The purpose of a carry trade is to profit from the difference in interest rates or the “interest rate differential” between two separate foreign currencies in a pair. A carry trade strategy can be either negative or positive, depending on the currency pair that you are trading. A carry trade in forex follows the above strategy to allow a trader to profit from the difference in interest rates between the base and secondary currencies in a forex pair.

Carry trade

A carry trade strategy is applicable to most financial markets, whether you are trading in the short-term or investing in a financial instrument in the long-term. A carry trade involves borrowing from a lower interest rate asset, which is usually a currency pair, to fund the purchase of a higher interest rate asset.

Although carry trade applies to a range of markets, this article will primarily discuss the carry trade in forex trading, as interest rates are consistently fluctuating within both major and minor forex pairs.

What is a carry trade?

- Positive carry trade = buying at a high interest rate / borrowing at a low interest rate

- Negative carry trade = buying at a low interest rate / borrowing at a high interest rate

Currency carry trade

What are the best carry trade pairs?

The most effective currency pairs for a carry trade change depending on whether the strategy is positive or negative. For example, if the carry trade is positive, traders should look for pairs with a higher interest base currency than the secondary currency. On the other hand, if the carry trade is negative, then traders should look for pairs with a higher secondary currency and a lower base rate.

Opportune forex pairs for a positive carry trade include the Japanese yen (JPY) or Swiss franc (CHF) as the secondary or quote currency, due to their low yields. For this reason, the AUD/JPY or AUD/CHF are an example of popular pairs to trade due to the difference in interest rates between currencies, where the Australian dollar has a much higher yield.

Carry trade strategy: how a carry trade works

As the purpose of a carry trade is to pay a lower interest rate on the asset that you are borrowing, this means that you should profit from a higher interest on the asset that you have bought. Most traders will enter a positive position with the hope that the higher yielding currency will appreciate in value.

When trading the forex market, our traders are required to trade on margin, or in other words, using leverage. This means that you only need to place a fraction of the full trade value in order to gain exposure to the currency market, which acts as a deposit. Leverage can work in your favour if the trade is successful, but it can also magnify your losses if the trade is unsuccessful. Traders should be cautious when trading on margin and always have a risk management plan to offset as much capital loss as possible. We will consider the use of leverage in a carry trade in the example below.

Carry trade example

For example, let’s say that an investor decides to deposit £1000 into a forex trading account. He chooses to trade AUD/JPY for a positive carry trade, which has an interest rate differential of 5%. Using a leverage ratio of 20:1 (based on our margin rate for this instrument), he can open a position for £20,000 of the currency pair, meaning that the deposit is only 5% of the full value.

Depending on which way the market moves, this carry trade strategy can result in various outcomes:

- If the currency pair appreciates in value over a period of time, then he will continue to receive 5% interest of the full position value and any other profits that come with it.

- If the currency pair depreciates in value over a period of time, this will result in losses and the investor may be closed out of the position when all that is left is the 5% margin of £20,000.

- If the currency pair’s exchange rate remains the same over a period of time, then the investor will receive 5% interest on the leveraged trade. He will not encounter any other profits or losses.

There is always the option to practise your carry trade strategy first with a forex demo account. This comes with £10,000 worth of virtual funds so that you can trade risk-free on our platform.

Practise your carry trade strategy

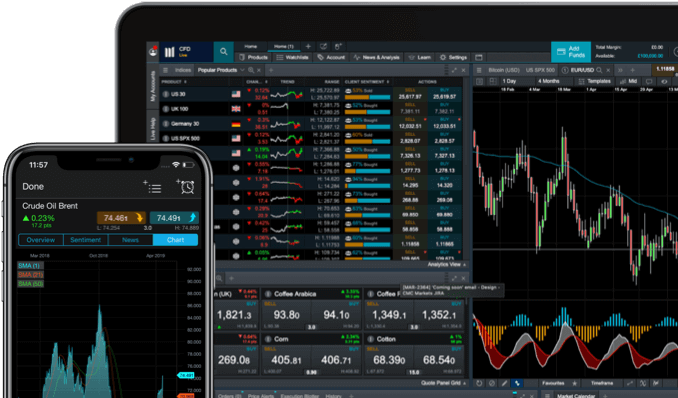

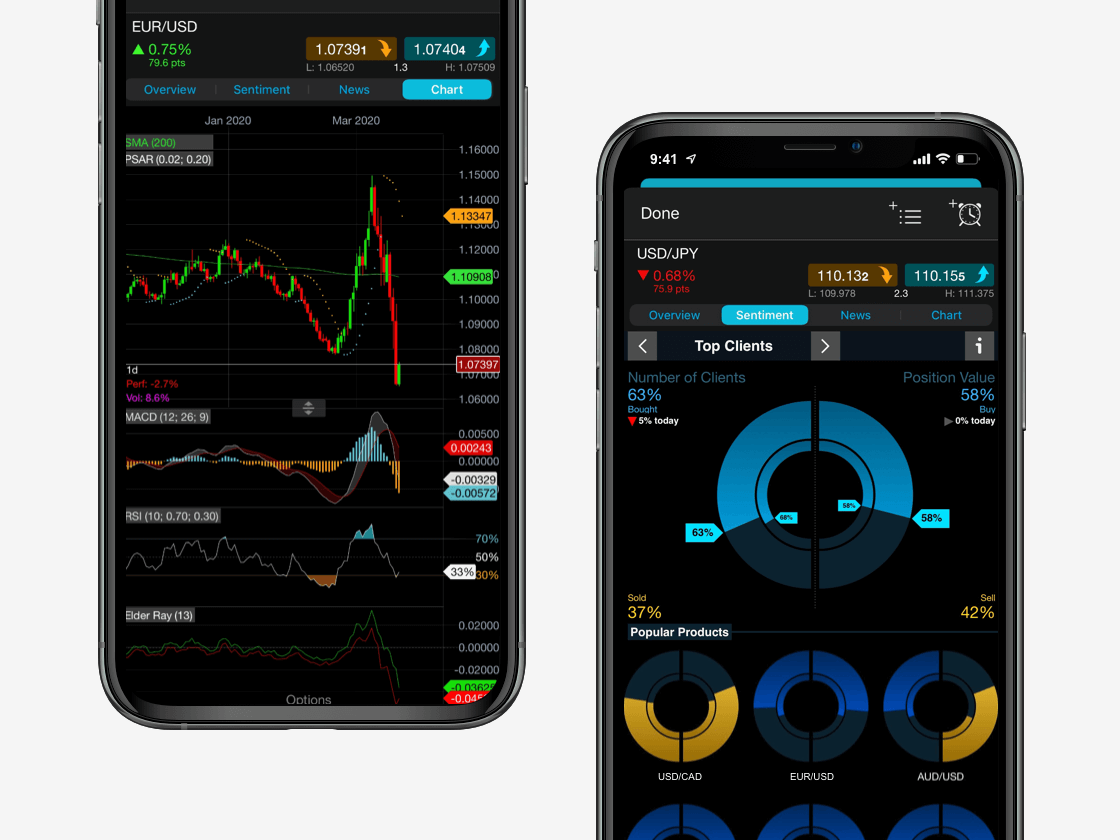

We offer the option to trade on over 330 currency pairs on our award-winning forex trading platform*, which is the highest in the industry. With tight spreads that start from just 0.7 points, low margin rates of 3.3% and lightning-fast execution, our platform is fully adaptable to a large number of forex trading strategies.

Before opening a carry trade position, it is important to build a trading strategy and explore our range of risk management tools. Forex trading can be volatile and this often results in loss of capital due to unforeseen price movements and events within the market. Placing a stop-loss order on your trade can help to manage risk by specifying the maximum amount that you are willing to risk on a trade before closing you out of the position. For extra safety, a guaranteed stop-loss takes into account gapping and slippage on price charts as well, minimising your risk further. Read more about our range of execution and order types.

Open an account now to get started.

Carry trade news

The stability (or instability) of an economy can have a significant impact on carry trade rates, especially within the forex market. This is because interest rates are subject to inflation and other external events, which can cause the value of currencies to fluctuate often. To keep up to date with the latest trading news and economic announcements, our news and analysis section of the platform is updated daily by our dedicated market analysts.

Seamlessly open and close trades, track your progress and set up alerts