Large-cap stocks

In the share market, publicly traded companies are often separated by their market capitalisations, depending on whether they classify as a small, medium or large-cap stock. Large-cap stocks have a market capitalisation of $10 billion or greater, which represents the value of the company’s outstanding shares. Market capitalisation is calculated by multiplying the share price by the number of outstanding shares.

A company with a market cap of $10 billion tends to grow more slowly than a small or medium-cap company, which are instead referred to as ‘growth stocks’. In general, large-cap companies are mature and well-established in the share market, and are featured on many prestigious stock indices as a benchmark for their industry. These include the Dow Jones 30 or S&P 500. Because of this, many traders see large-cap stocks as an effective long-term investment, rather than trading on more volatile markets or penny stocks, for example.

How many large-cap stocks are there?

Large-cap stocks, which can include some blue-chip stocks, make up approximately 90% of the US equities market. These cover a wide range of industries and sectors, such as technology, industrial, e-commerce, finance, retail, consumer goods, energy and transportation.

Large-cap stock prices tend to reflect their market capitalisation, as some can cost in the hundreds or thousands, and many would say that small or medium-cap stocks are more affordable. However, they also lack volatility in the way that smaller cap shares do not, and this could indicate that they are a more stable and reliable investment in the long-term.

Large-cap vs small-cap stocks

In contrast, a small-cap company is defined as having a market capitalisation of anywhere between $300 million to $2 billion. Large and medium-cap stocks have the ability to grow faster than large-cap stocks, and can be a good investment if the company thrives. However, these can equally crash or retain the same market capitalisation for the whole lifespan of the company, and for this reason, small cap stocks are more volatile investments. The Russell 2000 index is perhaps the best known stock index that tracks the performance of a variety of small US stocks.

Quite often, small-cap companies do not yet have enough income to pay dividends to its shareholders, whereas large-cap companies can afford these payouts from years of steady cash flows and balance sheets. Read about some of the best-yielding dividend stocks here.

Please note that small-cap stocks are not penny stocks, which are instead defined as trading on the stock market with a value of less than $5. Penny stocks sometimes have potential to substantially increase their market capitalisation; notable penny stocks that have reached large-cap status include JD Sports, Ford and Monster.

Largest market cap stocks in the world by category

To browse more than 8500 shares and ETFs that are available to trade on our online platform, including the stocks listed below; visit our instruments page for more information.

Trade on thousands of large-cap stocks

Large-cap industrial stocks

Industrial companies focus on manufacturing and distributing industrial goods. This can include machinery, engineering services, waste disposal, facilities, railway and airline operations and construction supplies.

| Company | Market cap |

|---|---|

| Honeywell | $145.1bn |

| 3M | $97.55bn |

| Caterpillar | $105.73bn |

Large-cap tech stocks

Technology accounts for a large proportion of the stock market, with FAANG stocks dominating the global market. Technology and electronics services can include but is not limited to software development, cloud computing, online advertising, mobile app development and home appliances.

Large-cap healthcare stocks

The healthcare and pharmaceutical industries tend to provide stable business, no matter what is happening elsewhere in world economies. The wider healthcare sector covers research and development, biotechnology, vaccine trialling, manufacturing and retailing of pharmaceutical drugs, medical equipment and the development of hospital and care facility supplies. Read more about pharmaceutical stocks.

| Company | Market cap |

|---|---|

| Johnson & Johnson | $428.53bn |

| GlaxoSmithKline | $97.46bn |

| Gilead Sciences | $84.07bn |

Large-cap Chinese stocks

China stocks are some of the most prosperous in the world, which also focus mainly on the technology sector. Recently, China has made advances in 5G technology, as well as e-commerce, social media and streaming services.

Large-cap growth stocks

Growth stocks are companies that are showing major growth potential, even if they are already defined as a large-cap stock. This usually happens in periods of economic instability, such as the Covid-19 pandemic, which leads certain areas of the stock market to thrive, and others to collapse. Large-cap growth stocks usually have a high P/E ratio, which signifies the promising future of the company.

Advantages of large-cap stocks

- Their dividend payout ratios are often generous.

- There is a large amount of publicly available information about the company, focusing on balance sheets, cash flows and historical data.

- They are stable, reliable and act as a benchmark for a specific industry.

Disadvantages of large-cap stocks

- Large-cap stock prices can be less affordable than a small or medium-cap share price.

- Many of the largest and most traded tech stocks, including popular choices like Google and Facebook, do not pay dividends to their shareholders.

- There is less growth potential compared with other small or medium-cap stocks that trade successfully, so the relative returns for large-cap stocks are not as exceptional.

Investing in large-cap stocks

There are a number of ways you can invest in large-cap stocks. The first is to simply buy and sell shares at spot price through share trading. This is the preferred method for investors who want to hold the position for a long period of time, usually for months or years, such as position traders. A share trading strategy ignores short-term price movements and instead focuses on the fundamentals of a company, including P/E ratios, historical data and earnings reports.

Trading large-cap stocks

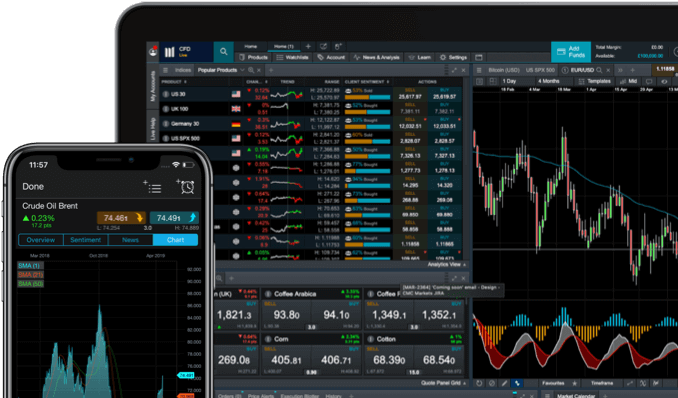

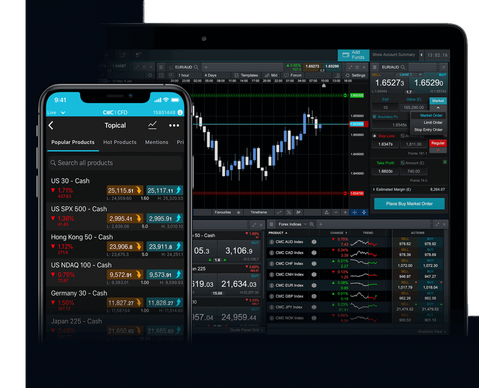

Buying and selling large-cap stocks is an efficient method for traders who are able to spend a large chunk of money on one position. However, there is also another way and that is to trade on the underlying price movements of a share, without actually owning the asset. This means that you do not have to buy the share outright and deal with the consequences if there is a market crash, or if the stock suddenly declines in price and value due to external factors. This is possible through a spread betting or CFD trading account.

Spread betting and CFDs are derivative products that allow traders to take a long or short position on a large-cap stock and depending on which way the markets move, this will result in profit or loss. In particular, spread betting allows you to trade tax-free* in the UK. Our online trading platform, Next Generation, offers over 8500 shares and ETFs, many of which are of large-cap status.

Get started trading on large-cap stocks by registering for a live account now.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.