While AI stocks have driven markets over the last 18 months, quantum computing stocks could soon come into their own. There are use cases across a wide range of industries, and some of the more innovative companies have already seen rapid share price gains over recent months.

- Airbus: quantum computing can lead to more accurate navigation and sensing.

- Artificial intelligence could accelerate performance.

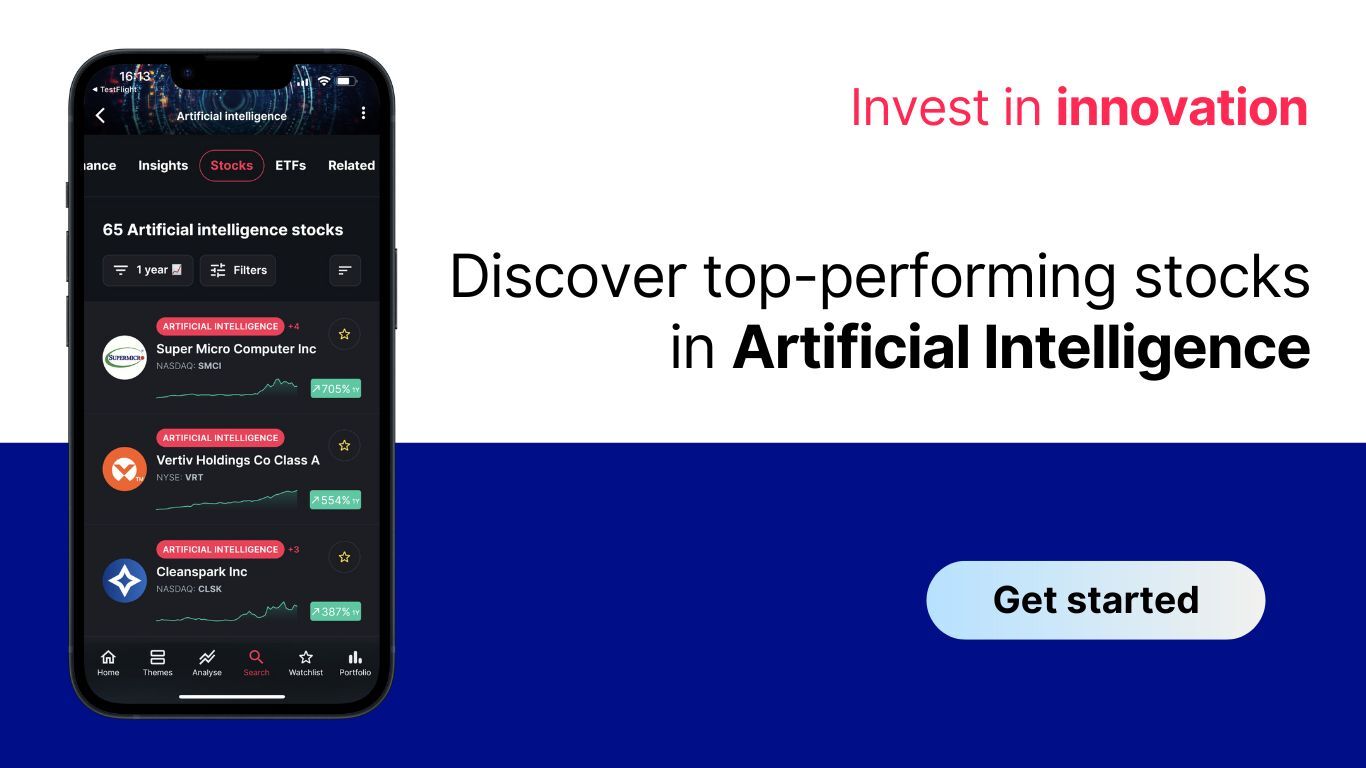

- Defiance Quantum ETF up 30% in the last 12 months.

Quantum computing — an emergent form of computing that harnesses the laws of quantum mechanics to solve problems more efficiently than classical computers — is moving out of the laboratory and into industry.

“Quantum technologies are impacting every industry that you work on,” Fernando Dominguez-Pinuaga, Vice President at SandboxAQ, told London Tech Week earlier this month. He cited finance, telecoms, defence and pharma as examples of sectors being affected by this rapidly emerging technology.

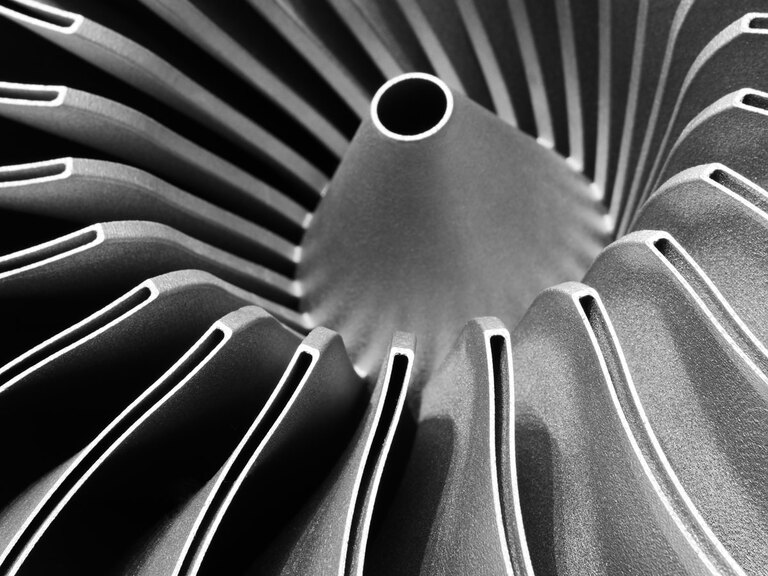

Aerospace is another. Dominguez-Pinuaga was joined on stage by Jasper Krauser, Quantum Technology Central Co-Ordinator at Airbus [AIR:PA]. Though Airbus is not often thought of as a quantum technology stock, Krauser explained how transformational the technology is for the aircraft manufacturer.

“Quantum technologies are expected to be a game-changer for the aerospace industry,” Krauser told the event.

Specifically, he highlighted quantum sensors as “one of the applications where, at Airbus, it’s obvious that we have a big advantage, because our products are filled with sensors”.

Acubed, the Silicon Valley innovation centre of Airbus, uses quantum sensing to create more accurate, more economical and lighter sensors for aircraft. These sensors can detect magnetic changes, thereby enabling navigation which, unlike the current global navigation satellite systems standard, doesn’t require line of sight to multiple satellites and is therefore less susceptible to interference.

Quantum sensors, said Krauser, are more accurate than conventional sensors. “When I say more accurate, I don’t mean 10%, or 100%. They’re potentially much more than that; maybe orders of magnitude.”

Which Quantum Stocks Will Take Off?

As industrial giants move into the space, specialised quantum computing stocks are establishing key partnerships.

IonQ [IONQ], for example, has collaborated with Hyundai [005380:KS] to accelerate autonomous vehicle technology. IonQ developed a quantum machine learning image recognition algorithm that recognises road signs, with a reduced number of input parameters compared to pre-existing methods.

Elsewhere, Quantum Computing Inc [QUBT] (QCI) secured a partnership last October with the Virginia Innovation Partnership Corporation to determine the best flight paths for drones and electric aerial vehicles — in other words, flying cars.

Bill McGann, Chief Technology Officer at QCI, explained in a press release that traditional computers can’t handle the demands of optimising for on-time delivery while simultaneously ensuring routes are efficient and safe. Currently, the technology is being applied to drones, but McGann believes that it can be scaled to passenger vehicles.

“We can imagine that when you put a person inside of a vehicle that’s now being autonomously flown or driven you have other criteria caused by the interaction between the vehicle and the person. That would add constraints, which would multiply the complexity of the problem.”

Given the outsized loads that quantum computers are expected to carry, it may not be surprising that the world’s most famous technology enabler is getting in on the act. Nvidia [NVDA], which became the largest company in the world by market cap on 18 June, announced in May that it will accelerate quantum computing centres around the world with its open-source CUDA-Q platform.

Supercomputer sites in Poland, Germany and Japan will deploy quantum computing units underpinned by Nvidia’s technology to research quantum applications in artificial intelligence (AI), biology, chemistry and energy.

Theme Trend

While some are comparing the potential rise of quantum computing to that of AI, it is perhaps more accurate to see the two as being linked, rather than separate categories. Dominguez-Pinuaga clarified that the two can catalyse each other, for example, when AI is used to interpret the results of MRI machines (which are based on quantum technology).

“When you apply AI to a machine that is so sensitive, you can start reading what you want to focus on much better,” he said.

Indeed, the crossover between quantum computing and machine learning (a form of AI), or quantum machine learning (QML), is already maturing as a focus area. According to IonQ, QML has the potential to optimise machine learning models, enabling them to solve more complex problems. This could unlock more than $140bn of potential value in the automotive, finance and technology sectors.

How to Invest in Quantum Computing Stocks

Nvidia’s share price tear isn’t showing signs of slowing; the stock is up 203.9% in the 12 months to 20 June and 164.1% year-to-date.

However, dedicated quantum computing stocks have struggled. QCI’s share price is down 57.3% in the last 12 months and 34.3% year-to-date, while IonQ’s is down 26.2% and 45.1% in the respective periods.

There are many potential reasons for this underperformance. For example, the long lead times and high research and development costs of these businesses, which are still very early in their trajectory, mean that they could take many years to generate a return. Interest rates remaining elevated for longer could amplify these challenges and damage investor confidence.

The Airbus share price gained 15.3% over the past 12 months and 7.1% year-to-date.

The Defiance Quantum ETF [QTUM] tracks the BlueStar Quantum Computing and Machine Learning Index, which focuses on companies that are directly involved in or enabling quantum computing. Nvidia is the fund’s top holding, with a 3.4% weighting as of 21 June. The fund also holds Airbus (1.3%) and IonQ (0.6%). QTUM is up 29.8% over the past 12 months, and up 16.8% year-to-date.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy