Data security software company Rubrik’s share price is trending flat following its 25 April IPO, despite a strong start to trading. The debut was heavily oversubscribed, with new orders outnumbering available shares by 20 to one. Rubrik’s IPO follows Reddit’s and Ibotta’s successful debuts.

- Rubrik’s shares trending flat across four sessions following IPO.

- US IPO market raises 235% more in Q1 2024 than year-ago quarter.

- Renaissance US IPO ETF has gained 33.5% over last 12 months.

Rubrik’s $752m Debut

In one of the most hotly anticipated IPOs of the year so far, Rubrik’s [RBRK] 25 April debut raised approximately $752m by selling 23.5 million shares at $32 per share.

The data security software company, in which Microsoft [MSFT] has held a stake since 2021, achieved a valuation of $6.6bn after it sold the shares in the range of $28–31, higher than their original valuation.

The listing drew 20 times as many orders as there were available shares in the runup, prompting an extra 500,000 to be added to the 23 million that the company had initially planned to sell.

During Rubrik’s first two sessions as a publicly traded company, the stock remained in demand with investors. It opened 25 April at $38.60 and reached a high of $40 during the session, before closing the day at $37. The following day, it closed at $38, but has since been on a downward trend: the share price sunk to close at $32.02 on 30 April, just 0.06% up from its price at IPO.

Rubrik occupies a specific niche within the cybersecurity industry that is particularly relevant to the current, artificial intelligence-dominated environment.

AI, on the one hand, requires vast amounts of data on which to train models and, on the other, presents cyber criminals with a potential weapon to use in appropriating this data. Rubrik’s products — such as Ruby — harness generative AI to simplify and accelerate cyber incident response and data recovery.

“AI, fundamentally, is based on data,” said Rubrik co-founder, chairman, and CEO Bipul Sinha in an interview with Yahoo Finance last week. “If you don’t have integrity and trust in your data, AI is garbage in, garbage out.”

Rubrik has never posted a profit, and made a loss of $354m in the 12 months to 31 January 2024. However, Sinha asserted that the company has a “path to profitability” in mind.

“We have a differentiated product, and we are creating long-term value,” he said.

Reddit and the IPO Revival

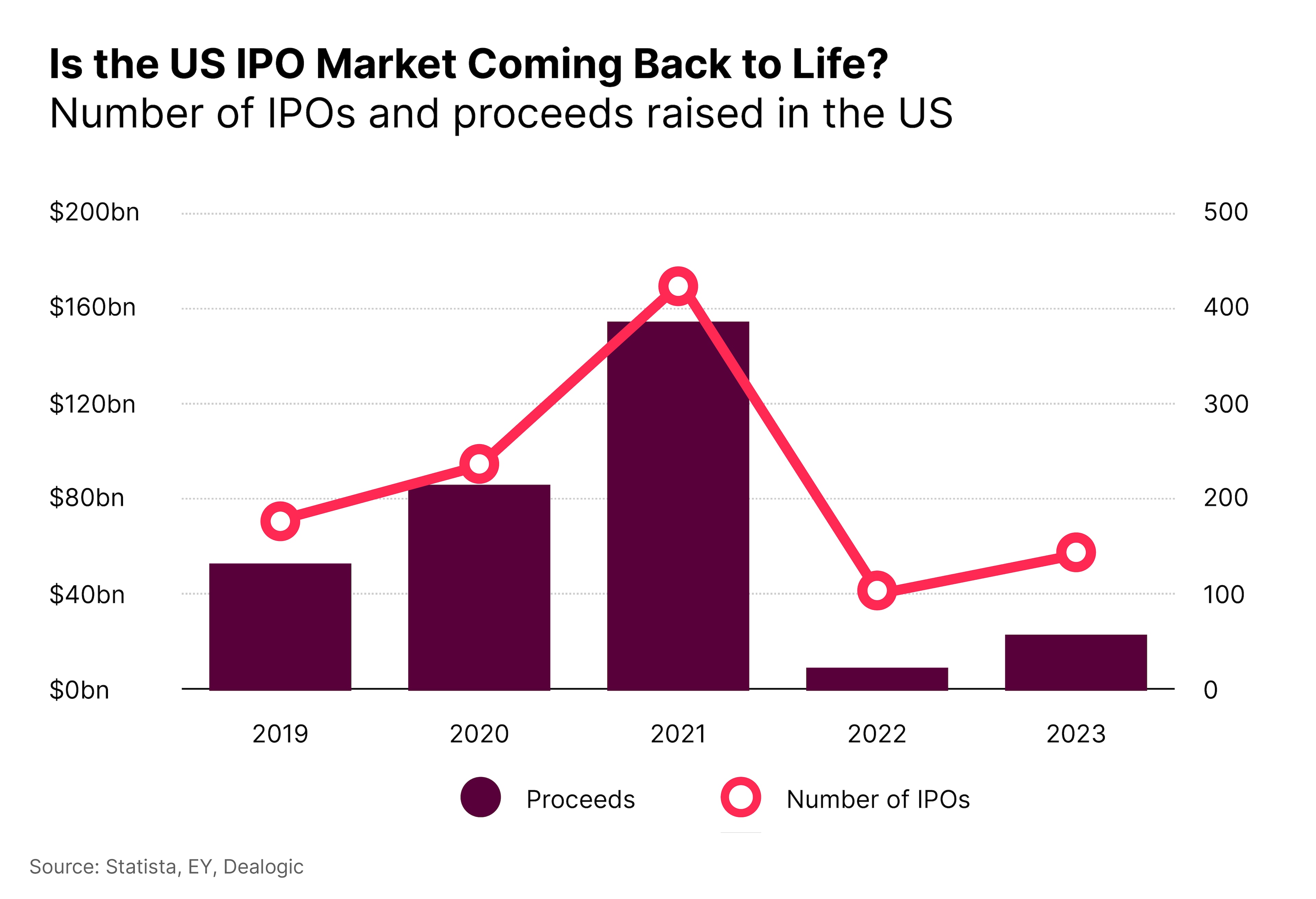

Rubrik’s debut is the latest in a series of high-profile IPOs, which together suggest the US IPO market is staging a recovery. After a record-breaking 2021, the market slumped to $8.6bn raised during 2022, with just 90 companies listing in the US. 2023 saw a slight recovery, with 128 IPOs raising $22.6bn.

Five more companies listed in Q1 2024 than listed in the year-ago quarter, while proceeds increased 234.6% to $8.7bn, according to EY.

One of the biggest names to IPO in Q1 was Reddit [RDDT]. The social media site’s shares gained 48% in its 21 March debut, raising $750m for Reddit and its selling shareholders.

However, in what could prove a cautionary tale for Rubrik’s new shareholders, Reddit stock has underwhelmed since its impressive debut.

After peaking at $74.90 on 26 March, Reddit stock has fallen since then to close at $44.44 on 30 April. While still 30.7% above the $34 at which Reddit sold its shares, it is 9.1% below the $48.88 at which they first opened on the market 22 March.

Ibotta Sets the Standard

By contrast, Ibotta [IBTA], which went public in the week before Rubrik, has so far had a positive experience.

Ibotta offers cash back and other deals in exchange for users’ purchase data, which it shares with brands while charging vendors a fee for the sales it generates. The stock gained 17.3% on its opening day, closing at $103.25, having launched at $88.

Since then, Ibotta’s share price has shown some volatility: it fell to $93.15 on its second day of trading before spiking to $110.95 on 24 April. However, on the whole, the stock has made progress, closing 30 April up 16.2% from its IPO price.

Elsewhere, former US President and 2024 candidate Donald Trump’s Trump Media & Technology Group [DJT], which operates his social media platform Truth Social, has fallen 29.6% since listing on 26 March via a SPAC deal.

Trump is set to be paid a stock bonus worth $1.3bn, according to Reuters, which could reportedly help him pay off legal fees and fines including a $454.2m civil fraud case, which he is appealing in New York.

Funds in Focus: Renaissance Capital US IPO ETF

Investors interested in gaining broad exposure to the US IPO market can consider the Renaissance Capital US IPO ETF [IPO]. The ETF tracks the Renaissance IPO Index, which in turn is comprised of large, liquid companies within three years of their IPO.

As of 26 April, none of the companies mentioned here are included in the fund’s holdings, as its quarterly rebalance happens in March, based on data from four weeks prior — i.e., before Reddit’s IPO.

However, as of 29 April, both Rubrik and Reddit have a larger market cap than Klaviyo [KVYO] ($6bn), IPO’s smallest holding, suggesting they could be contenders to be added in the next rebalancing.

IPO has gained 33.5% in the last 12 months and is flat year-to-date.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy