Matt Hougan, Chief Investment Officer of Bitwise Asset Management, discusses the future of stablecoins, including pending US legislation and disruptive potential, while a recent Visa and Allium study suggests that 90% of stablecoins transactions involve bots. He also unpacks the potential use cases of other non-bitcoinblockchain technologies, inside and outside of finance.

Matt Hougan, Chief Investment Officer of Bitwise Asset Management, wrote a note to clients at the end of April which suggested stablecoins could be “bigger than bitcoin ETFs”.

The latest chapter in what Hougan calls “the mainstreaming of crypto” could, paradoxically, be good news for the US dollar.

Stablecoins, he explains to OPTO Sessions, “are a tool that makes US dollars accessible to everyone around the world with a cell phone. That’s an amazing service, particularly in economies that have high inflation or unstable regimes.”

In effect, he says, stablecoins could export US dollars around the world, and potentially extend the currency’s hegemony.

“For this reason, the Federal Reserve and lots of Congress have actually rallied behind stablecoins,” says Hougan.

As a result, despite the historical trend against significant legislation during election years, Hougan thinks there is a realistic possibility of the bipartisan Lummis-Gillibrand Payment Stablecoin Act being passed this year.

“For this reason, the Federal Reserve and lots of Congress have actually rallied behind stablecoins.”

However, Hougan cautions that many crypto advocates are wary of the contents of the legislation itself because it is potentially restrictive.

These bills “are not as freedom-forward as the traditional stablecoin market,” he says. “From an investment perspective, and in terms of what it means for the crypto ecosystem, the impact is so potentially large, that even though these are imperfect regulations, I think it would be a massive catalyst. So yeah, I really think it's a potential big deal.”

“Even though these are imperfect regulations, I think it would be a massive catalyst.”

Destabilising Incumbents

“If we get that, we’ll see JPMorgan [JPM] launch a stablecoin, we’ll see Citigroup [C] launch a stablecoin,” says Hougan. The most disruptive consequences, however, could be felt by the $150trn payment industry’s current incumbents.

“Stablecoins are a faster way to pay for things,” explains Hougan. For that reason, “We’re going to see stablecoins start to compete for traditional payments with Visa [V] and other networks. It’s a much more efficient way for dollars to be stored and sent than the existing system.”

Hougan believes that these businesses already “see the writing on the wall”. He points to the moves that major players have made into the space as evidence of this: PayPal [PYPL], for example, launched its own stablecoin, PayPal USD, in August 2023. Visa, meanwhile, has collaborated with blockchain data platform Allium Labs to create a stablecoin monitoring tool, the Visa Onchain Analytics Dashboard.

“It’s a much more efficient way for dollars to be stored and sent than the existing system.”

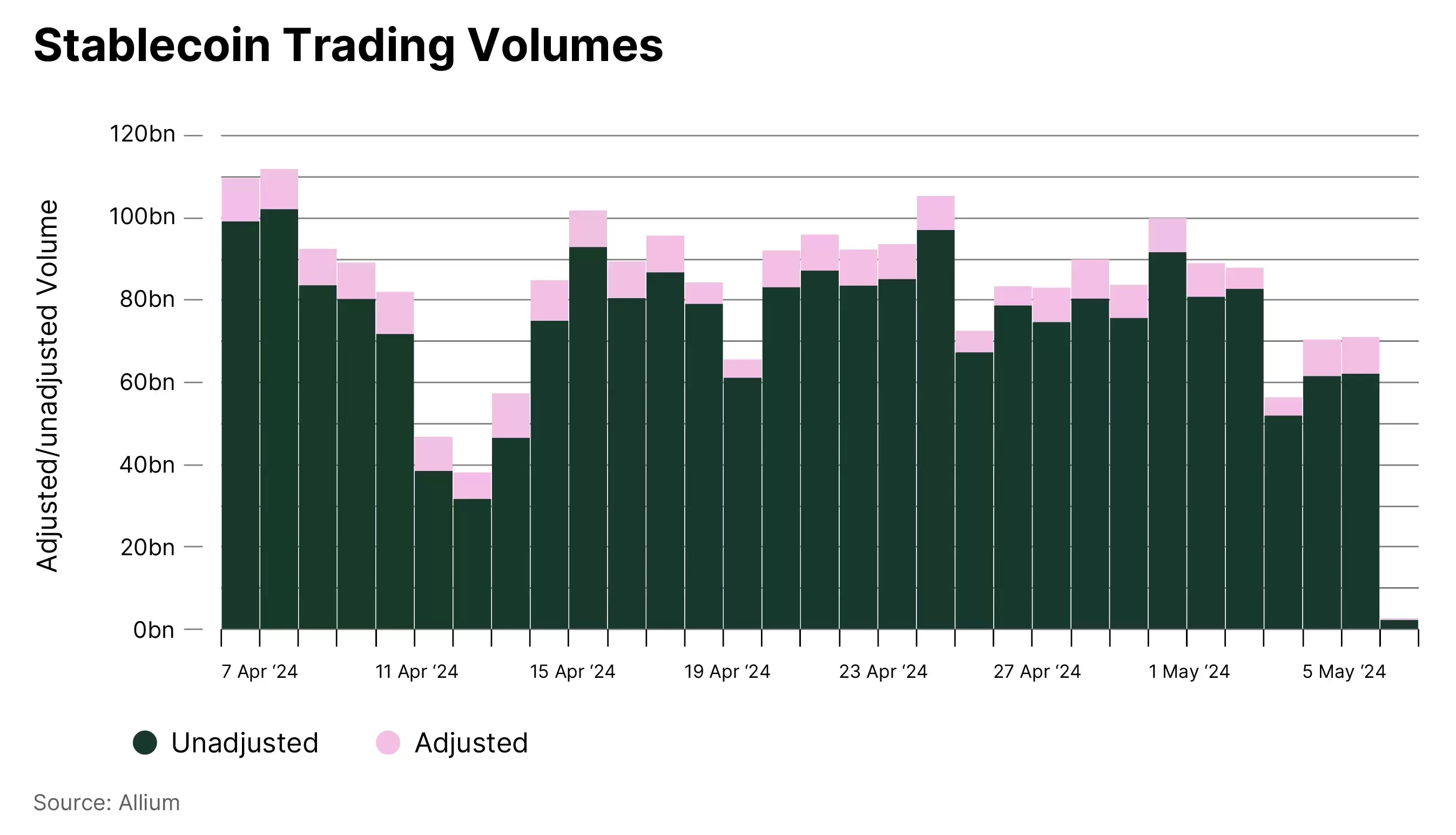

While the dashboard’s existence hints that established payments players appreciate the viability of stablecoins, its findings imply that the market may be less mature than Hougan and other advocates suggest. A report from Visa and Allium published on 25 April suggests that bots and high-volume accounts represent as much as 90% of total transactions.

Rendered Useful

While stablecoins could potentially revolutionise the future of payments, other forms of blockchain and cryptocurrency technology could have transformative impacts across the financial landscape, and even outside the world of finance.

“You can build applications on Ethereum or Solana the same way you can build applications on Apple's [AAPL] App Store,” says Hougan. “There are a large number of killer apps being built on those ecosystems.”

Tokenisation is, he says, enabling faster access to capital. “If you want to get a margin loan on your Treasury ETF, you have to sign a prime brokerage agreement that takes weeks. If you do it on your tokenised Treasury fund, you’ll soon be able to do that on platforms like Hive [HIVE] in a matter of seconds.”

Networks like Render even tap into the blockchain in order to allow 3D graphics rendering.

“Render uses blockchains and token economics to tap into unused graphical processing capabilities on computers around the world,” says Hougan. “So instead of paying Microsoft [MSFT], you can pay a decentralised system” to loan the compute power required for graphics rendering.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy