care services. Direct-selling companies like Nu-Skin [NUS] and Medifast [MED]also create gig jobs.

There are beneficiaries on the financial side, too, with platforms such as Square [SQ], PayPal [PYPL], Visa [V]andCeridian [CDAY]providing easy modes of payment to gig workers. Intuit [INTU]and Avalara [AVLR], as providers of tax software, also benefit from the rise of the entrepreneurial society. Green Dot [GDOT] recently invested in a fast-growing company Gig Wage, which is focused on creating a better financial ecosystem for the rapidly expanding gig economy. HCM Software names like Workday [WDAY], Paycom [PAYC], Paylocity [PCTY] and Automatic Data [ADP] are also seeing a resultant demand for services.

At a NASDAQ Conference in December, Intuit discussed the opportunity for QuickBooks Advanced in the gig economy:

“We now can serve service-based businesses, which is the majority of the market, and we serve product-based businesses. We can disrupt from the bottom with QuickBooks Cash, where you don't really need to worry about accounting at all, and eventually, we do it for you. … It gives us an opportunity to provide a lot more services that have far higher ARPU, and we actually have a very disruptive price compared to the alternative. And so we're very well positioned to serve this market.”

At the Citi Financial conference in November, Visa discussed the surging demand for on-demand payroll due to the gig economy and their Visa Direct platform. Visa Direct is designed for B2C, P2P, some small-ticket B2B transactions and even G2C (government to consumer) payments.

“So, fundamentally, it's a vast expansion of what we as a business can do. We are going into more and more use cases. So just to give you an idea of some of the big use cases. … We're seeing significant growth in on-demand payroll as well as payments to gig economy workers. So, while payments to Uber drivers may have gone down, we're seeing a big increase in delivery drivers right now in terms of disbursements. … These are early days in Visa Direct. I mean the opportunity is vast.”

"We're seeing significant growth in on-demand payroll as well as payments to gig economy workers" - Visa

ANGI HomeServices’ special call in July also discussed the gig economy: “There's a lot of opportunities for the on-demand economy, the gig economy for us to be able to do gigs and other opportunities for just the instant payments of that. … And we have seen a seismic shift happening, really accelerated by the COVID environment from [finding] off-line recommendations for childcare and senior care into online, and we are the de facto platform to come and make those matches.

"So we see that the 2 core tenet verticals, so to speak, childcare and senior care, are rich of opportunity, but there's also opportunities to go into adjacencies such as pet care, as you mentioned. And the technology is built in a way in order to service that. We're in pet care today, but we can continue to tackle that market and go deeper there. And on the first question, what I'd say is when we look at the overall landscape, there's a real opportunity for us to continue to grow and go into the penetration of that TAM. And so we're barely scratching the surface. I like to say to a lot of people we haven't even left the dugout yet. We're not even in the bottom of the first, so we've got a ton of room for us to scale and to grow.”

In closing, the longer-term trend towards a more flexible labour market will continue to drive excellent growth across gig economy platform providers, as well as payment and HCM software providers. This theme is a massive opportunity in the early stages digitalisation, much like ecommerce over five years ago. I expect that these stocks will continue to perform well given the positive backdrop.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy