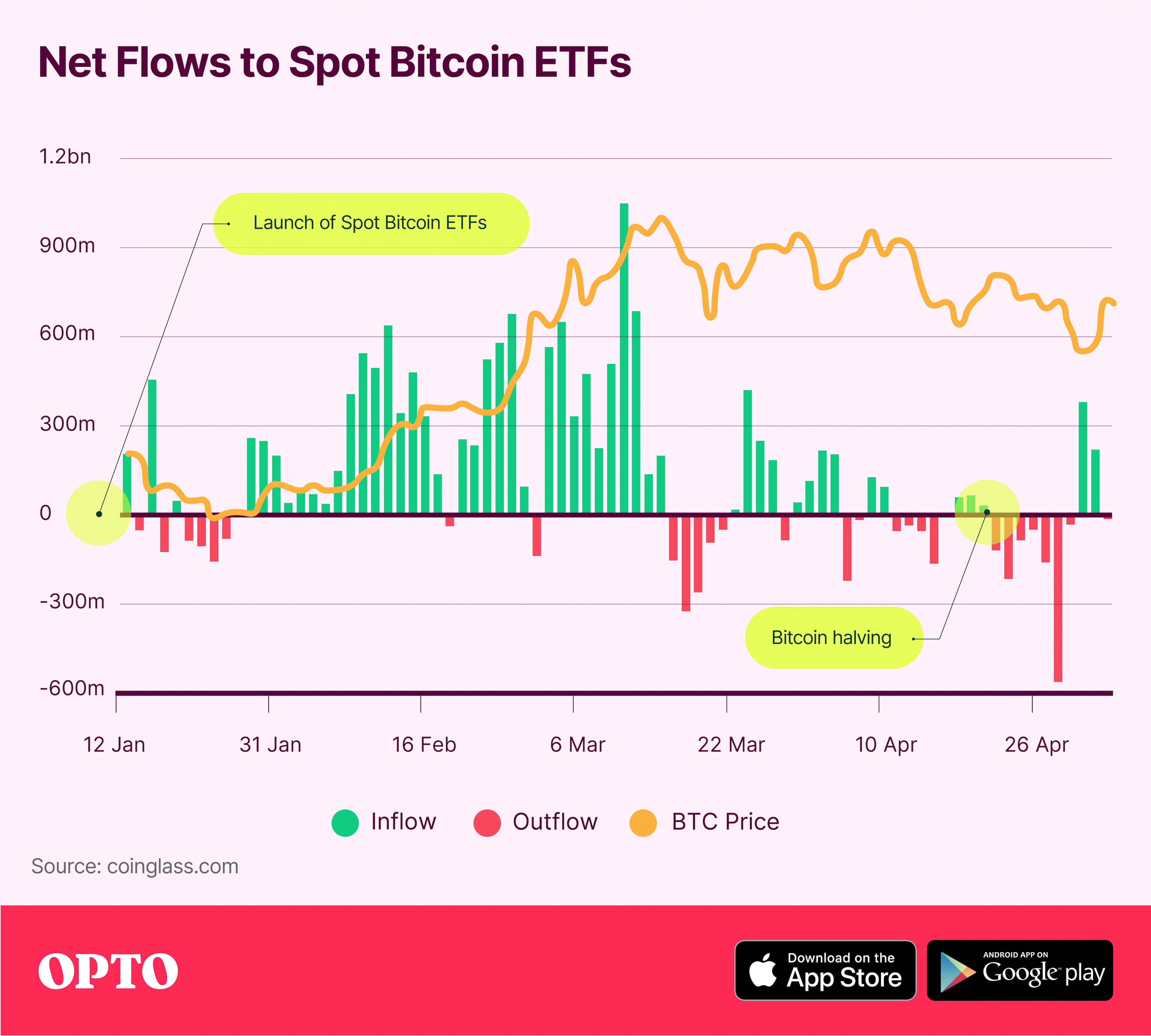

Despite netting record inflow levels during their first three months of trading, spot bitcoin ETFs witnessed a slowdown of inflows in the weeks either side of the fourth halving event. There are various reasons why this might be the case, ranging from a natural drop-off in initial excitement through to complex factors affecting market liquidity.

- Spot bitcoin ETF flows turned negative for five days prior to the bitcoin halving, and for seven of the following ten.

- Experts attribute the slowdown to diverse factors, including a broader stock market selloff.

- Grayscale Bitcoin Trust ETF up 31% since its inception.

Spot bitcoin ETFs attracted $12.5bn net inflows during their first three months — making them “the most successful ETF launch in history”, in the words of Matt Hougan, Chief Investment Officer of Bitwise Asset Management.

However, flows into these ETFs slowed notably in the weeks on either side of the fourth bitcoin halving event on 19 April.

There are several possible explanations for this. Some experts attributed the slowdown to a predictable dip in investor enthusiasm.

“It’s natural that the initial excitement would wear off,” Noelle Acheson, author of the Crypto is Macro Now newsletter, told OPTO.

Michael Zhao, Research Associate at Grayscale Investments, echoed this sentiment, explaining that the majority of inflows during the ETFs’ early months “were from self-directed retail investors”. In Zhao’s opinion, the serious, institutional money hasn’t yet appeared on the scene.

Five consecutive days of net outflows preceded the halving. While the three days immediately following the halving saw modest positive net inflows, these in turn were followed by another seven consecutive days of significant net outflows.

It is possible that this is a continuation of the effects that Acheson and Zhao described; however, as they and other commentators have acknowledged, there could be more complex factors at play.

Market Corrections

Acheson, for example, points to broader influences that could be weighing on investor appetite for bitcoin.

Linking the fall in investment to the broader market mood, Acheson suggests that weakness in the stock market could be a headwind for risk assets, particularly bitcoin.

“I’m concerned about a stock market correction, and BTC is likely to get hit should that happen as investors sell whatever they can.”

“Equity resilience has been surprising so far, however, and it could continue for a while longer, despite flashing alarm signals,” she added.

The link Acheson draws between bitcoin price movements and the broader stock market is compelling. While bitcoin has shown greater volatility, the direction of its price movements has largely mirrored those of the S&P 500 and the Nasdaq 100 year-to-date. All three registered a drop on 1 May.

It May Be the Season

Seasonality could also be influencing bitcoin’s price movements in the near term.

Arthur Hayes, Co-founder of 100x and Chief Investment Officer at Maelstrom, predicted in early April that US tax payments, the Fed’s continued bank quantitative tightening (QT) policy, and the Treasury General Account (TGA) would all drag on the bitcoin price through the second half of April.

“The precarious period for risky assets is 15 April to 1 May,” Hayes wrote in a blog post. “This is when tax payments remove liquidity from the system, QT rumbles on at the current elevated pace, and [US Treasury Secretary Janet] Yellen has yet to start running down the TGA.”

All three of these dynamics have the effect of reducing dollar liquidity, which in Hayes’ view acted as a headwind for bitcoin at around the time of the halving.

“After 1 May, it’s back to regular programming … asset inflation sponsored by Fed and US Treasury financial shenanigans,” he wrote on 9 April.

In retrospect, 1 May appears to have been an inflection point. The price of bitcoin, stock market indices and spot bitcoin ETF flows have rallied since that date.

Looking Longer Term

While they are difficult to predict over the short term, given the complex range of influences at play, most experts are positive about future inflows into spot bitcoin ETFs. Broadly speaking, this is because they believe that knowledge and interest levels among institutional investors and financial advisors will increase over time.

“The money that’s come into the ETFs so far was the money that was ready to buy on launch day,” according to Hougan.

“The bigger wave of potential capital is from investors who hadn't prioritised conducting due diligence on bitcoin prior to the ETF launch. That cohort is conducting its due diligence now. That process takes months or quarters (and sometimes years). The next wave of capital will come when that group starts entering the market later this year.”

Spot bitcoin ETFs have performed well so far despite the recent slowdown. The Grayscale Bitcoin Trust ETF [GBTC] gained 30.9% since its inception on 11 January, while the Bitwise Bitcoin ETF [BITB] gained 26.5% over the same period. The bitcoin price (which the ETFs track) gained 31.1% during the same period.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy