Forward contracts

Forward trading is a transaction between a buyer and seller to trade a financial asset at a future date, at a specified price. The price of this asset and trade date is agreed beforehand as part of a forward contract.

A forward contract is a type of derivative product that shares similar characteristics to futures and options trading. This means that the contract’s value is based upon the stability of the underlying asset. For example, an exchange rate can affect the value of a currency pair, or political unrest can affect the value of a commodity, as seen in coal or oil trading.

What is forward trading?

Forward trading is an alternative to buying and selling at spot price, where an investor will physically purchase and own an asset based on its current spot price, with the intention of selling it later for a higher amount. When evaluating whether to buy an asset at spot price or using a forward contract, traders can use the theory of contango and backwardation to see whether the future delivery price will be lesser or greater than the current spot price. If it is greater, they may opt to use a forward contract.

The cash settlement takes place at the end of a forward contract period, as it has a pre-defined date of expiry. A forward hedging strategy is often used to decrease the risk of losses when price movements are particularly volatile in a financial market, as traders can close out their positions before the delivery date of the underlying asset in return for cash. In particular, this applies to forex hedging, where cross currency swaps use forward contracts to hedge the risk of fluctuating exchange rates between international currencies.

Are forward contracts traded on an exchange?

Despite this expiry date, it is still possible to customise forward contracts as they are considered an over-the-counter (OTC) instrument, rather than being traded on an exchange. Customisable aspects include expiration date of the contract, the exact asset to be traded (for example a currency or commodity) and the exact number of units of the asset. You can also close positions early in order to minimise capital losses or take advantage of any profits.

- Open a live account to start trading forward contracts now.

- Open a demo account to practise trading forwards risk-free.

Characteristics of a forward contract

- They are private and binding forward trade agreements between the buyer and seller.

- They cannot be traded on a centralised exchange but instead are traded over-the-counter instruments.

- They are non-standardised, meaning that they can be customised at any time throughout the trading duration.

- They are typically used within markets where spot prices are more common, for example, in the commodities market to trade popular raw materials such as oil, gas, corn, sugar, silver and gold. However, forward trading has more recently expanded to include currency forward contracts, indices and treasuries.

- They can be traded through spread betting or CFDs.

Forward contract example

The value of a forward contract tends to vary as the value of the underlying asset increases or decreases. As an example of forward trading in commodities, let’s say that an agricultural supplier is looking to sell 1000 barrels of white sugar in six months’ time that are valued at a total price of £10,000. The supplier is concerned for declining weather conditions in the country of produce that may have an effect on supply and demand, and therefore the price of the sugar. It agrees to a cash settled forward contract to sell the 1000 barrels to an international buyer for the spot market price of £10,000.

The spot price of sugar has three possible directions that it can turn after the six-month period: the value will remain the same, it will be higher than the contract price, or it will be lower than the contract price.

If the spot price remains the same at £10,000 for 1000 barrels of sugar, then the contract can be closed without anyone owing extra money.

If the spot price is now higher than the contract price, the supplier will owe the buyer the difference between the current spot price and the contracted forward rate.

If the spot price is now lower than the contract price, the buyer will owe the supplier the difference between the contracted rate and the current spot price.

Trade forwards on 200+ instruments

What is the difference between futures and forwards?

Both futures and forwards offer a contractual agreement to buy and sell a financial asset at a set price in the future. However, while there are many similarities between the two trading contracts, there are some notable differences.

Structure of forward and future markets

Futures contracts trade on a centralised public exchange and are standardised, meaning that their terms cannot be changed once a contract is made. On the other hand, forward contracts are more flexible in this respect. Their terms can instead vary from one contract to another. Cash settlement occurs at the end of a full forward contract, whereas changes are settled on a daily basis when trading futures until you reach the end of a contract.

Difference between forward and future prices

Hedgers tend to trade forwards in order to avoid the volatility of an asset’s price, as the terms of agreement are set at the beginning of the contract. Any price fluctuations, therefore, will not influence the price at the end of the forward contract and traders can be confident with their starting agreed price. However, within the futures market, traders are able to take advantage of asset price fluctuations in the hope of making profit from their asset increasing in value. As these contracts are settled each day, both parties must ensure that they have the funds available to withstand the fluctuations in price throughout the duration of the agreement. As a result, traders will often close out the trade early and delivery will rarely happen, in the place of a cash settlement instead.

As futures are traded on an exchange, a clearinghouse involved guarantees the performance of a transaction, which is not available for forward trading. This means that a forward contract will be much more susceptible to credit risk and may default a transaction. The probability of default for a futures contract is almost never. This is why forward contract prices often include a premium charge for the extra credit risk.

How to trade forward contracts

- Open a live trading account to start forwards trading on our financial markets. You will be granted access to a free demo account, where you can practise forward trading with virtual funds.

- Decide which individual asset you would like to explore by visiting our instruments page.

- Browse our news and insights page to take advantage of our market commentaries, key economic announcements and to stay up to date with news analysts. This is particularly useful for markets impacted by global events and resulting price movements.

- We recommend that you build an effective trading strategy prior to placing your trades.

- Familiarise yourself with the risks associated with forward contracts and trading on leverage. Apply any subsequent risk management efforts in order to minimise losses as much as possible. For this reason, most traders choose to use stop-loss and take-profit orders.

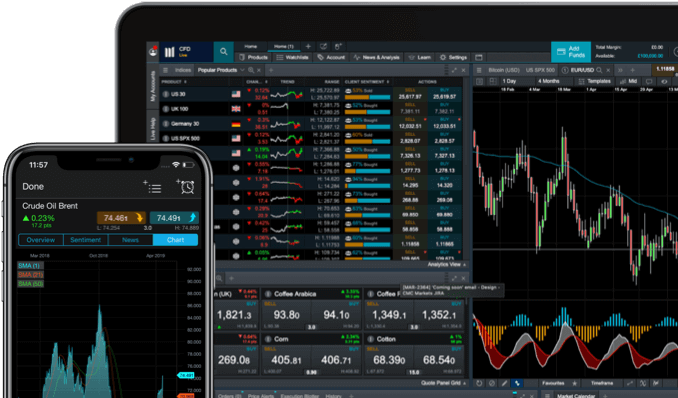

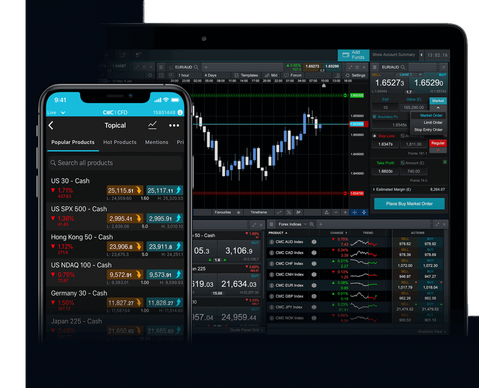

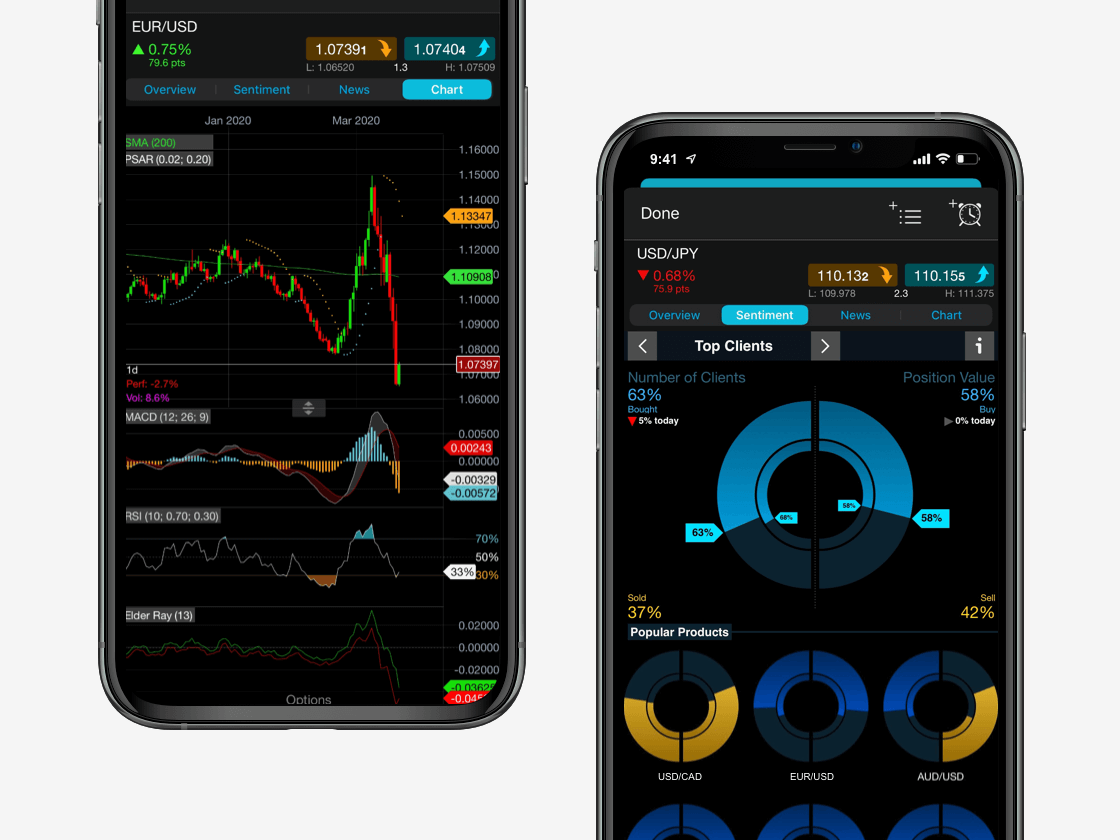

Powerful forward trading on the go

Seamlessly open and close trades, track your progress and set up alerts

Advantages and disadvantages of forward contracts

Forward contracts can be very popular with investors as they are unregulated by the government or Financial Conduct Authority (FCA), which means that they can be customised throughout the trade duration in order to meet buyer and seller’s specific needs. They also provide privacy and security for both the buyer and seller in their contractual agreement.

The binding nature of a forward contract can be seen as both an advantage and a disadvantage. On the one hand, the agreement to buy and sell at specific prices ensures that there is less risk due to market volatility, in the case that your asset value decreases throughout the contract period. However, some traders prefer to take advantage of these price fluctuations in the hope that their asset will increase in value. It may be more beneficial for these types of traders to look into a more flexible hedging strategy such as futures trading.

It can also be difficult to interpret trends and predictions for forwards trading as the size of the forwards market is unknown. As we have discussed, this may increase the likelihood of defaults on behalf of the counterparty, where the buyer is unable to make or finish their payments to the supplier. Large institutions usually measure this counterparty risk in advance to creating a forward contract, although this risk can never be completely eliminated.

Summary

Some derivatives such as forward contracts can provide a more stable investment for traders of a chosen asset. However, derivatives are complex instruments with inherent risks, so it is important to conduct research and take these into consideration. Market volatility is an inevitable part of an exchange, but forward trading can help to hedge against possibly damaging price movements and fluctuations, while also offering contracts that are private and customised to your personal needs.

Read more about the meaning of CFDs here.

FAQ

What is the difference between a spot market and forward market?

Whereas a spot market represents the price of an asset that can be traded “on the spot” with immediate execution, a forward market represents the price for a transaction that will take place at some point in the future. If you’re unsure whether to trade at a spot or forward price, read about contango and backwardation to help you decide on whether the future delivery price is likely to be higher or lower.

Do forward contracts have a premium?

Forward contracts may come with a premium fee if the forward exchange rate is quoted at a different price to the spot exchange rate. Learn more about our trading costs.

How are forward contracts calculated?

At CMC Markets, our forward CFD and spread bet contracts are based on the underlying price of a futures contract and are the equivalent instruments for trading future prices. Learn more about trading futures.

How can I hedge using forwards?

Traders often use forward contracts to hedge against volatile price fluctuations, as the terms of agreement are set at the start of the agreement. This particularly applies to the forex market, where forex hedgers can use products such as cross currency swaps to hedge against exchange rates between international currencies.

Can a forward contract be cancelled?

A forward contract can be cancelled upon agreement between the buyer and seller by creating an opposing position. For example, a forward buyer wishing to cancel their contract could enter into an opposite sell contract that has the same expiry date as the original. Browse our range of markets to see which instruments we offer through forward trading.