Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

Stripe IPO

How to trade on Stripe’s upcoming IPO

Hailed as the most valuable US technology start-up, payment processing firm Stripe is planning to debut on the stock market as a public company in the second half of 2021. Read on to discover the details of Stripe’s initial public offering and how to get involved with the process.

Late 2021

Stripe going public

$95bn+

Stripe’s expected valuation

$2.2bn

Amount raised for IPO

When is Stripe’s IPO date?

An official IPO date hasn’t yet been released, although Stripe filed its intentions to IPO with the Securities and Exchange Commission (SEC) in July 2021, so it is expected that the company will go public in the third or last quarter of 2021.

Keep an eye out for upcoming IPOs and new stocks available to trade on our platform >

Where will Stripe be listing?

The company also hasn’t disclosed a particular stock exchange that it intends to list on but given that it is a US-based company, we can predict that it will be either the New York Stock Exchange or the Nasdaq. The latter in particular is a popular choice for technology companies. Some of the biggest IPOs in terms of raised funds within the past year that have listed on the Nasdaq include Airbnb, Coinbase and Bumble, whereas the New York Stock Exchange holds new listings from Snowflake, DoorDash and DiDi.

What is Stripe’s IPO valuation and share price?

Stripe was last valued by investors at $95bn in a fundraising round in March 2021, which is an increase of over 160% from its previous valuation in 2020. It has a large private market value, which is even higher than companies such as SpaceX and Instacart.

Overall, the company has raised $2.2bn in funds from 39 investors. It is planning to use the funding for the following purposes:

Along with the date, a share price will be revealed at a later stage, along with the number of shares that the company is planning to float on the exchange.

How to trade on Stripe’s IPO

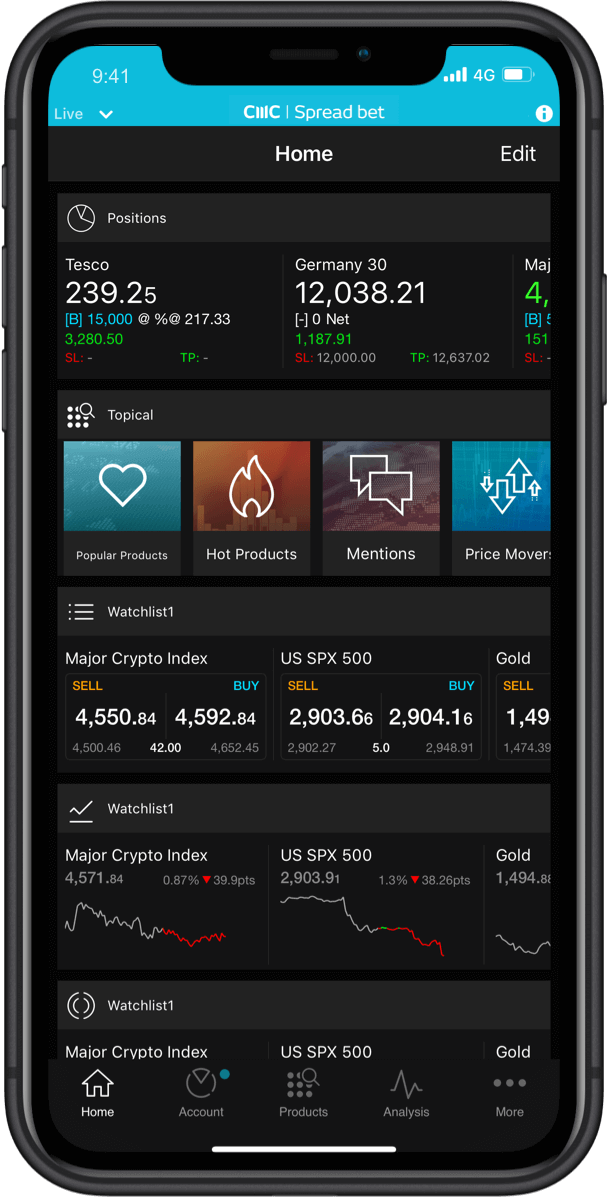

1. Register for an account

Choose whether you want to spread bet, which is tax-free in the UK*, or trade CFDs, which are available globally.

2. Decide whether to buy or sell

You can either open a long position if you think that Stripe’s value will increase, or a short position if you think its value will fall. Please note that some trading restrictions may apply on initial trading.

3. Add risk-management controls

IPOs can be a volatile process, so it is best to avoid losses by adding stop-loss orders to your positions, which may close you out of a position at your specified price.

4. Keep an eye out for news

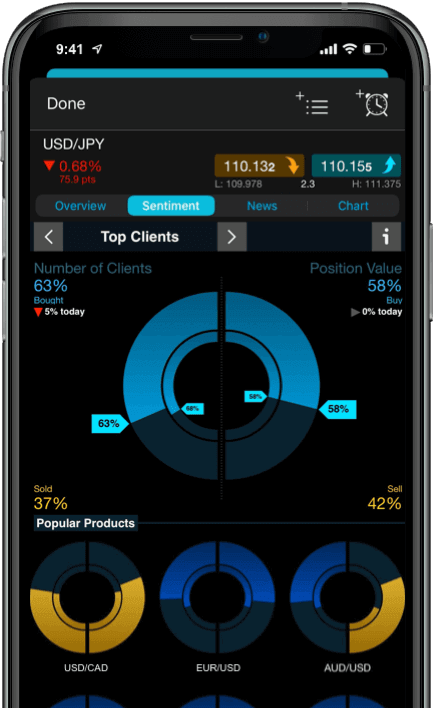

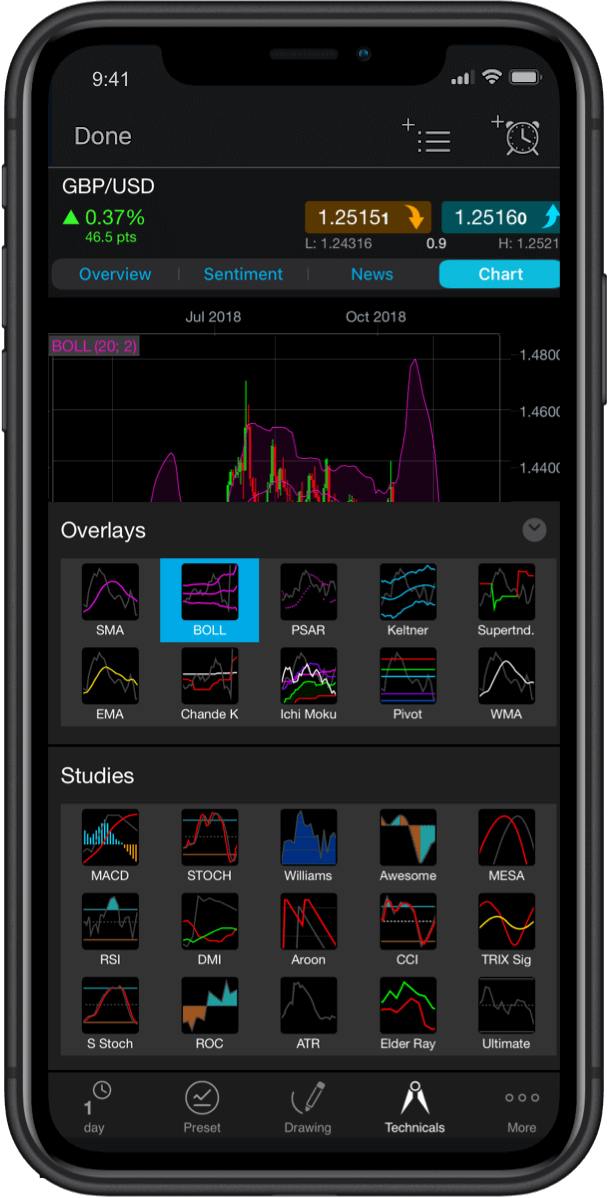

The digital payments industry is becoming increasingly competitive and there are many companies in the race. Enable trading alerts on your mobile app so that you never miss an important development.

Stripe’s financials pre-IPO

There is limited information on Stripe’s financials, given that it is a private company and is therefore not required to release reports on revenue and profitability. However, according to the Wall Street Journal, the company’s revenue rose by 70% in 2020 to a figure of around $7.4bn.

According to its website, only 14% of commerce takes place online, despite the global economy’s shift towards a digital working. Stripe processes hundreds of billions of dollars per years for businesses worldwide, so its mission is to grow the GDP of the internet, which will make it easier for other companies to follow suit.

Why may investors be interested in Stripe?

Does Stripe have any investors and/or investments?

Early investors of the company include Sequoia Capital, Allianz X, Baillie Gifford, Axa and Fidelity Management at different stages, as well as angel investors like Elon Musk (CEO of Tesla) and Peter Thiel (co-founder of PayPal and Palantir).

Stripe itself has invested in a number of well-known and start-up businesses over the years, including Monzo, Rapyd, Balance, Step and Assembled. The company also focuses on acquiring companies that can help to increase its global product offering. For example, it bought the Nigerian tech company Paystack in 2020 to expand its business in Africa, as well as software start-up Index in 2018, which could help Stripe compete for an in-store market share as well as online.

Why may investors be dubious?

No.1 Web-based Platform

ForexBrokers.com

Best CFD Provider of the Year

Shares Awards

Best Spread Betting Provider

The City of London Wealth Management Awards

Who are Stripe’s competitors?

There is a number of high-profile companies within the payments industry, the fiercest competition possibly coming from San-Francisco giants PayPal (PYPL) and Square (SQ), Amsterdam-based Adyen (ADYEN) and London-based Wise (WISE). Formerly known as TransferWise, the company recently launched on the London Stock Exchange in July 2021.

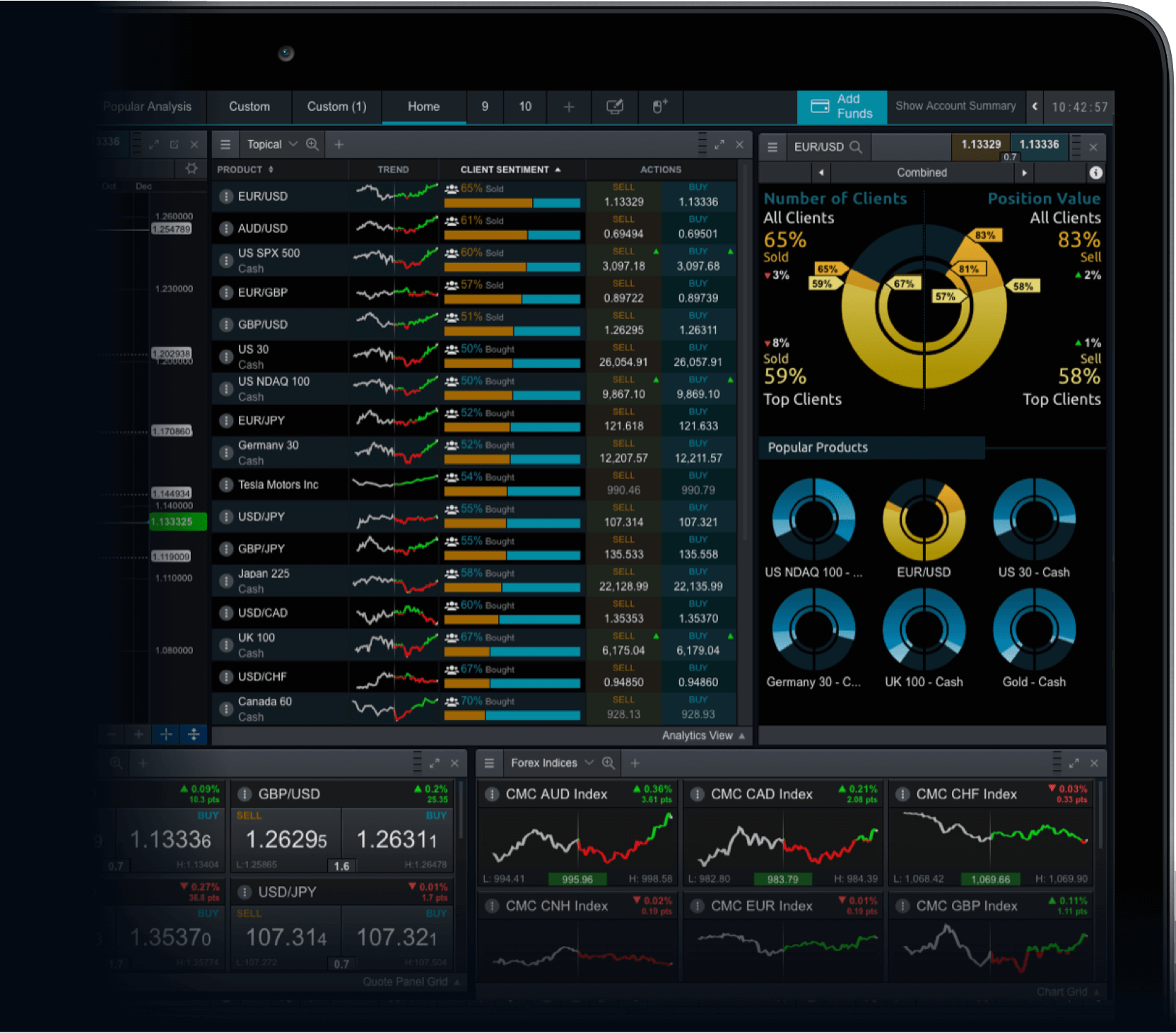

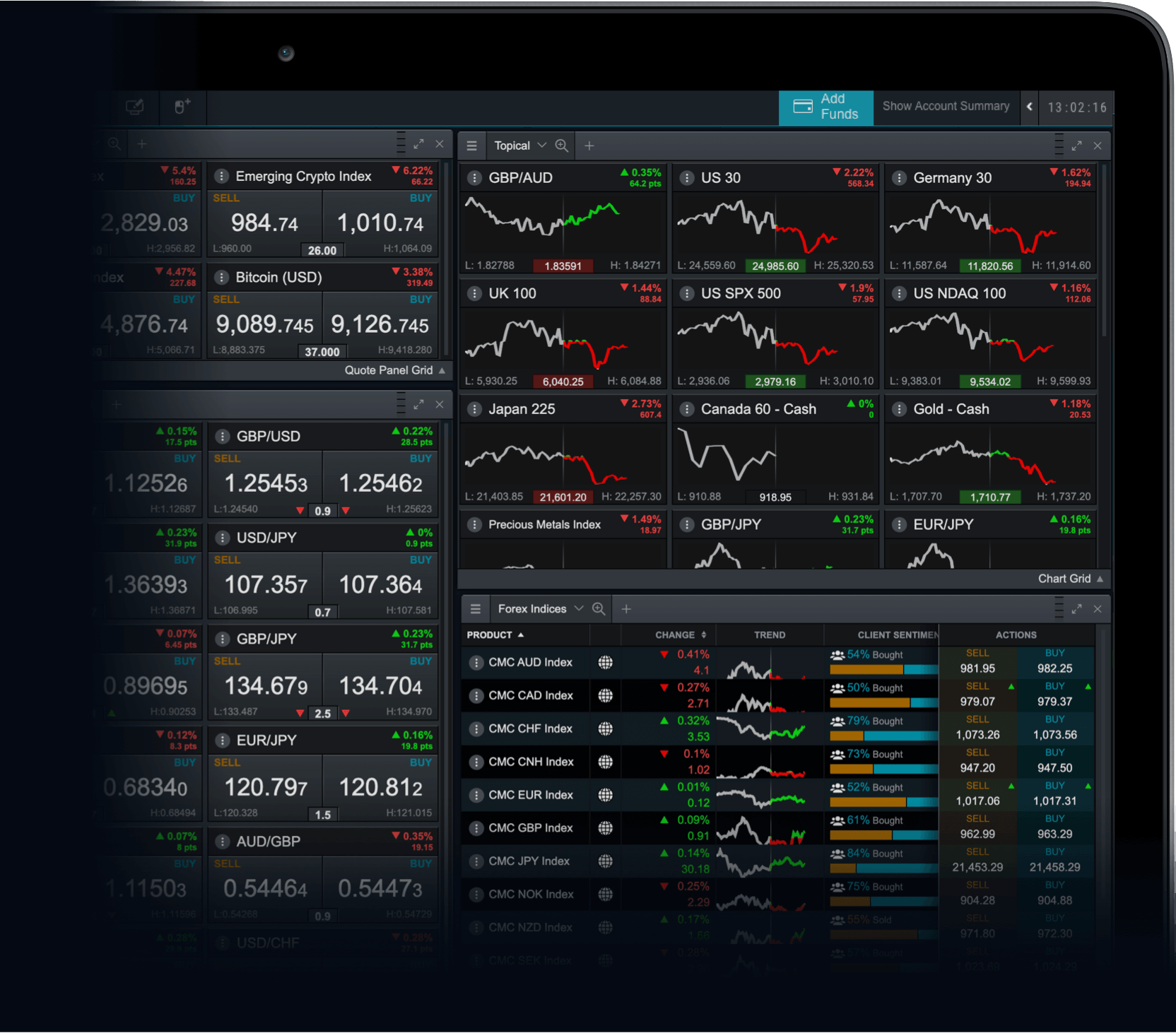

These stocks are all available to trade on via spread bets and CFDs on our Next Generation trading platform while you’re waiting for Stripe’s IPO to launch.

Other smaller platforms that rival Stripe are WePay, Braintree, Dwolla, Worldpay and 2Checkout. In early 2021, Reuters also reported that Swedish buy-now-pay-later platform Klarna may be opting for a direct listing later this year, which could put further pressure on the industry. The company is said to have raised over $3.1bn in funding and was last valued at $31bn back in March 2021.

Stay up to date with Stripe IPO news

As we don’t yet know the full details of Stripe’s IPO, including its expected date or share price, these will be announced as the company gets further along the process. Therefore, it’s important to keep an eye out for stock market news and announcements.

By entering your email address into the box above, we will notify you when Stripe stock is available on our platform. You can also enable trading alerts on your desktop or mobile device after setting up an account, so that you don’t miss out on any vital IPO developments.

FAQ

How can I trade on Stripe shares?

You will be able to spread bet and trade CFDs on Stripe shares when it has listed on a stock exchange and is available to the public. Decide whether you would prefer to spread bet or trade CFDs, as both products offer different benefits and risks.

Who are the underwriters for Stripe’s IPO?

Stripe plans to hire investment banks later on in the IPO process, but has already selected Cleary Gottlieb Steen & Hamilton LLP as a legal advisor for early-stage preparations for the listing.

Is Stripe going public in 2021?

Investors predict that Stripe will go public in Q3 or Q4 of 2021, although IPOs can be a long process, so it may be delayed until early 2022. See which other companies are planning their upcoming IPO that you may be interested in.

How does Stripe make money?

Stripe makes money by charging transaction fees to clients, which can depend on the size of the business. Fees are negotiated on a case-by-case basis for larger clients, as their volume and values of sales will be taken into account into pricing.