Order types and execution

The Next Generation platform provides fast, 100% automated execution, complemented by multiple order types, which provide flexibility on how you enter trades and give you more control over your risk management. Learn about our platform pricing and execution quality.

Best Trade Execution

Global Forex Awards

Best Trading Technology Provider

HedgeWeek European Awards

Best Trading Execution

Professional Trader Awards

Multiple order types

Our range of order types allow flexible order placement, and our risk-management tools are customisable and easy to use. You can set default stop-loss and take-profit orders to manage risk on every trade. However, all stop-order types except guaranteed stop-loss orders are susceptible to market slippage and gapping.

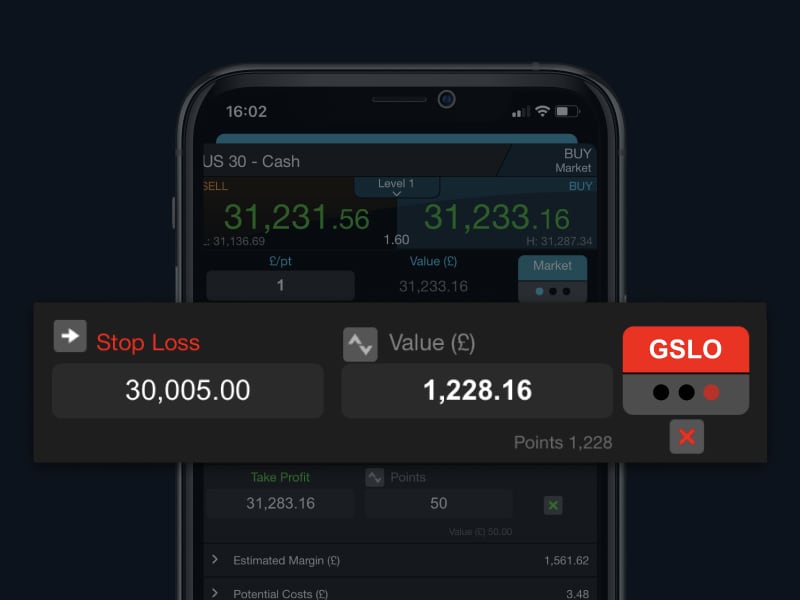

Guaranteed stop-loss orders

For a premium, our GSLOs give you 100% certainty that your stop-loss will be executed at the exact price you want, regardless of market volatility or gapping. We refund the premium if the GSLO is not triggered.

Market orders

Use market orders to open or close trades at the current market price. Our automated execution means market orders get filled at the next available price.

Limit and stop entry orders

Limit orders and stop-entry orders are used to trigger a trade execution at a specific price above or below the current market price, and within a set time period.

Partially close trades

It's possible to close only a portion of existing trades. For example, if you have four CFD trades of 2 units each on the UK 100, you can choose to close out one part (2 units), leaving the other three trades in place.

Stop-loss orders

Stop-loss orders allow you to specify a price at which a position will be closed out by the platform, if the market moves against you.

Trailing stop-loss orders

A trailing stop-loss will follow a price as it moves favourably for you, remaining at the distance specified when the order was placed.

Take-profit orders

Take profit orders are used to set a predetermined target level at which you would like the platform to close a trade and secure the profit from that trade.

Advanced order features

The platform includes an array of advanced order features that allow for even greater control, flexibility and customisation when it comes to orders and trade execution.

Trade from charts

Open, close and amend orders directly from charts and view levels against historical price action. Once a position has been opened, just click the triangular trade entry icon on the chart and drag stop-loss and take-profit levels to change them. '1-Click Trading' allows you to place trades immediately by clicking on any streaming buy or sell price. Your usual default risk-management and order settings will automatically be applied.

Use boundary orders in volatile markets

Control slippage in volatile markets by specifying a boundary price range in the order ticket. If the price at execution is outside this range, then the order will be rejected. Available on market and stop entry orders.

Price ladder trading for large orders

Our price ladder displays prices for trades that are larger than what's available at the first bid and offer price. It lets you enter trades which you otherwise wouldn't be able to enter, with just one order, but with a wider spread. Our automated trade execution ensures that positions up to our maximum trade size will always be executed through price ladder trading.

Go long and short simultaneously

With account netting disabled (via 'Account Settings'), it's possible to place long and short trades on the same product at the same time.

Trade using unrealised profit

If a trade is in profit, you can use this unrealised profit to open new trades, thus taking advantage of other opportunities without having to close profitable trades.

Pre-set order preferences

Set default order preferences for all or specific products. You can turn off pre-order confirmations and set last trade size, stop losses and take profits as default.

Rollover discount on forwards

When you manually roll a forward to the next contract, you enter the new trade at the mid-price and save 50% on the spread cost. You can also set forward settlement behaviour to 'Auto Roll-Over' to have this rule applied to all of your forward positions.

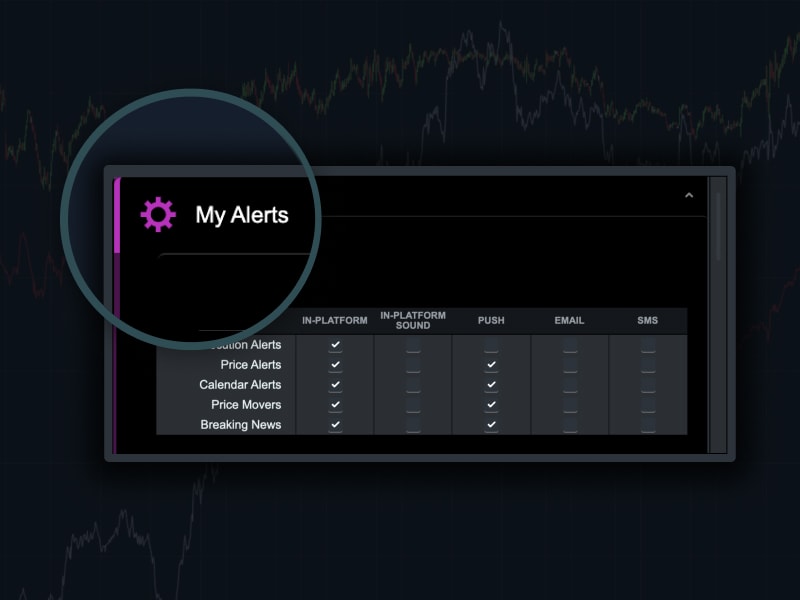

Execution alerts

Set up our alerts system to notify you when important price levels are breached or when your pending orders are triggered. Receive platform pop-ups and have alerts emailed to you, sent to you by SMS, or pushed to your mobile device.

Via email, SMS or push

Get trade execution alerts, including mobile push notifications, when pending orders (such as stop entry, limit, stop-loss or take-profit orders) are executed in your account. To complement execution alerts, we also offer price alerts. These enable you to receive notifications when the price of a product you're interested in reaches a significant level specified by you, such as a major support or resistance level.

Account close-out

You can choose the account close-out method* used by the platform to automatically close out your trades if your account revaluation amount** falls below your close-out level. Change the close-out method in 'Account Settings' on the platform.

Complete close-out

This is the default setting whereby all trades on your account are closed out^.

Last trade in, first out

This option will start by closing your most recent trade first, or a portion of it. Then the next most recent trade will be reduced or closed if necessary, and so on.

Largest position loss first

This option will start by closing the position showing the largest unrealised loss first, or portions of it, on a first in, first out basis.

Largest position margin first

This option will first close the position with the largest position margin, or portions of it on a first in, first out basis.

Powerful trading wherever you are

FAQS

What is a limit order?

A limit order is a trade order to ‘buy’ or ‘sell’ an asset at a specific price. A buying limit order can only be placed at the market price or lower, while a selling limit order can only be placed at the market value or higher. A limit order helps to give a trader more control as to what price they will pay for an asset, and are placed with an expiration date. A good way to understand limit orders is by placing practise trades with £10,000 of risk-free virtual funds on our demo account.

What is a stop-loss order?

A stop-loss order is a market order that can help manage your risk by closing a trade at a pre-determined price. It is an essential risk-management tool and can be used to avoid excessive loss of capital. Besides a classic stop-loss order, trailing stop-loss orders and guaranteed stop-loss orders are available to use. Find out more about stop-loss orders.

What is a market order?

Market orders are the simplest of all trade order types, opening and closing trades at the current market price. Our automated execution means market orders get filled at the next available price. Read more about market orders.

What are trade orders?

Trade orders are various types of orders that are placed to open a trade. These orders involve the buying or selling of an asset at a certain price. The most common trade orders include market orders, limit orders and stop-loss orders. Find out more about stop-loss orders here.