ETF trading account

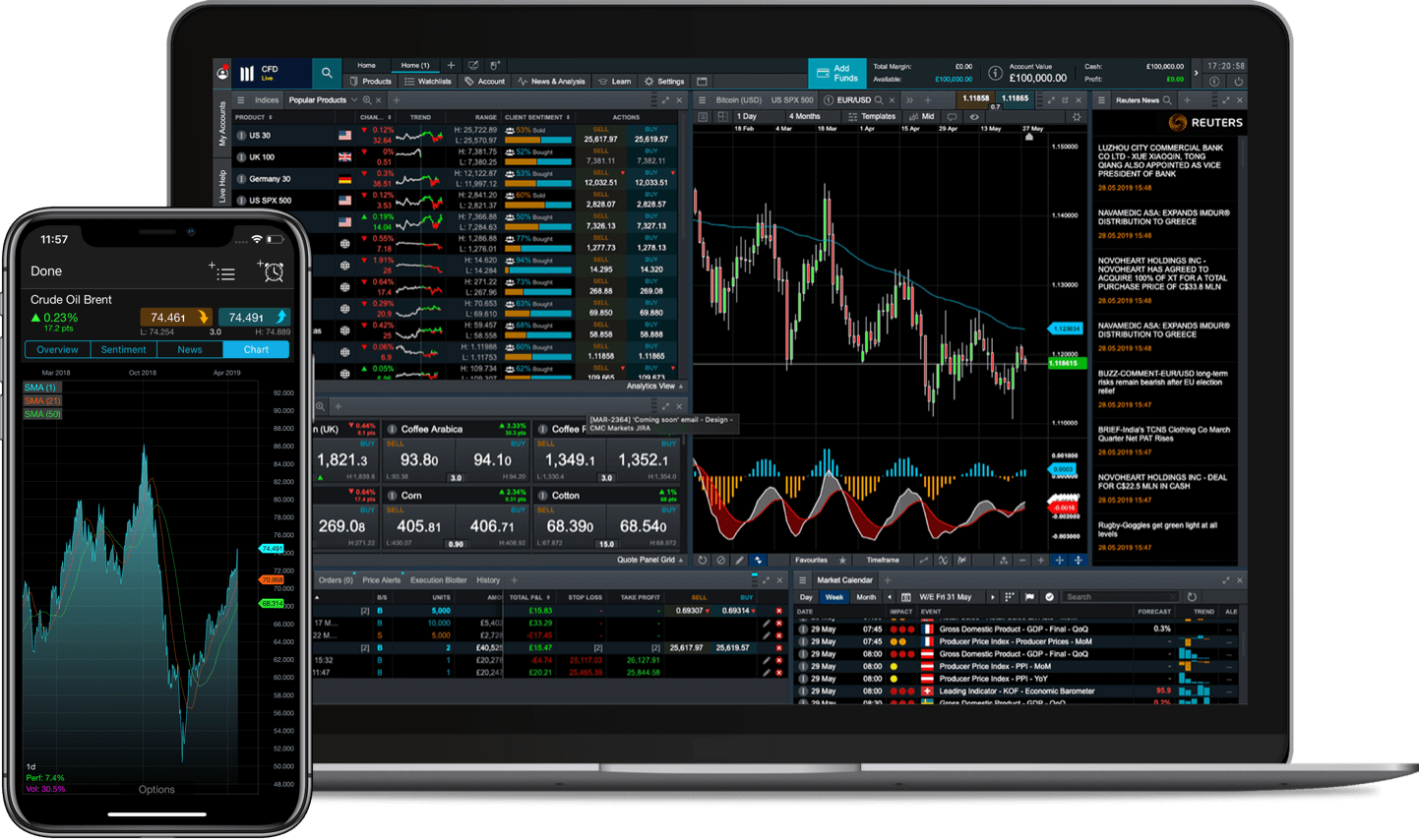

Discover exchange-traded fund (ETF) trading in the UK and spread bet or trade CFDs on over 1,000 ETF instruments.

KEY BENEFITS

FCA regulated

Segregated funds

FTSE 250 group

What is ETF trading?

An exchange-traded fund or ETF is an investment fund that comprises a collection of assets including shares, commodities and bonds. An ETF is a single entity and offers the opportunity to spread risk over several assets with a single transaction. ETFs can track certain sectors in the market, such as marijuana or the biopharmaceutical industry. Some ETFs commonly track market indices, such as the UK 100 or US 30.

ETF trading provides the opportunity to trade on margin by utilising leverage, through which you only need to deposit a percentage of the full trade value in order to open a position. This initial deposit is known as margin. However, your profits and losses are based on the full trade value.

Why open an ETF trading account with us?

We create value with competitive spreads and margins across our ETF markets.

Dedicated customer service

Our UK-based customer service team is here to help, whenever the markets are open

34 years' experience

We're one of the pioneers of the industry

We’ve got the markets that matter

Trade on over 10,000 shares and 1,000+ ETFs

Features of ETF trading

Risks of ETF trading

When trading on ETFs, you only need to put down a percentage of the full value of the trade as a deposit, but remember that profits and losses are amplified based on the full trade value. Leveraged ETFs are complex financial instruments that carry significant risks. Make sure you’re using appropriate risk management strategies when trading ETFs. Certain leveraged ETFs are only considered appropriate for experienced traders, so make sure you understand the risks.

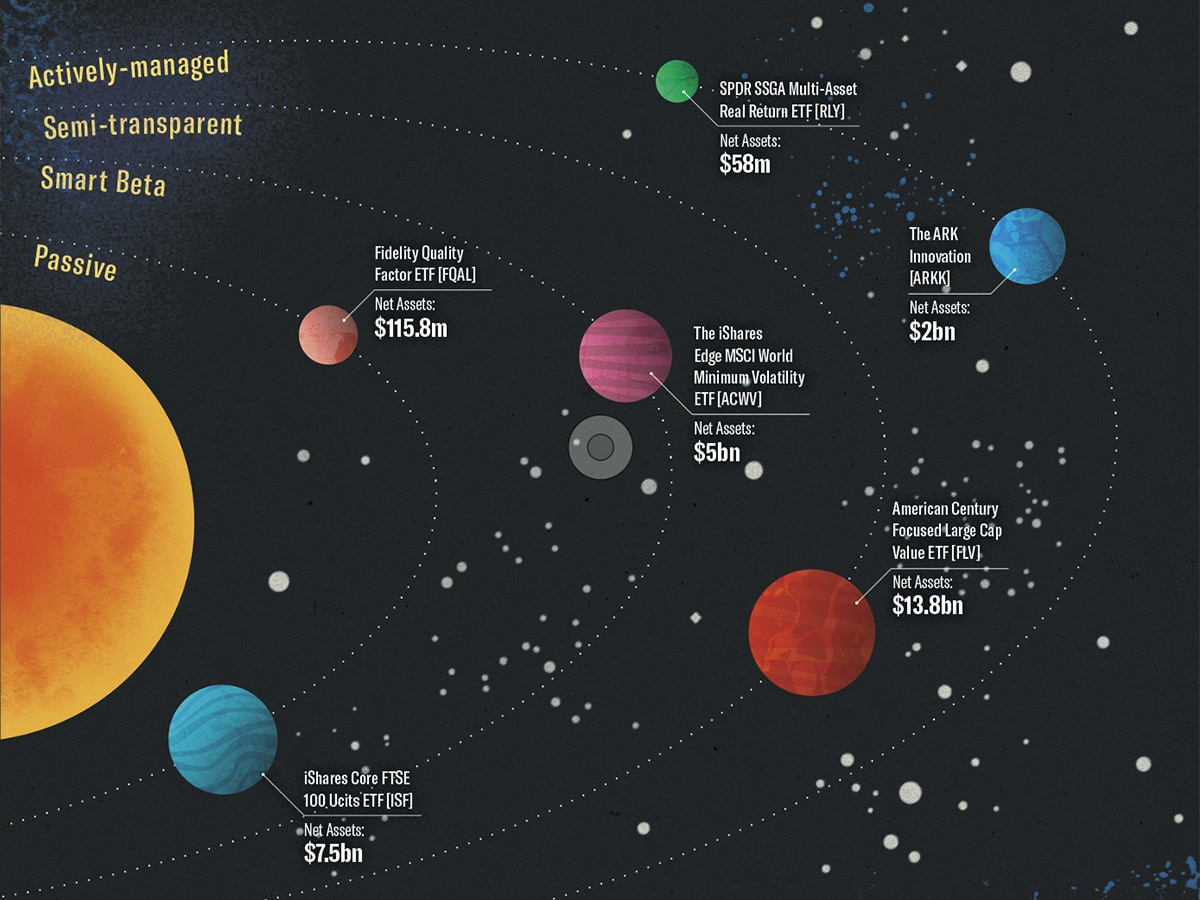

What kind of ETFs can I trade?

Sector ETFs

Take a position on multiple companies in the same industry through sector ETFs.

Index ETFs

Trade ETFs to gain exposure to an entire index through just one position.

Geographical ETFs

If you’re looking to diversify your portfolio, a geographic ETF can help. Choose a region to focus on, and gain exposure to the relevant shares in that region.

Currency ETFs

If you're looking for exposure to the forex market, without buying the underlying currencies, look no further than a currency ETF.

Commodity ETFs

Commodity ETFs are a single product, which can be an advantage when compared to holding futures contracts and having to roll them constantly.

What are some popular ETFs to trade?

Other popular instruments

Pricing is indicative. Past performance is not a reliable indicator of future results.

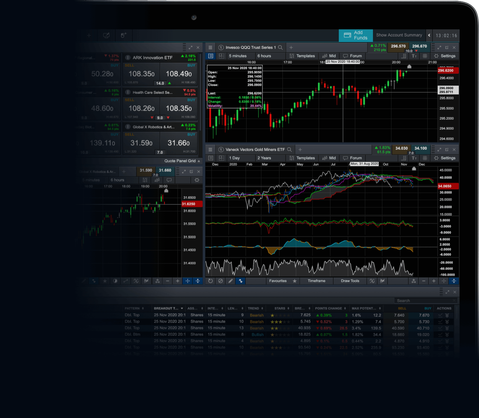

No.1 Web-based Platform

ForexBrokers.com Awards

Best Mobile Trading Platform

ADVFN International Financial Awards

Best CFD Provider

Online Money Awards

No.1 Platform Technology

ForexBrokers.com Awards

FAQS

What are leveraged ETFs?

A leveraged exchange-traded fund (ETF) is a financial instrument that tracks a collection of individual assets, such as shares, commodities and bonds. The main characteristic of leveraged ETFs compared with ETFs in the underlying market is that your profits and losses are magnified, as you are trading on margin. Find out more about leveraged trading.

What’s the difference between ETF trading and stock trading?

Trading stocks focuses on trading a single company. ETFs instead provide exposure to a tracked market index, in a similar way to the S&P 500 or FTSE 100. ETFs also track a selection of assets that can include stocks, bonds and commodities, for example. Although an ETF is essentially a wrapper tracking several assets, they are still traded like a share. Find out more about how to invest in ETFs.

Can ETF trading help to diversify your portfolio?

All investments contain a certain amount of risk, including ETF trading. However, when compared to trading individual shares, ETF trading benefits from diversification, which could help reduce risk. This is because an ETF tracks a selection of assets and isn’t reliant on the performance of a single asset or instrument. Consult our risk-management guide to help reduce your exposure to risk when trading.

What are the advantages of trading ETFs?

Trading ETFs can benefit investors in a number of ways. ETFs track several assets within a single trade, so when compared with trading on individual shares, ETFs can be a less costly investment, while also offering a more diversified selection of assets. Additionally, ETFs can provide exposure to markets that may not otherwise be available. Learn more about ETF trading.

What are the costs of trading ETFs?

ETF trading is better value compared with trading the constituents of an ETF individually. You can open a CMC Markets account for free, with no minimum deposit.