Equity trading

Equity trading is the buying and selling of company shares or stocks, also known as equities, on the financial market. There are a few ways in which you can invest in equities. Most equity trading refers to the buying and selling of public company shares through a stock exchange or as over-the-counter products.

Every country has its own stock exchange (organised market), where shares of listed companies are bought and sold. These can vary across stock market sectors and industries, and each stock exchange has its own trading hours. These mainly apply to the weekdays and close on the weekends, although this does vary according to each country's timetable. Learn more about trading equities on stock market hours here.

What is equity trading?

It is possible to buy and sell equities through an investment fund, such as an exchange traded fund (ETF). Equity funds invest in a range of shares in different companies. They diversify and spread the risk by investing in equities from different countries, regions and industries. By investing in shares this way, you are taking direct ownership of the underlying asset. This means that if the value of a stock rises, you make a profit. If the value of the stock falls, you make a loss. You also get the benefits of any dividend payouts.

As well as ETF trading, you can also trade the financial markets via spread bets and contracts for difference (CFDs). When share trading in this way, you don’t take direct ownership of the underlying instrument. Instead, you are taking a position on the price movements of that instrument. This is known as derivative trading. Spread bets and CFDs are both leveraged products, which means that you only need to deposit a percentage of the overall value of a trade to enter that trade. This deposit is known as margin. Profits and losses are based on the total value of the trade, not just the margin amount, so, it is possible to make larger profits, as well as larger losses.

An advantage of spread betting and CFD trading is that traders can make money from rising as well as falling markets. This is known as going long or short. The ability to take a short position in this way allows traders to hedge a physical share portfolio if it was losing money in the short term. This can be done by opening an opposite position in the same company’s shares as a spread bet or CFD.

What is an equity?

Equities in trading are portions of ownership in a public-listed company. Equity is bought and sold in the form of shares or stocks, which are issued by companies as a way to raise money. When you buy equity, you are taking ownership of a small portion of that company. Taking ownership of that asset entitles investors to a share of any profits made by that company.

The return from shares comes in two forms: dividends and capital growth. Dividends are usually paid twice a year and are a distribution of profit that the company has made. Larger, well-established companies are more likely to pay out dividends than smaller ones. Generally, the more profitable a company is, the larger the dividend payouts will be. Shareholders can also make a profit by selling their shares or stocks for a higher price than they bought them for. This provides traders with capital growth. It’s important to remember that share prices can go down as well as up, so you can lose money as well as make a profit. Read about some of the best-yielding dividend stocks in the UK.

To make it easier for investors and traders to buy shares, companies can opt to have their shares listed on a stock exchange. For example, UK companies can list on the London Stock Exchange (LSE). Exchanges have requirements that companies must meet in order to become listed. To be listed on the LSE, a company needs to have been trading for at least three years. It would also need a market capitalisation of at least £700,000. Market capitalisation is the number of outstanding shares in circulation, multiplied by the current share price.

As mentioned above, a trader has a number of options when it comes to trading in the equity market, including investing via a shareholder or investment fund. Some banks also offer ways to invest in the equity market. There are a variety of funds available (equity traded funds) and the services they offer can be different. Some allow traders to manage the shares themselves, while others will manage the portfolio on behalf of their clients for a fee.

Equities vs stocks: what is the difference?

There is no difference between the equity market and the stock market; they are synonymous. Both refer to trading equity in companies. Equities are represented by stock shares, which are traded on the stock exchange. The stock market allows individuals to take ownership of portions of companies.

Numerous trading platforms offer free tutorials, as well as webinars and seminars that explore how to trade the financial markets. When it comes to what you can trade, there is variety among the different types of stocks and shares. There are two types of stocks that companies issue: common stock and preferred stock. Common stock is most commonly issued by companies and therefore is the most commonly traded. Preferred stock has a higher claim on a company’s assets and earnings. Visit our learn section to make the most of our educational tools and reources, which include free webinars, platform guides and trading strategies articles.

Trade on over 8,000 equities with us

Types of equity

The size of the company also affects the type of equities you can invest in:

- Large-cap: also known as 'blue chip’ stocks, these are stocks from large companies. They can offer regular dividend payments and steady growth in share prices.

- Mid-cap: these are equities from medium-size companies. They are slightly riskier than large-cap, but still pay a dividend and can have greater potential for growth.

- Small-cap: small company stocks are much riskier. They don’t usually pay dividends, but if the company is successful, the share price can rise dramatically.

Factors affecting the cost of equities

The price of shares is affected by several factors that can be both internal and external, according to economic indicators. For example, companies publish their financial results once a year, and if the company is performing well and this is expected to continue, this could have a positive effect on the share price. The opposite also applies. Another influential factor on the price of equities is the general economy. If economic conditions are good, this will have a relative effect on the value of equities.

Market sentiment and demand for shares can increase the price of stocks. The more demand there is for a stock, the higher its price will be. If economic conditions are bad, on the other hand, investor demand for equities is likely to decrease. Share prices can therefore fall, even if a company is performing well.

One can gauge the general performance of equities via a stock market index. In the UK, for example, the main stock market index is the FTSE 100. This measures the performance of the 100 largest companies in the UK by market capitalisation. There are many different indices measuring the performance of equities in different countries, regions and industries.

How to trade equities

Equity day trading

Day trading is a short-term strategy that involves the analysis of price movements. It requires traders to be alert and quick with their transactions. Day trading strategies aim to buy and sell equities, such as shares, and profit from small price movements when the market is particularly volatile. They then close their positions before the end of the day, in the hope that these small profits have overridden any losses. Day trading is effective within volatile markets, as there is more liquidity and traders are entering and exiting the market often.

Options vs equity trading

Options are derivative contracts that can also be used to trade stocks and shares at a future date, for a specific price. Orders for options are conducted in the same way as equities, with buy and sell offers, and transactions between both products work in a similar way. However, all options have an expiration date, whereas stocks can be held for an indefinite amount of time. In addition, options do not give traders the right to earn dividends or ownership of the asset, whereas equity trading allows for both of these.

Social trading equities

You can also use information and strategies from other traders that you observe online. This is called social trading. For beginners, in particular, social trading equities is an effective method for mirroring the trades you see on our platform by other professional investors. As the stock market can be volatile, social trading is a great way to get accustomed to our platform and each strategy that you can use for stock trading.

Open an account to get started.

Trading equities vs forex

Whereas equity trading involves the buying and selling of shares on the stock market, forex trading involves the exchange of currency pairs from different nations. These are perhaps the most liquid and popularly traded financial markets across the world. There are risks involved with both markets, involving leverage and volatility, and currency trading also comes with the risk of interest rates and currency inflation. You should analyse the risks of both markets before placing a trade.

What are the risks of equities?

The main risks involved with trading equities are related to the loss of some, or all of your capital as a result of adverse price movements. If you spread bet or trade CFDs on equities, then losses, amplified by the leverage associated with these products, can have a significant impact on capital. While it does come with certain risks, investment in shares can also help to grow your portfolio, and there are ways to manage the risks. To some extent, it is possible to control certain risks, while others might be unavoidable.

For example, investing in equities from economically developed countries is thought to be less risky than those from emerging economies. This is obviously not guaranteed, but equities from developed countries generally have high market liquidity and are considered less volatile. Making informed decisions and researching company fundamentals before investing is always a good idea. Well-off investors can also provide small start-up companies with what is called venture capital. While this type of investment in equities can have above-average returns, it can also be extremely risky if the company does not perform well.

The general state of the economy is also a risk when investing in shares. If the market moves in the opposite direction or collapses, one can be subject to market value risk. A way to combat this is to make sure that not all of the shares you are invested in are based in the same sector or geography. Diversifying your portfolio can be a way of helping to spread the risk. If equities in one sector start to perform badly, shares in other sectors may be unaffected and therefore offer some security by offsetting this poor performance. During the global crash of 2008-2009, however, most sectors and regions were affected. In situations like this, there is little an investor can do.

You should also try to remove emotion from the equation when trading. Trading the stock markets inevitably involves speculation. Traders should try to let their investment strategy rather than emotions influence their trading decisions. Turbulent emotions could become a liability if they lead to rash decisions, especially during periods of high volatility. Read more about risk management in trading.

Practise risk-free with virtual funds

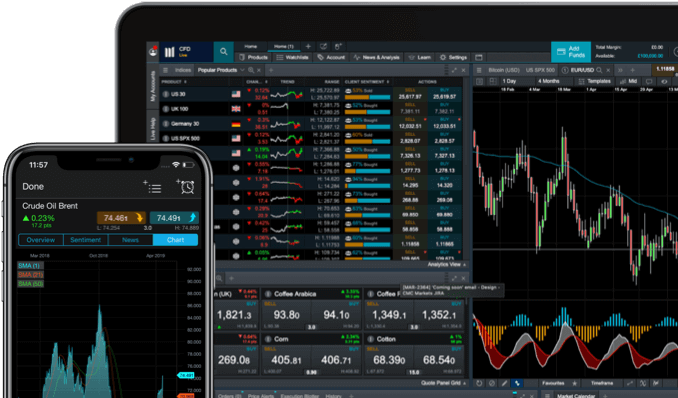

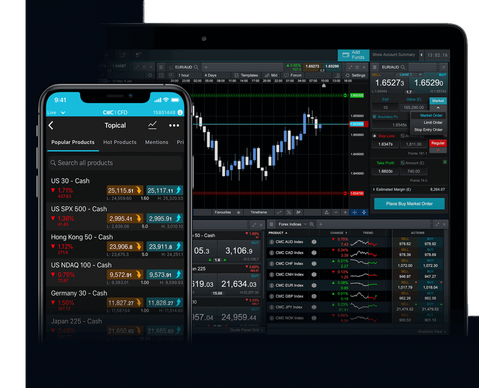

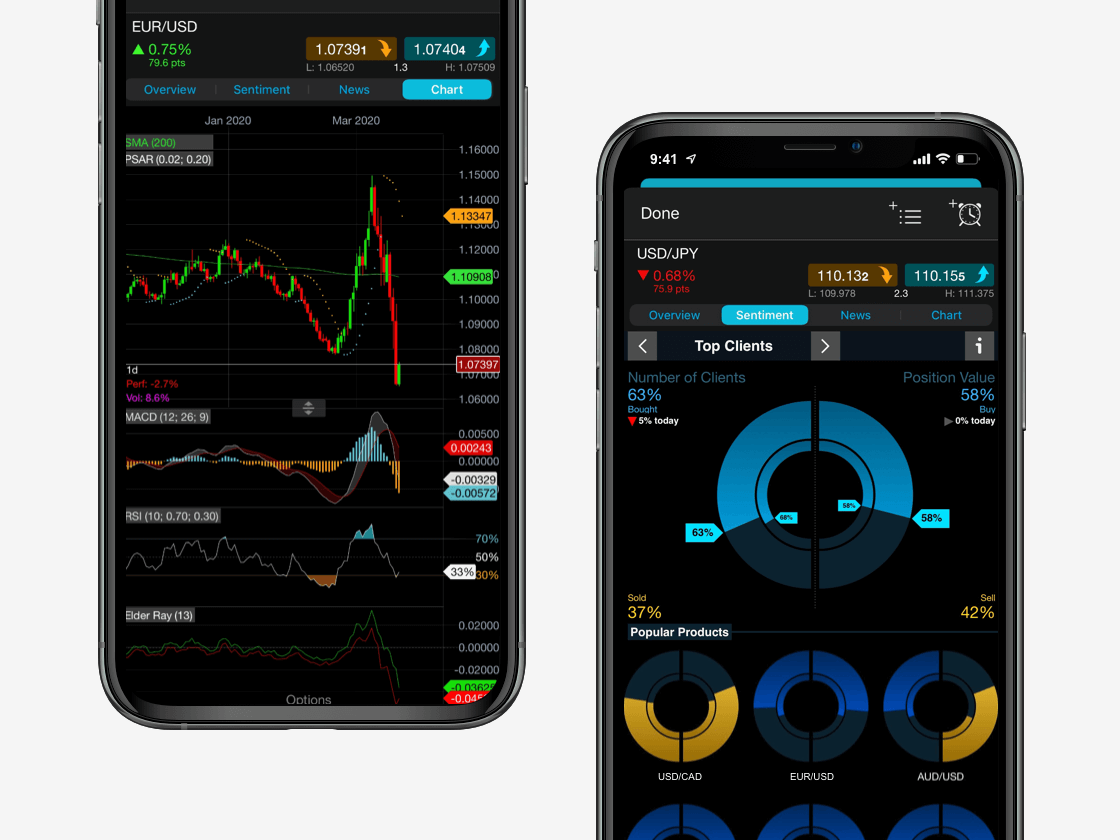

Seamlessly open and close trades, track your progress and set up alerts

Equity trading platform

You can trade equities on our award-winning trading platform, Next Generation. We offer over 8500 equity products, including shares and exchange-traded funds, that are available to trade on our equity trading software. Trade on large cap, small cap, blue chips and penny stocks all at once with our advanced software and technical tools.

Equity trading account

It is a simple process to open a live account now and start trading equities straight away. Our online platform also comes with sections for news and analysis, which is updated daily by our professional market analysts. A live account comes with exclusive features, such as a trading forum, fundamental reports from Reuters and Morningstar on the equity market, and a wide range of tools and indicators. Keep up to date with the latest news about equity performance, as well as new stocks on the share market and upcoming IPOs.

Interested in trading a large number of equities within a particular sector at once? Take a look at our new share baskets product here.

Summary

Equities are portions of ownership in publicly listed companies, so when buying equity, you are taking ownership of a small portion of that company. You can either buy shares directly outright or you can trade them via spread bets and CFDs. Equities are made up of stocks and shares, and there are different types of stocks which you can invest in. They can vary by factors such as company size, geography and sector, to name a few. As with any type of trading, there are certain types of risks that come with equity trading. The biggest risk being that you can lose all of your capital. It’s important to manage this risk through methods such as portfolio diversification.