Since going public via a reverse merger in late 2020, the Desktop Metal share price has struggled for momentum. As economic headwinds ease, the use of 3D printing to manufacture end-use parts has the potential to be a $900bn opportunity. Airbus, GE Aerospace and Lincoln Electric are a few of the players in the additive manufacturing space.

- Lincoln Electric is manufacturing propulsion parts for the US Navy.

- GE Aerospace is to scale its 3D printing capabilities as part of a $650m investment.

- Airbus-led consortium sends 3D printer to the International Space Station

It was once thought that 3D printers were poised to become as ubiquitous as microwaves. This has yet to happen.

Not only has the additive manufacturing industry been slow to reach mainstream adoption, it’s also been experiencing a tough time of late, amid economic headwinds and inflation in material prices, as Desktop Metal [DM] Founder and CEO Ric Fulop said on the company’s Q3 2023 earnings call last November.

This has led to financial difficulties. In January, the company announced it would be axing 20% of its workforce as part of an aggressive cost-cutting strategy.

The Desktop Metal share price has tumbled 33.8% year-to-date to close at $4.97 on 18 June. Early this month, Desktop Metal’s board approved a 1-for-10 reverse stock split, in order to comply with the NYSE’s minimum bid requirement.

Printing End-Use Parts is a $900bn Opportunity

Despite Desktop Metal’s share price struggles, the company is confident that the industry will bounce back.

“While our industry is working through a challenging period, Desktop Metal’s commitment to [additive manufacturing] has not changed. We continue to have a positive long-term outlook for this industry as it transitions to mass production,” said Fulop in late January.

As an industry leader in additive manufacturing, Desktop Metal’s 3D printers have been used by the likes of Ford [F] to mass produce end-use parts.

The need for original equipment manufacturers to produce high-quality parts, at speed and at scale, isn’t going away. The market potential for printing end-use parts across all industries could hit $900bn, according to ARK Invest.

A white paper published by the investment firm, ‘Platforms of Innovation’, released in March, noted that “3D printing has begun to see meaningful uptake into end-use applications across aerospace and automotive”. The benefits of 3D printing include removing design barriers and speeding up the time it takes to bring products to market.

ARK Chief Futurist Brett Winton, who authored the research, cited the example of lighter 3D-printed parts that could “reduce global emissions and give flight to new aircraft both for earth and outer space”.

Where are the interesting opportunities in additive manufacturing beyond Desktop Metal?

Lincoln Electric is Manufacturing Propulsion Parts for US Navy

Welding equipment provider Lincoln Electric [LECO] operates the world’s largest wire-based 3D metal printing platform. In February, the company announced it had been selected to manufacture metal propulsion parts for the US Navy.

Lincoln Electric’s services were sourced by Chevron [CVX] in 2022 to manufacture replacement parts during the supply chain crunch. The pandemic saw many industries build up buffer stocks to prevent delays. Holding excess inventory can be costly, though, so Lincoln Electric showed Chevron what’s possible when 3D printing is used to produce parts on demand.

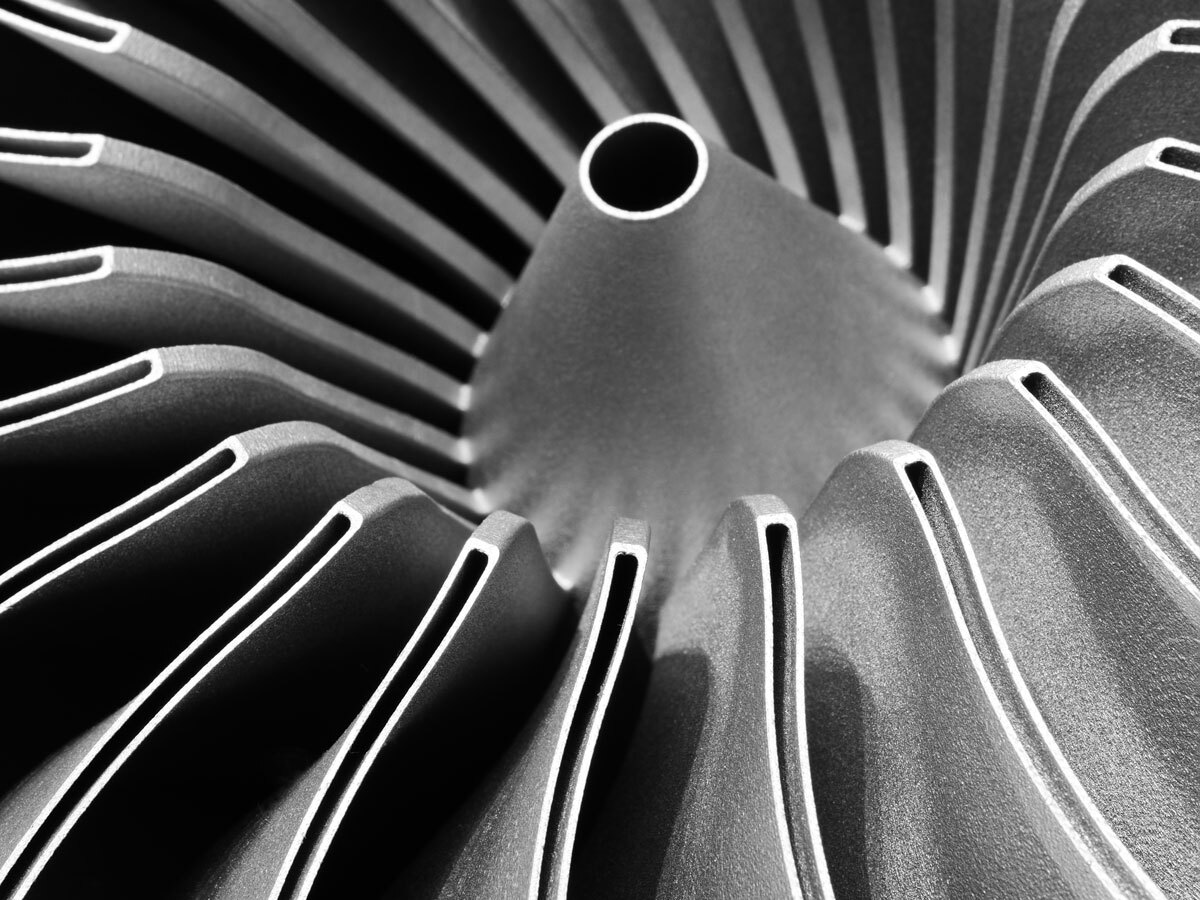

GE Aerospace to Scale Jet Engine Production

General Electric [GE], now known as GE Aerospace following the completion of the spin-off of its energy unit GE Vernova [GEV], is a long-term believer in 3D printing. A study by the European Patent Office published last September shows that, between 2001 and 2020, GE filed more additive manufacturing-related patents than any other company — a total of 1,793, compared with HP’s [HPQ] 1,362 and Siemens’ [SIE:DE] 996 patents.

As part of a plan to invest $650m in its manufacturing and supply chain, unveiled in March, GE has earmarked $107m for new tools and equipment, including 3D printers, to increase production capacity of commercial and military aircraft engines in the Cincinnati region. A further $54m will be used to improve the 3D printing capabilities at its facility in Auburn, Alabama, where it produces military rotorcraft engine components.

Airbus Helps Astronauts Print Parts on Demand

European aerospace giant Airbus [AIR:PA] has helped develop the first metal 3D printer to be sent into space. The machine was part of the payload of a NASA resupply mission to the International Space Station (ISS) launched aboard a SpaceX Falcon 9 rocket in January.

NASA experimented with machines that can print parts from plastic in space as far back as 2013, but metal 3D printers could enable astronauts to produce crucial parts, easing the logistical challenge of space resupply. This could mean they wouldn’t need to wait weeks or months to carry out a fix.

“Thinking beyond the ISS, the applications could be amazing. Imagine a metal printer using transformed regolith [moondust] or recycled materials to build a lunar base,” Gwenaëlle Aridon, Lead Engineer at Airbus Space Assembly, said in a press release.

Thematic ETFs Offer Exposure to a Range of 3D Printing Capabilities

While 3D printing has been around for decades, the nascent state of the technology means that the industry is still volatile. Plenty of players have been looking to consolidate, including Desktop Metal.

In light of concerns around profitability faced by pure-play 3D printing companies, another way to invest in the industry is through thematic funds that offer exposure to a range of 3D printing capabilities across various industries.

The ARK 3D Printing ETF [PRNT], the only fund focused solely on 3D printing, has allocated Desktop Metal 2.4% of its portfolio as of 20 June; it also holds GE (1.8%) and Lincoln Electric (1.3%). The fund is down 13.6% year-to-date through 18 June and down 13.3% in the last 12 months.

The Vanguard Industrials ETF [VIS] has GE as its biggest holding, with a weighting of 3.6%, while Lincoln Electric and Desktop Metal are each held at less than 0.5% of the portfolio as of 31 May. The fund is up 20.6% in the past year and up 8.2% year-to-date.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy