How to short sell currency

Short selling currency can be a good strategy if the trader believes that the currency will fall in value. In certain market conditions, traders could benefit from taking a short position and ‘selling’ a currency pair. Take the recent example of Brexit, where many traders shorted the pound as a result of negative market sentiment.

In this article, we will explain what short selling a currency means and provide examples of taking a short position on the pound and euro in the forex market. Following this, we provide a step-by-step guide on short selling forex through spread betting and CFDs, so traders can start to short currency pairs if they believe they will fall in value.

What is short selling a currency?

Short selling currency is the same as opening a position to ‘sell’ a currency pair. When a trader speculates that the value of a currency will fall, they can open a position to ‘sell’ the currency. If the price of the currency falls in value, the trader can make a profit relative to the degree that the price falls. Similarly, if the trader makes incorrect speculations and the market increases in value, the investor will make a loss relative to the price increase.

When market sentiment turns negative due to factors that impact a market’s prosperity, many forex markets can decrease in value, causing many currency short sellers to enter the market. This can cause a domino-like effect, further reducing the value of the market.

How shorting forex works

When trading in the forex market, you have the option to either ‘buy’ or ‘sell’ a currency pair. In both options, you are buying one currency and selling another. Whether you are buying are selling determines which currency you are buying and which you are selling.

Say, for example, you are trading GBP/USD.

If you go long on that currency pair and ‘buy’, you are simultaneously going long on the pound while going short and selling US dollar.

Conversely, if you sell and go short on that currency pair, you are simultaneously going short on the pound while buying and going long on the US dollar.

When you are trading forex pairs, you are always going long or short on a currency’s value relative to another. Examples are the best method to see how shorting a currency works. We will cover two examples below on some popular currencies - the pound and the dollar.

Shorting the pound

If you suspect the price of the pound to fall in the future, you could go ahead and short the pound. However, to short the pound you would have to choose a counter currency to ‘buy’ while ‘selling’ the base currency - the pound. Popular choices include USD, AUD and EUR. In this example, we will short the pound while buying the US dollar with a CFD trading account.

Let’s say that GBP/USD is trading at 1.23015.

You can go long and ‘buy’ GBP/USD at 1.2302,

or go short and ‘sell’ GBP/USD at 1.2301.

Let’s assume that, following Brexit, you think the value of the pound will fall against the US dollar. You decide to go ahead and open a ‘sell’ position on GBP/USD.

Selling a single unit of GBP/USD is essentially the same as trading £100,000 for $123,010. Knowing this, you decide to sell 5 CFDs, giving you a total position size of £500,000 or $615,050.

GBP/USD has a margin rate of 3.3%, which means that you have to deposit 3.3% of the full trade value to open a position. Therefore, your initial deposit (or position margin) in order to open a trade value of £500,000 ($615,050) would be around £15,000 ($20,296.65). Read more about margin trading.

Shorting the pound: a winning trade

You speculate correctly on the price drop of GBP/USD, and it drops to 1.22015.

You close your position on the 5 CFD contracts at the new ‘buy’ price of 1.2202.

To close the trade, you buy 5 CFD contracts at $610,100. Therefore, to work out your profit, you would subtract this from your original investment.

$615,050 - (£122,020 per CFD contract x 5 contracts)

$615,050 - $610,100 = $4,950 profit

Shorting the pound: a losing trade

You speculate incorrectly on the price drop of GBP/USD, and it rises to 1.24015.

You close your position on the 5 CFD contracts at the new ‘buy’ price of 1.2402.

To close the trade, you buy 5 CFD contracts at $620,100. Therefore, to work out your loss, you would subtract this from your original investment.

$615,050 - (£124,020 per CFD contract x 5 contracts)

$615,050 - $620,100 = $5,050 loss

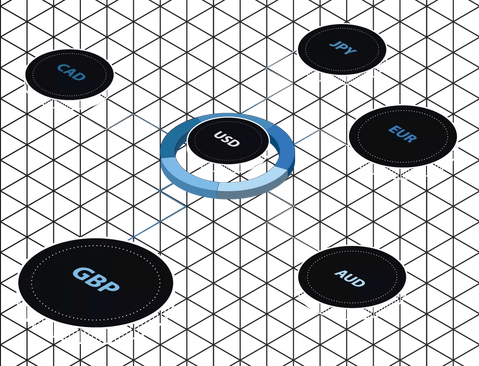

Trade on forex indices

EXCLUSIVE TO CMC

Expecting major economic announcements? Our forex indices are a collection of related, strategically-selected pairs, grouped into a single basket. Trade on our 12 baskets of FX pairs, including the CMC USD Index and CMC GBP Index.

How to short forex

- Choose a forex currency pair to trade. Based on your research, determine what forex currency pair to trade. You can use our news and analysis section or our trading tools and insights for some inspiration.

- Carry out research on your chosen forex pair. Using fundamental or technical analysis, or a blend of both, gain a deeper understanding of the currency pair you are trading.

- Use a forex trading strategy to guide your efforts. Pick a forex trading strategy and determine your market entry and exit points. Don’t forget to implement risk-management conditions to manage your exposure to risk.

- Create an online trading account.Open a CMC Markets trading account and deposit funds to start using your live trading account. If you are a beginner, you can practise on a demo account in a risk-free environment.

- Open, track and close your first position. Go short and ‘sell’ your first currency pair. Once your position is open, track its progress and close when ready.

Summary

Going short on a currency is a simple concept and involves you betting against the market. Currencies can be volatile, and strong currencies like the pound can even fluctuate wildly in price. This was evident following Britain’s announced departure from the EU, where many traders opted to short the pound. Shorting a currency provides more trading opportunities than just going long in that market, but short traders should always be aware of factors that can influence the currency’s strength and use risk-management conditions to mitigate any risk.