Defensive stocks for hedging against portfolio risk

Investors may flock to defensive stocks in times of economic turmoil, given their reputation to outperform the general stock market, or keep these types of stocks in their portfolio long-term. Learn what a defensive stock is, and how you can use them to hedge against risk in a bear market and as part of your investment strategy in general.

What is the definition of a defensive stock?

A defensive stock refers to a company that tends to outperform the share market in periods of economic downturn. A defensive stock can provide a stable dividend yield, earnings and cash flow, regardless of external events that are happening. Its share price remains mostly unaffected by high volatility or economic uncertainty.

Why do defensive stocks outperform the market in times of economic crisis?

Defensive stocks tend to have a track record of performing consistently, or sometimes even better, during a stock market crash or recession. This is because they belong to sectors where there is a constant demand for products, including food and beverages, utilities, and healthcare services. These types of products don’t usually see a major change in demand throughout the year and are said to have “inelasticity of demand”, which means that if their price changes, it won’t significantly impact demand.

For this reason, defensive stocks are often seen as a type of ‘safe haven asset’ which investors may buy and hold as a way to hedge against portfolio risk. This means that, in times of economic downturn when cyclical sectors are underperforming (consumer discretionary, travel and tourism, technology etc), defensive stocks remain strong and may help to balance out the risk on your open positions in economically sensitive areas.

List of defensive sectors

Consumer staples

The consumer staples sector highlights companies that offer services or products considered ‘essential’ to everyone, regardless of their financial status. Consumer staples stocks are often favoured by more risk-averse investors that are looking for safe returns and dividends with low volatility. Examples include:

- Food and beverage brands and outlets (McDonald’s, PepsiCo, Kraft Heinz)

- Supermarkets (Walmart, Tesco, Costco)

- Household and personal care products (Unilever, Reckitt Benckiser, Procter & Gamble)

- Tobacco (Imperial Brands, British American Tobacco, Altria)

Healthcare

As healthcare is a prevalent issue worldwide, there is consistent demand throughout the year for new drugs, treatments, and research and development centres for a variety of illnesses and diseases. This can increase during outbreaks of infectious diseases, such as the Covid-19 pandemic. These types of stocks also have the potential to benefit in the long term as the demographics of advanced economies continue to get older. Examples include:

- Pharmaceuticals (GlaxoSmithKline, AstraZeneca, Sanofi)

- Vaccine developers (Pfizer, Moderna, BioNTech)

- Biotech and life science development (Novo Nordisk, Bristol Myers Squibb, Regeneron)

- Medical device manufacturers (Johnson & Johnson, Medtronic, Abbott Labs)

Communication services

As technology is continually progressing, companies that offer services within the telecommunications and entertainment industries tend to perform well during an economic crisis, although they can sometimes be volatile. Some examples include:

- Telephone and broadband (AT&T, Verizon, Vodafone)

- 5G network (Nokia, NVIDIA, Qualcomm)

- Media and advertising (Comcast, Walt Disney, Alphabet)

Utilities

The utilities sector is made up of several industries that provide a range of services. These are considered essential for living and their pricing is often heavily regulated. This defensive sector has shown steady returns in the past and can be used hedge portfolio risk, although the renewable energy aspect of these companies hints at their potential for growth. Examples include:

- Electric, gas and water (General Electric, Centrica, Severn Trent)

- Independent power producers (NextEra Energy, Canadian Solar, Duke Energy)

How to trade on defensive stocks

- Register with CMC Markets. Open an account to access 10,000+ stocks in our product library.

- Choose whether to spread bet or trade CFDs. Spread betting is tax-free in the UK and Ireland* and comes with zero commission fees, although other charges may apply. When trading CFDs, you will pay a commission on share CFDs.

- Pick a trading strategy. Investors usually take a buy-and-hold approach with defensive stocks, so you could open a long position if you think that the stock will increase in value.

- Apply risk-management controls. When trading in periods of economic downturn, you should consider stop-loss orders to protect your account.

- Keep up to date with news. You should be vigilant of any economic events or announcements that may have an effect on your open positions or sector that you are investing in. This includes things like earnings reports and political updates.

Did you know that you can now trade on a basket of stocks within a relevant sector using our share baskets? We offer a number of CFD share baskets that contain multiple defensive stocks, including Big Tech, Renewable Energy and 5G, which you can trade on with a single position. These come with lower holding costs than individual stocks and zero commission fees (other charges may apply).

NEW

Share baskets

Get exposure to the world's fastest-growing, trending industries, from Driveless Cars to Streaming Media

What’s the difference between defensive and cyclical stocks?

The opposite of a defensive stock would be a cyclical stock, which tends to see price fluctuations based on different phases of an economic or business cycle. For example, cyclical stocks perform better during periods of economic growth and rising inflation, when consumer have more disposable income to spend on products and services that aren’t deemed necessary. During a recession or a bear market, however, these types of stocks would typically fall in value, having a knock-on effect on their share price. Read more about cyclical stocks.

How to find defensive stocks

In order to find out whether a particular stock is considered defensive, you could measure the following:

- Stock beta. This is the measure of a stock’s volatility compared to the overall market. Defensive stocks tend to have a lower beta value since they’re less affected by volatility.

- Past dividends. Companies that have paid a consistent dividend to shareholders over the years may be more reliable or perceived to have strong cash flows.

- 52-week price range. The larger the gap in share price over a 52-week period, the more volatile we would assume the stock to be.

Examples of defensive stocks

| Company | Sector |

|---|---|

| McDonald’s [MCD] | Consumer staples |

| Sanofi [SAN] | Healthcare |

| Verizon [VZ] | Communication services |

| Procter & Gamble [PG] | Consumer staples |

| RWE [RWE] | Utilities |

| Pfizer [PFE] | Healthcare |

| Nestlé [NESN] | Consumer staples |

| Comcast [CMCSA] | Communication services |

| NextEra Energy [NEE] | Utilities |

| PepsiCo [PEP] | Consumer staples |

Defensive FTSE 100 stocks in the UK

Reckitt Benckiser [RKT]

A consumer defensive stock, Reckitt manufactures and retails products relating to health, hygiene and nutrition, including well-known brands such as Nurofen, Air Wick, Dettol, Gaviscon and Veet. These are in constant demand throughout the year and the company doesn’t require periods of economic growth to generate a profit. For example, during the Covid-19 pandemic in 2020, Reckitt Benckiser reported its highest ever sales growth of 12%, which was driven by its hygiene and cleaning products.

Tesco [TSCO]

Tesco is the UK’s largest supermarket in terms of market capitalisation, revenue and market share. Given that food is essential for human survival, investors may hold a supermarket stock in their trading portfolio, as this type of business tends to be consistent and reliable all-year round. It could also rake in profits when other food and beverage outlets are closed or underperforming.

GlaxoSmithKline [GSK]

GSK is involved in the research, development, manufacturing and retailing of various medicines and vaccines. It also produces consumer healthcare products such as medical instruments, pain relief medicines, and vitamins and supplements. GSK has a more diverse offering than many other pharmaceutical companies on the FTSE, which may help to offset risk as it offers exposure to both the healthcare and consumer staples sectors.

BAE Systems [BA]

This defense and aerospace company is among some of the largest worldwide in terms of revenue. It is a trusted partner of the UK and US governments, often receiving funding for new projects. Although it has links to the aviation industry, which is considered a more cyclical type of stock, this division contributes less than 10% of overall sales. BAE Systems shows a consistently strong balance sheet and order book, proving resilient to recent economic crises.

United Utilities [UU]

United Utilities owns and operates water and wastewater services in the northwest of England. Water utility services are essential for living and have a history of performing well in periods of economic downturn, although this is not guaranteed, as with any stock.

Are there defensive ETFs?

Similar to our share baskets, you can spread bet or trade CFDs on multiple stocks using a single position via exchange-traded funds (ETFs). These instruments track the performance of an underlying share index in order to replicate similar results and are made up of the same constituents. There are a number of defensive ETFs that you can trade on, including the following:

- Invesco Defensive Equity ETF – this is based on an index that provides broad exposure to large-cap US stocks, offering a potentially better chance of risk-return during periods of stock market weakness. Top holdings include Costco, Quest Diagnostics, and Garmin.

- Utilities Select Sector SPDR Fund – this ETF represents the utilities sector within a US index that measures 500 of the largest companies. It provides exposure to electric, gas and multi-utility industries, as well as independent power producers (IPPs). Top holdings include Duke Energy, Southern Company, and NextEra Energy.

- Vanguard Consumer Staples ETF – tracks the performance of a benchmark index containing stocks within the consumer staples sector. These companies provide direct-to-consumer products that are considered nondiscretionary. Top holdings include Procter & Gamble, Walmart, and Philip Morris.

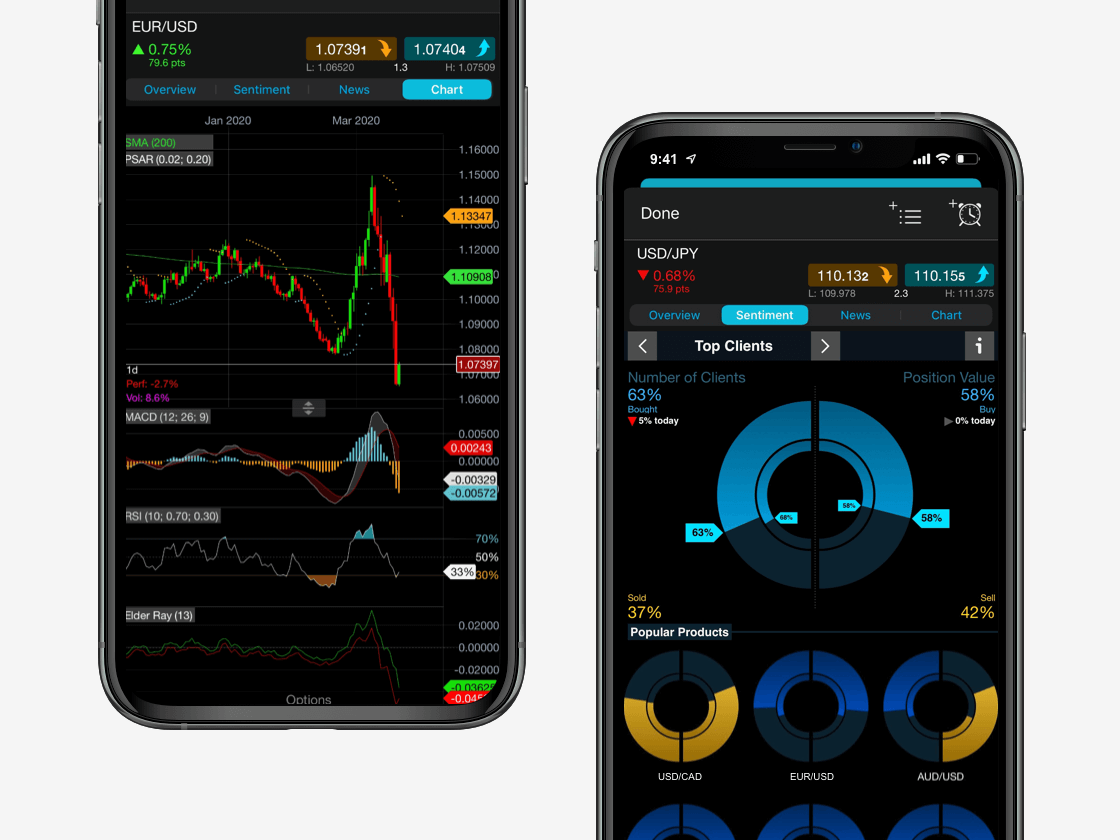

Trade with virtual funds

Seamlessly open and close trades, track your progress and set up alerts

FAQ

What are examples of defensive investments?

Other examples of defensive investments outside the share market include government bonds (gilts), precious metals and currencies. These are sometimes referred to as ‘safe haven investments’.

Are defensive stocks the same as counter-cyclical stocks?

Defensive and counter-cyclical stocks share similarities, but they aren’t the same thing. Counter-cyclical stocks usually outperform the market during economic downturns and can underperform during periods of economic growth, when other stocks are doing well. On the other hand, defensive stocks tend to perform consistently throughout all stages of the business cycle. Read more about counter-cyclical stocks.

Are defensive stocks worth investing in?

Many investors choose to add defensive stocks to their portfolio in order to offset the potential risks of other more growth-based investments. This can also help to diversify their portfolio. However, remember that all investments come with risk and no stock is guaranteed to turnover profits, no matter how stable they appear to be.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.