Calculating CFD margins

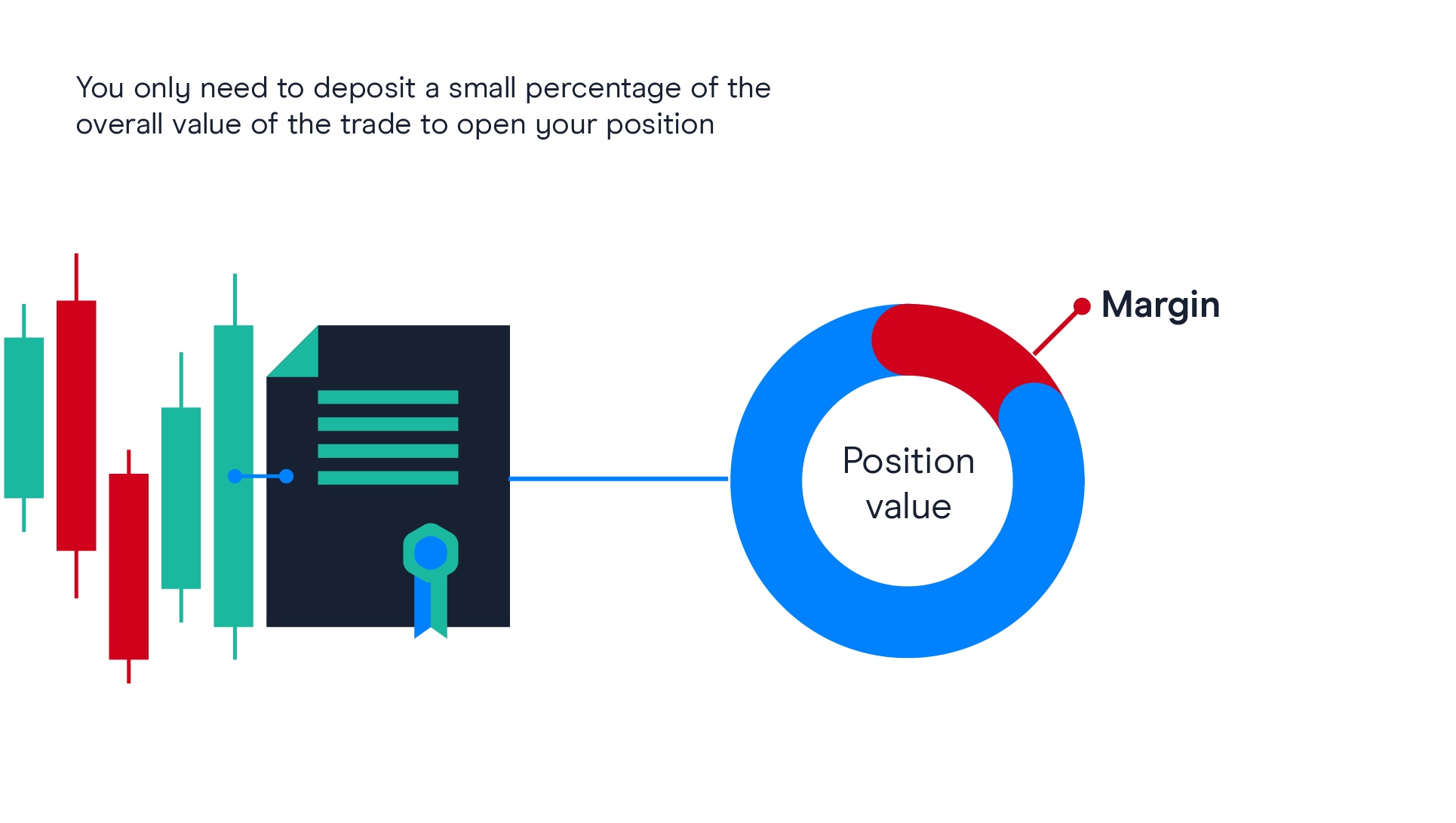

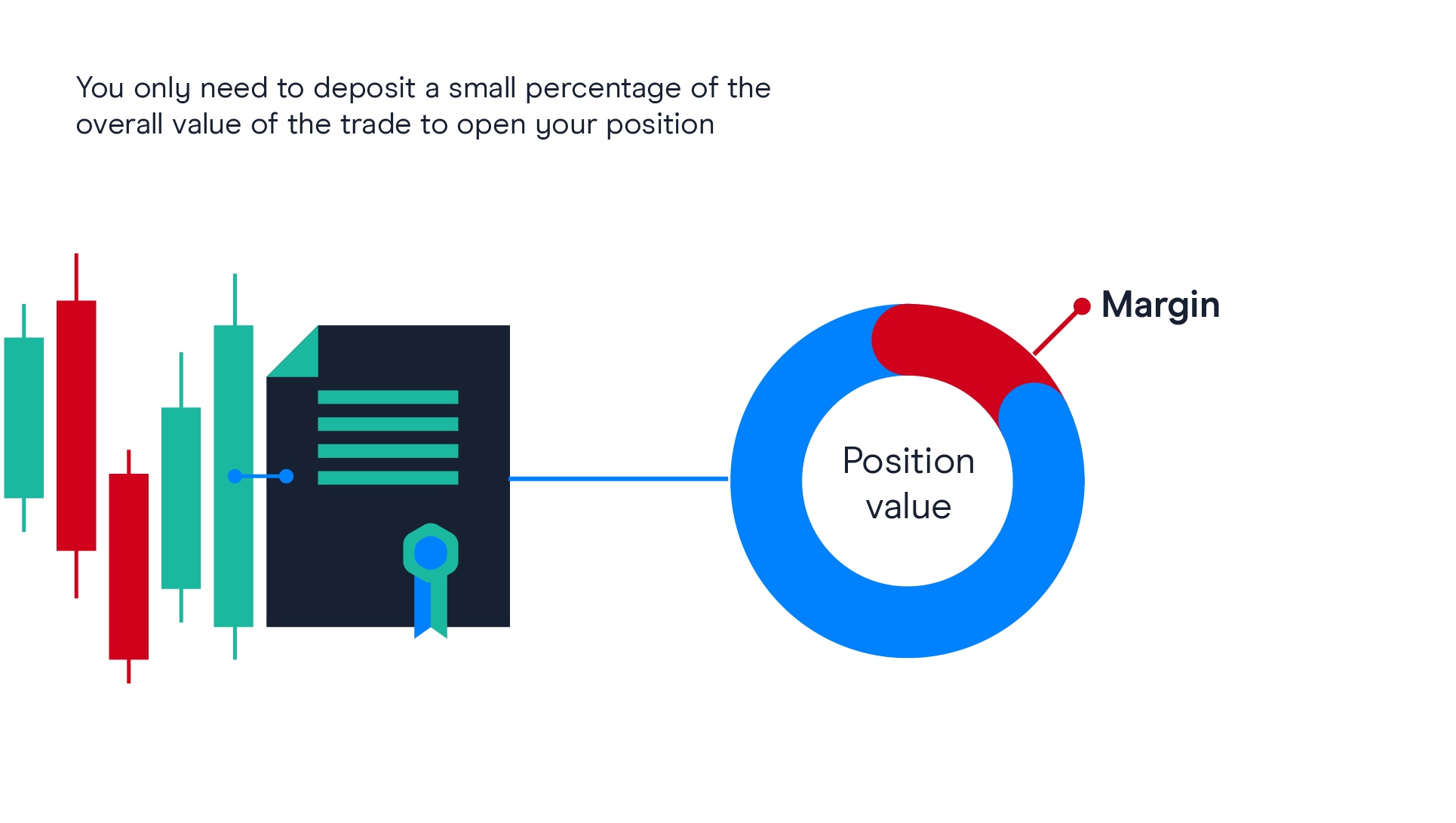

In order to open a CFD (contract for difference) position on your account, you will need to deposit an amount of money known as margin.

The margin reflects a percentage of the full value of the position, and is referred to as 'position margin' on our platform. The position margin will be calculated using the applicable margin rates, as shown in the product library area on the platform. Read more about our CFD margin rates.

CFD margin explained

For shares, different margin rates may apply depending on the size of your position, or the tier your position (or a portion of your position) in that instrument falls within. The portion of the position that falls within each tier is subject to the margin rate applicable for that tier.

In order to calculate the position margin, the level 1 mid-price (shown on the platform) is used.

Position margin example

Company ABC (GBP) margin rates

| Tier | Position size (units) | Margin rate |

|---|---|---|

| 1 | 0-1,000 | 20% |

| 2 | >1,000-3,000 | 25% |

| 3 | >3,000-5,000 | 30% |

| 4 | >5,000-10,000 | 35% |

| 5 | >10,000 | 50% |

Unit in Tier 1 x Tier 1 Margin rate

Unit in Tier 2 x Tier 2 Margin rate

The sum of: Unit in Tier 3 x Tier 3 Margin rate x level 1 mid-price

Unit in Tier 4 x Tier 4 Margin rate

Unit in Tier 5 x Tier 5 Margin rate

Based on the margin rates shown in the table for company ABC (GBP), a position of 6,500 units, using the level 1 mid-price of 275.0 (£2.75), would require a position margin would be £5,018.75.

Trade CFDs on 12,000+ instruments

CFD margin calculator

Your position margin requirement is calculated as follows:

| Tier | Position size | Margin rate | Calculation |

|---|---|---|---|

| 1 | 1,000 | 20% | 1,000 x 2.75 x 20% = £550 |

| 2 | 2,000 | 25% | 2,000 x 2.75 x 25% = £1,375 |

| 3 | 2,000 | 30% | 2,000 x 2.75 x 30% = £1,650 |

| 4 | 1,500 | 35% | 1,500 x 2.75 x 35% = £1,443.75 |

| 5 | 0 | 50% | 0 |

| Total | 6,500 | Total = £5,018.75 |

The notional value of your total position is £17,875.00 (6,500 x 2.75).

CFD margin requirement

As you can see, margin trading allows you to open a position by depositing a percentage of the full value of the position. This means that your losses will be amplified and you could lose more than your initial deposit. Profits and losses are relative to the full value of your position. Learn more about our trading fees.

Trading using margin is not necessarily for everyone, so you should ensure that you understand the risks of CFDs, and if necessary, seek independent professional advice before placing any trades.

FAQ

What is margin in CFD trading?

Margin allows traders to open CFD positions for a fraction of the full value, rather than paying the entire position upfront. This gives traders a level of exposure to the financial markets that they may not have been able to access otherwise. Learn more about margin trading.

Are CFD margin rates higher than for spread betting?

At CMC Markets, our margin rates are the same across both spread betting and CFD products. For example, you can trade on 300+ currency pairs starting at just 3.3% margin, or 80+ global indices starting at 5%. Browse our range of markets for more examples.

How are CFD margins calculated?

CFD margins are calculated differently across and within each asset class and are dependent on your position size and number of units. See an overview of our CFD margin rates.

What does a 5% margin rate mean in CFD trading?

A 5% margin rate means that you’re only required to put down 5% of the trade’s value in order to open a position. This can magnify your profit or loss by 20 times the original amount. A 5% margin rate is equivalent to a leverage ratio of 20:1. Read more about leverage in trading.

Can I trade CFDs without margin?

You can’t trade CFDs without the use of margin or leverage, given that these are derivative products. If you are concerned about trading on margin, read our money and risk guide to find risk-management controls that can be used to help minimise any losses.