Index trading

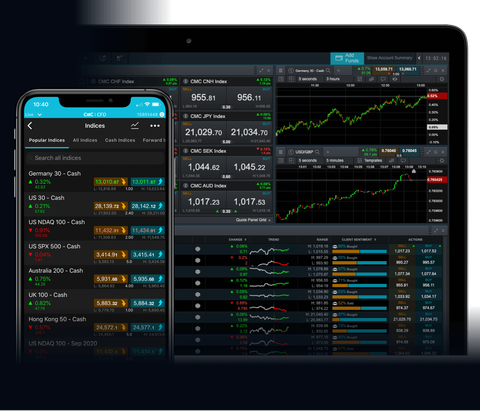

Trade on over 80 cash and forward global indices based on the FTSE 100 and more, with leverage, on our award-winning spread bet and CFD platform. Enjoy tight spreads, lightning-fast execution and the highest-rated customer service in the industry.*

FCA regulated

Segregated funds

FTSE 250 group

Search instruments:

More than an index trading platform

Your favourites in one place

Trade on more than 80 cash and forward indices based on FTSE 100 and dozens of other global markets.

Trade out of hours

Favourites like the UK 100 and US 30 trade 24/5, so you don’t have to stop when the markets do.

No partial fills

And never any dealer intervention, regardless of your trading size.

Precision pricing

We combine multiple feeds from tier-one banks, to get you the most accurate bid/ask price.

Dedicated customer service

UK-based client service, whenever you're trading.

Exclusive products

Get broader access to the market in a single position with our exclusive share baskets.

Trade on over 80 indices

Trade on more than 80 cash and forward indices based on the FTSE 100 as well as regional indices including Australia, Asia-Pacific, US and Europe.

Other popular instruments

Pricing is indicative. Past performance is not a reliable indicator of future results.

See our index costs

Whatever you trade, costs matter. We’re committed to keeping our costs as competitive and transparent as possible, whether you trade on UK, US, European or Asian indices.

EXCLUSIVE TO CMC

Looking for an opportunity? We’ve analysed the trends driving the market and grouped shares into topical buckets like Driverless Cars or Renewable Energy, to allow you to trade across a trending theme with a single position.

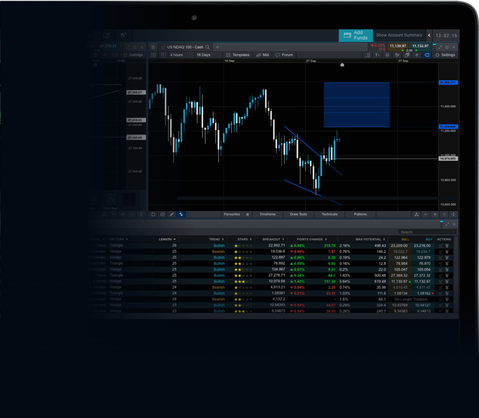

The platform built for index trading

Fast execution, exclusive insights and accurate signals are vital to your success as an index trader. Our award-winning trading platform was built with the successful trader in mind.

Pattern recognition scanner

We automatically scan over 120 of our most popular instruments every 15 minutes for emerging and completed chart patterns, such as wedges, channels and head & shoulders formations, and overlay them on to your charts to alert you to potential emerging trends.

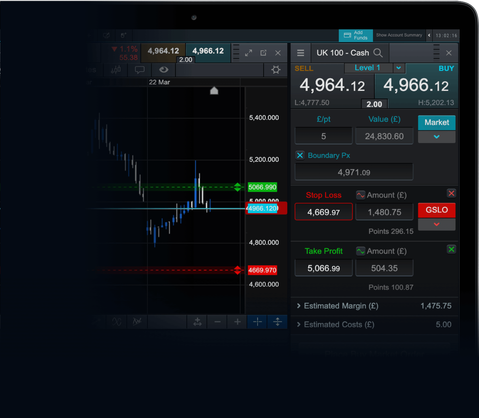

Advanced order execution

We offer a range of advanced order types, including trailing and guaranteed stop losses, partial closure, market orders and boundary orders on every trade, so you have the flexibility to trade your way.

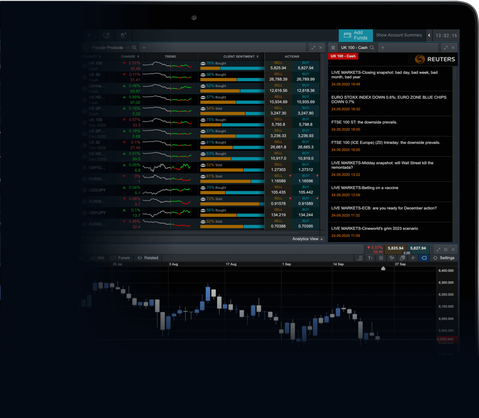

Reuters news and analysis

Industry-leading charting

No.1 Web-Based Platform

ForexBrokers Awards

Best Mobile Trading Platform

ADVFN International Financial Awards

Best CFD Provider

Online Money Awards

News

Opto Sessions: Jack Schwager’s market misconceptions

PODCAST

Jack Schwager, renowned author of the Market Wizards book series, reveals a major misconception in investing.

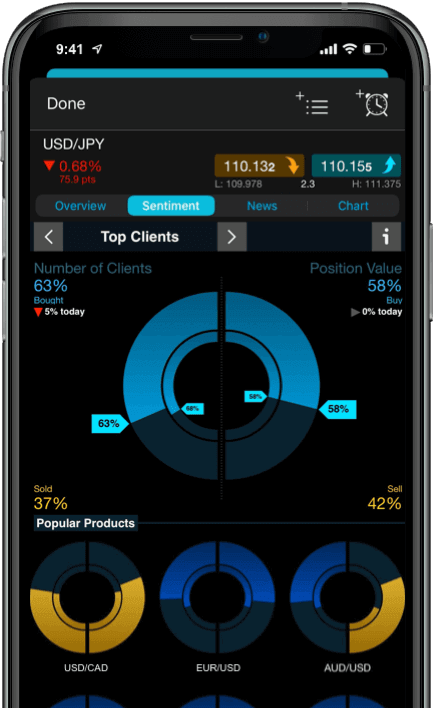

Powerful trading wherever you are

Trade like you’re on a desktop, on your mobile. Our award-winning mobile trading app* allows you to seamlessly open and close trades, track your positions, set up notifications and analyse mobile-optimised charts.

FAQs

New to trading?

Is it free to open an account?

There's no cost when opening a live spread betting or CFD trading account. You can also view prices and use tools such as charts, Reuters news or Morningstar quantitative equity reports, free of charge. However, you will need to deposit funds in your account to place a trade. Learn about the costs involved in spread betting and CFD trading

What are the costs of trading on indices?

There are a number of costs to consider when spread betting and CFD trading, including spread costs, holding costs (for trades held overnight which is essentially a fee for the funds you borrow to cover the leveraged portion of the trade), rollover costs for expired forward trades, and guaranteed stop-loss order charges (if you use this risk-management tool). Find out more about our costs

Is CMC Markets regulated by the FCA?

Yes, CMC Markets UK plc (registration number 173730) and CMC Spreadbet plc (registration number 170627) are fully authorised and regulated by the Financial Conduct Authority (FCA) in the UK. Retail client money is held in segregated client bank accounts and money held on behalf of clients is distributed across a range of major banks, which are regularly assessed against our risk criteria.

Is CMC Markets covered by the FSCS?

Yes, your eligible deposits with CMC Markets are protected up to a total of £85,000 by the Financial Services Compensations Scheme (FSCS), the UK's deposit guarantee scheme. If CMC Markets ever went into liquidation, retail clients would have their share of segregated money returned, minus the administrator's costs in handling and distributing these funds. Any shortfall of funds up to £85,000 may be compensated under the FSCS.

How does CMC Markets protect my money?

As a CMC client, your money is held separately from CMC Markets' own funds, so that under property, trust and insolvency law, your money is protected. Therefore your money is unavailable to general creditors of the firm, if the firm fails.

How does CMC Markets make money?

Our income primarily comes from our spreads, while other fees, such as overnight holding costs, make a minor contribution to our overall revenue.

We never aim to profit from our clients' losses. Our aim is to build long-term relationships by providing the best possible trading experience through our technology and customer service.

New to index trading?

What are indices?

Indices are a measure of a section of shares in the stock market, created by combining the value of several stocks to create one aggregate value. Learn more about indices

How to trade on indices?

You can start trading on indices now by opening a live account. If you would like to practise your index trading strategy first, open a demo account to trade with virtual funds.

What is leveraged trading?

One of the advantages of spread betting and CFD trading is that you only need to deposit a percentage of the full value of your position to open a trade, known as trading on leverage. Remember, trading on leverage can also amplify losses, so it’s important to manage your risk.

Why spread betting?

Spread betting allows you to trade tax-free on a wide range of financial markets 24 hours a day, from Sunday nights through to Friday nights. Trade on your phone, tablet, PC or Mac on a wide range of instruments using leverage. Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

How does spread betting/trading CFDs on indices actually work?

When you spread bet or trade CFDs on indices on our platform, you don’t buy or sell the underlying index. Instead, you’re taking a position on whether you think the index will go up or down.

With spread betting, you buy or sell an amount per point movement for the index instrument you’re trading, such as £5 per point. This is known as your stake. With CFD trading, you buy or sell a number of units for a particular instrument. For every point or unit that the price moves in your favour, you gain multiples of your stake, and vice versa.

While you can trade on leverage, your profits and losses are based on the full value of the trade. As a retail client, you will never lose more than the amount in your account.