Yiren Digital has, like many Chinese technology companies, struggled in the aftermath of the Covid-19 pandemic and the government’s crackdown on the sector. Investors will be looking for signs that the AI/fintech hybrid is gaining strength when the company reports earnings on 14 June.

- Yiren projects back-to-back annual revenue growth for the first time since 2018.

- Fintech has been at the forefront of Beijing’s crackdown on tech platforms.

- Yiren stock is up 121% since its 52-week low in July last year.

Yiren: An Overview

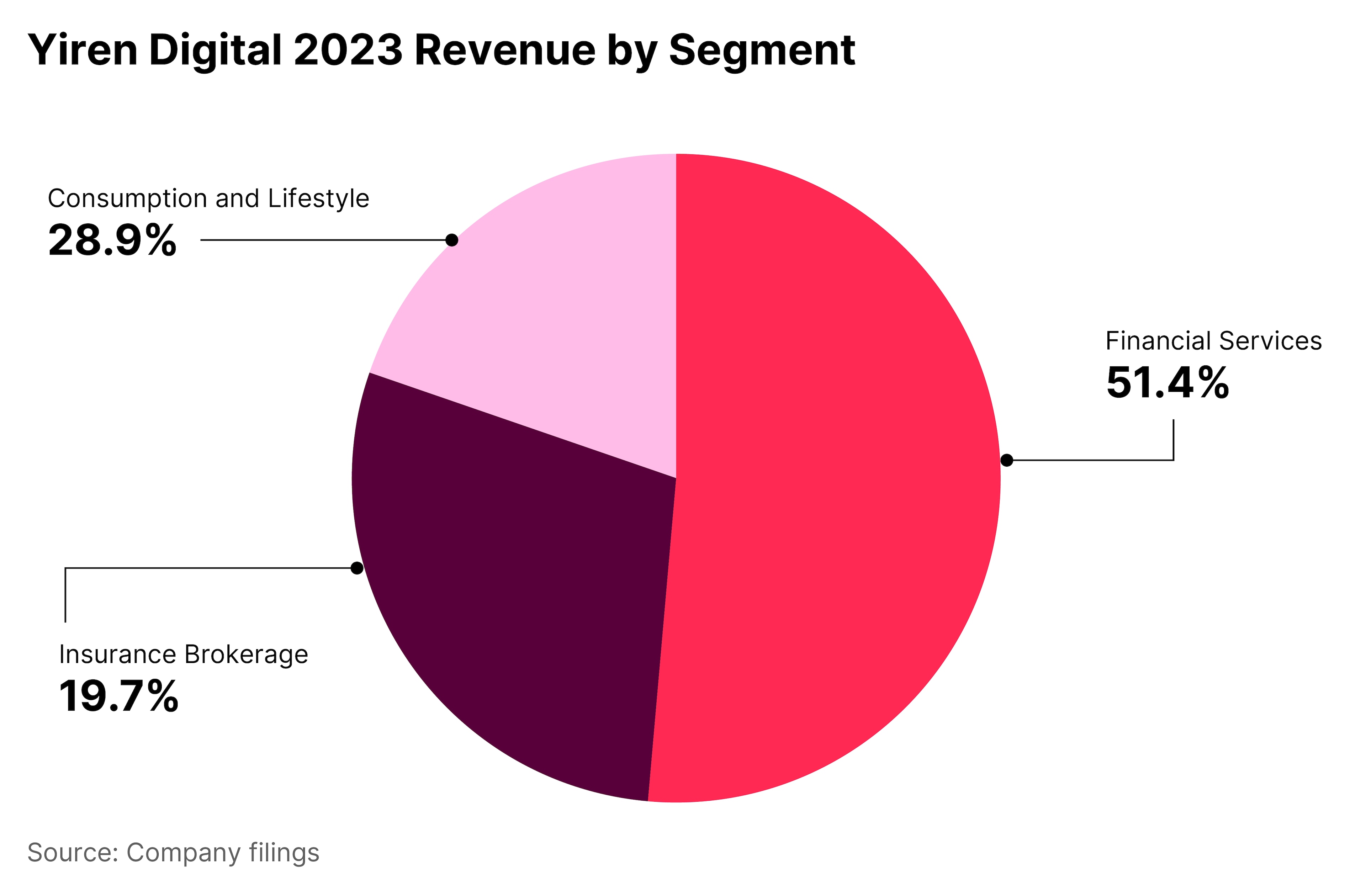

Yiren Digital [YRD] is one of China’s leading AI-powered fintech platforms. It has three principal business lines: financial services, insurance brokerage, and its consumption and lifestyle arm.

Its financial services business consists of a diversified portfolio of loan products offered to high-quality and selected underserved borrowers in China.

Yiren’s insurance brokerage, operated by Hexiang Insurance Brokers, one of its subsidiaries, provides life, health, property and casualty insurance services to businesses and individuals.

Lastly, the consumption and lifestyle business sells non-financial products, such as consumer electronics or healthcare products and services.

Underlying these business segments is Yiren’s proprietary AI model, DiTing. Within Yiren’s platform DiTing informs risk pricing and control; marketing and customer analysis; product testing; and data protection.

It is also used by other businesses, among them banks, insurance companies and fintech platforms. DiTing passed the one-billion decision milestone in late March.

Yiren Returns to Growth

In Q4 of 2023, Yiren achieved total net revenue of RMB1.3bn ($179.5m), a 16.5% year-over-year increase, and generated earnings per share (EPS) of RMB3.26 ($0.46), a 20.3% increase.

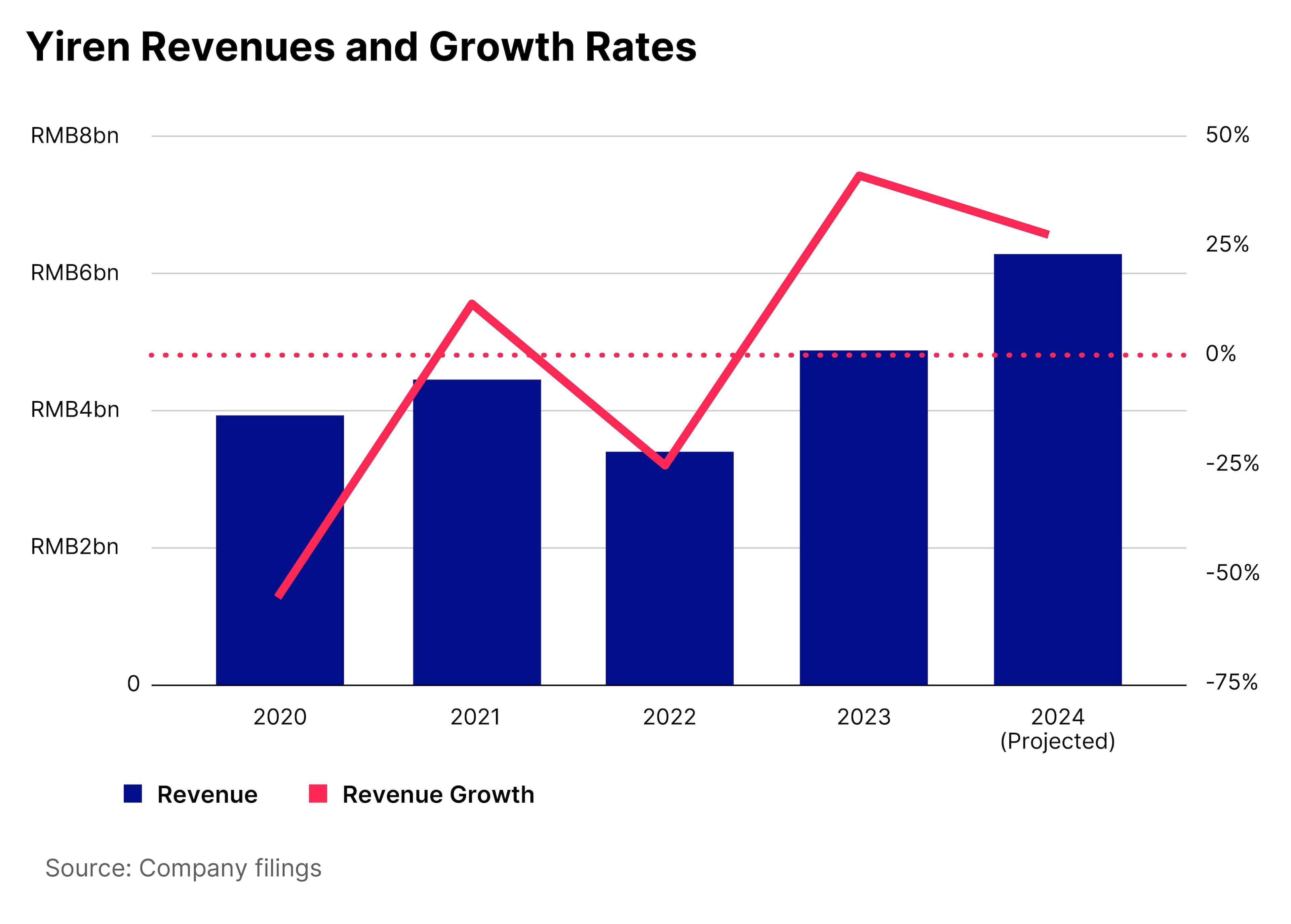

Through the full financial year, Yiren’s total net revenue amounted to RMB4.9bn ($689.5m), an increase of 42.9% year-over-year. EPS for the year came in at RMB11.77 ($1.66), which marked a 72.1% year-over-year increase in renminbi terms.

The figures continued a trend of increasing revenues for the company, which went hand in hand with increasing customer numbers. The number of borrowers served increased 79.97% during the year, from approximately 1.6 million to 2.9 million.

In the Q4 report, Yiren projected full-year 2024 revenue of RMB5.8–6.8bn, implying year-over-year growth of 28.8% at the mid-point. While this is a respectable rate of growth, it does reflect a significant slowing down from the 42.9% rate in 2023.

This would continue an erratic period of revenue growth for Yiren, which has mirrored China’s stuttering recovery from the Covid-19 pandemic. Yet while investors may not welcome decelerating revenue growth, they may be encouraged if Yiren does manage to increase revenue in two consecutive financial years for the first time since 2018.

By segment, financial services accounted for over half of Yiren’s revenue during 2023, making this the company’s most important.

Yiren’s share price movements reflect its erratic revenue movements; over the five years to 11 June, the stock is down 68.1%.

However, since hitting a 52-week low of $2.13 on 10 July last year, Yiren’s share price has trended upwards, gaining 121.1% during that time. The stock has gained 51% year-to-date and 79.1% over the past 12 months.

Is China Tech Out of the Woods?

The last five years has been a rocky period for China’s fintech sector and its technology industry more broadly.

The sector was front and centre of Beijing’s technology crackdown in the wake of the pandemic. The scuppering of lending and payments platform Ant Group’s proposed 2020 IPO and subsequent disappearance of owner Jack Ma were emblematic of the government’s suppression of the sector.

Combined with China’s fitful re-emergence from the depths of the Covid pandemic, Chinese technology stocks suffered across the board. The Invesco China Technology ETF [CQQQ], which tracks an index comprised of Chinese technology stocks (but does not hold Yiren), has fallen 19.4% over the past five years.

However, it appears that the crackdown is now over. Ma has let go of Ant Group, which has also undergone a “rectification” campaign, according to China’s central bank and securities regulator in July last year.

CQQQ has fallen 3.5% year-to-date and 14.7% in the past year. However, since hitting a 52-week low of $27.68 on 5 February, the fund has recovered 25.3%.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy