What is global macro trading, and how can I do it?

Macro trading is a strategic investment approach that considers macroeconomic trends occurring within a country, and on a global level, to determine whether financial securities will benefit from these trends as they play out. Several prominent hedge funds and billionaire investors use a macro trading strategy, including George Soros and Ray Dalio.

In this article, we explain what global macro trading is, how to do it, and strategy ideas that may be worth following. Test drive your macro trading skills with our free zero-risk demo account where we give you access to our advanced trading platform and £10,000 in virtual funds to play the market with. Sign up for a free demo account.

What is global macro trading?

Global macro trading looks at major trends occurring on a country or global level. If this outlook is favourable, investors may buy assets that appreciate in such conditions. If the outlook is flat, they might choose to stay invested in cash or low-risk interest bearing instruments. If the outlook is weak, they may short assets that could decline. They may get this information from analysing economic indicators.

Macro investors may buy or short stocks, bonds, currencies, commodities, and exchange-traded funds (ETFs). For example, if a macro investor believes that the US economy is heading towards a recession and predicts that stocks may decline, they may start shorting a wide array of stocks or stock index ETFs.

While some macro traders may only look at the macroeconomic conditions of the country that they’re based in, some around the world take a global approach and may invest in, or short, the different assets in different countries. For example, if the outlook for India is strong, a global macro investor based in the UK may buy Indian stocks, and at the same time, may short stocks in Russia and sell the country’s currency if its outlook is weak, for example.

Macro vs micro: what’s the difference?

Macro investing is not concerned with the profit levels of an individual company. Rather, the macro investor looks at whether profits are rising, on average, within a country for most companies. They look at whether the economy in that country is doing well or poorly, and what the political situation is like or may become, in order to find potential trading opportunities.

The investor considers whether commodities are rising or falling and the direction of interest rates. They may use fundamental analysis of economies and countries to assess where the economy is likely headed, and then make investments based on those assumptions.

On the other hand, micro investing is analysing individual assets to determine where that asset’s price may go. Buying an individual stock based on its technical analysis outlook or earnings per share is an example of micro investing. Value investing and growth investing strategies are also micro trading strategies because they focus on individual assets as opposed to broad-based trends.

Who are some famous macro traders and hedge funds?

George Soros is a well-known macro investor, who founded Soros Fund Management in 1970. In 2010, it was ranked as a top performing fund, with returns averaging more than 20% over its 40-year history.

Ray Dalio is another macro investor, who is the founder of Bridgewater Associates. According to TipRanks, the firm has returned an average of 11.25% to investors over the last three years to September 2021. This is similar to its longer-term performance going back to 1975. Major holdings include the SPDR S&P 500 ETF Trust and Walmart.

For comparison, the S&P 500 index has averaged 21.97% annualised returns from the start of 2019 to 2 September 2021.

What are the three approaches to macro trading?

According to the Corporate Finance Institute, macro trading falls into three categories:

- Discretionary Macro: This approach allows flexibility and discretion. The macro trader does their analysis, whether fundamental or technical, and then deploys capital as they see fit. They are not limited to going only long or only short, or only trading certain assets or in certain countries. Essentially, based on their analysis, they can trade how they want with this information.

- Systematic Macro: This approach is more rigid and rule based. Systemic strategies are often programable, meaning the rules are precise enough to be fed into a computer and have it decide what to buy and sell. There is no discretion here. The strategy defines exactly what to do based on the data points provided. Such strategies are typically based on historical backtesting or hypothetical models/predictions.

- Commodity Trading Advisor (CTA)/Managed Futures: Managed futures or CTAs trade futures contracts on behalf of their clients. The manager may take a discretionary or systematic approach, but they only trade in futures contracts. Futures contracts can be traded on stock indices, commodities, volatility (VIX), currencies and interest rates.

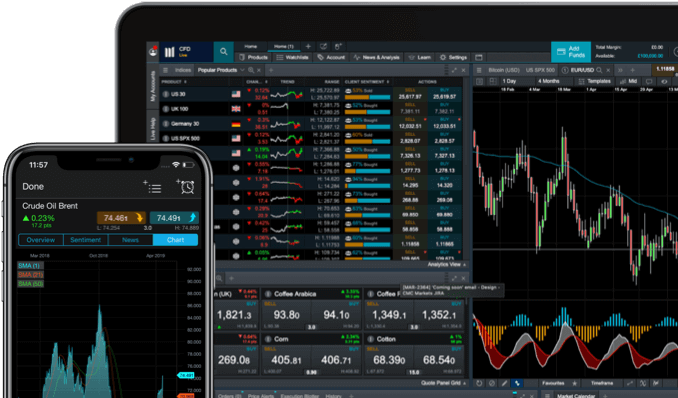

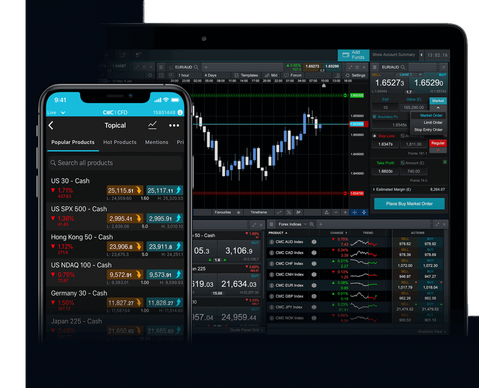

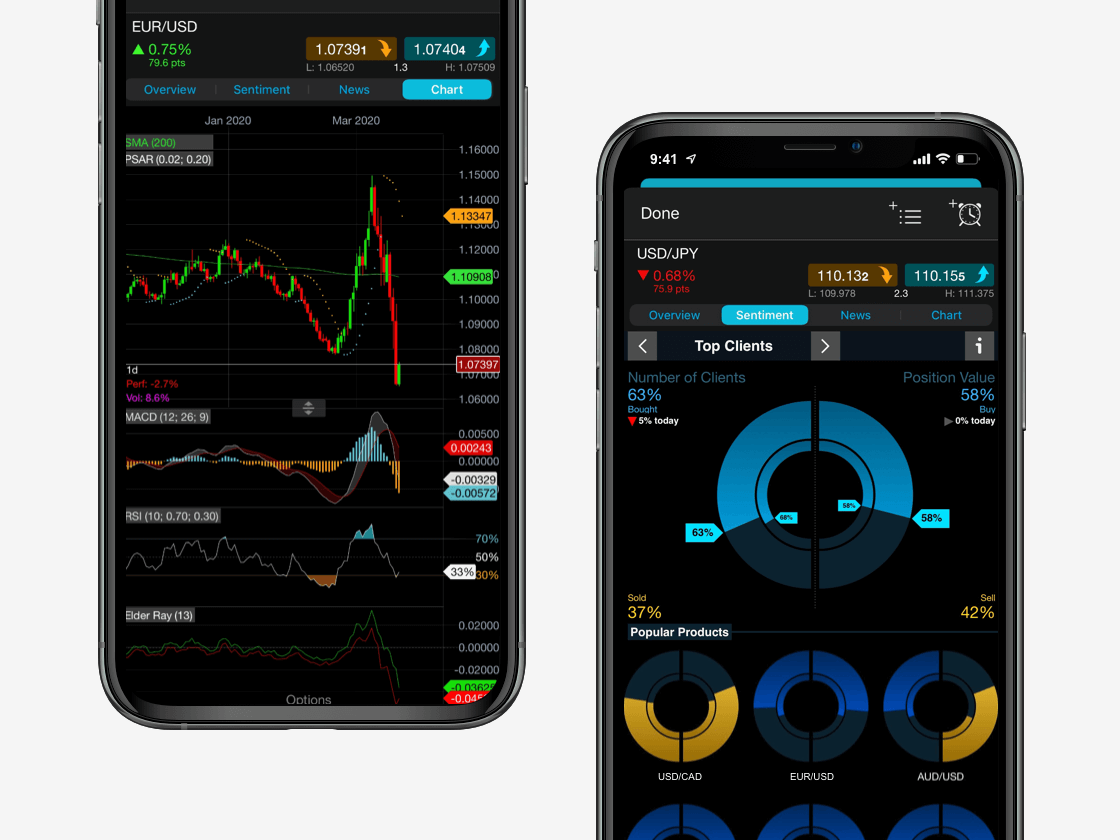

Practise trading with virtual funds

Seamlessly open and close trades, track your progress and set up alerts

What are some global macro trading strategies?

Global macro trading strategies use different inputs to assess whether a country’s economy is likely to perform better or worse in the future. Below are examples of the type of strategies macro traders may look at:

Trading on fundamental analysis

Macro traders look at economic data on a macro or country level. Important data points include GDP, price indices (inflation), employment rates, home sales and builds, interest rate announcements and expectations, manufacturing, and shipping numbers.

No single data point is important on its own. Rather, macro traders look for trends and extremes in the data relative to historic levels.

Monetary and fiscal policy

Monetary and fiscal policy are tools central banks and governments use to help control the economy.

Monetary policy controls the supply of money in the economy, primarily using interest rates. Lower interest rates and increasing money supply generally mean higher asset prices. Higher interest rates and decreasing money supply mean less buying and lower asset prices, generally.

Fiscal policy is how governments spend and tax. Higher spending and lower taxes tend to stimulate the economy. Lower government spending and higher taxes on businesses and individuals tend to result in slower economic growth.

Macro traders may look at these trends to assess whether it is a good time to buy or short the various asset classes.

Geopolitics

Macro traders look at how stable countries are and consider how that may change in the future. Stability allows for growth, while instability could create fear and push asset prices lower.

Technical analysis and trend following

Price trends in an asset may warrant interest from macro traders, as this suggests that there is movement or volatility within the stock market for some reason. Stock market cycles can last several years, whereas interest rate cycles and commodity cycles can last decades. Therefore, spotting a trend early can mean that you can profit from that trend for years to come, if successful.

Market mispricing

Macro traders may watch for events that signal major price turns in an asset class. These major trend changes tend to occur when market prices have moved far away from their intrinsic value or historical norms. Bubbles and crashes result in extremely high and extremely low asset prices, respectively. A carry trade (borrowing from a lower interest rate asset to fund the purchase of a higher interest rate asset) or currency peg (fixed exchange rate for a currency with another country) can result in an asset trading at a very different value than it otherwise would. If the carry trade unwinds or the peg is lifted or adjusted, it can result in rapid and sizable price movements.

Black swan events

Black swan events are rare events that are not expected by most market participants. They cause price moves well outside normal expectations or typical market movements. When a black swan event will occur, or its magnitude, is unknown in advance. But macro traders can look at prior black swan events to get an idea of the potential fallout if another similar event were to occur.

An example of a black swan event is when Long-Term Capital Management, a high-profile hedge fund, was liquidated in 1998 and nearly brought down the whole US financial system with it.

Demographics

Macro investors may look at demographic changes to predict emerging trends. An increasing number of younger people in a population may increase technology demand, while an ageing population means greater demand for healthcare, for example.

NEW

Share baskets

Get exposure to the world's fastest-growing, trending industries, from Driveless Cars to Streaming Media

What books are there on macro trading?

If you are interested in learning more about macro trading, here are some books that explore this strategy in further detail:

- The Alchemy of Finance by George Soros

- Global Macro Trading: Profiting in a New World Economy by Greg Gilner

- Fed Up! Success, Excess and Crisis Through the Eyes of a Hedge Fund Macro Trader by Colin Lancaster

- Mastering the Market Cycle: Getting the Odds on Your Side by Howard Marks

- Geopolitical Alpha: An Investment Framework for Predicting the Future by Marko Papic

How to craft your own macro trading strategy

Interested in creating your own macro trading strategy? Here are steps you can take in order to get started:

- Pick strategies that interest you and that you can find data on.

- Define what assets you will trade, such as stocks, ETFs, bonds, currency pairs, and/or commodities.

- Choose which countries you will trade on stocks from. Each country will have different factors affecting its macroeconomic performance.

- Use historical data to establish benchmarks, noting the range of values for the data, and what happened to asset prices when extreme values occurred. For example, if trading US stocks and monitoring US interest rates, note what happens to stock index prices when interest rates fluctuate.

- Establish buy and sell rules for the assets you’ve chosen to trade. Determine what data points (employment or GDP, for example), and at what levels, constitute a buy or sell in an asset class. Consider adding in technical buy and sell signals based on price charts.

- Establish risk-management protocols. These include where stop-losses will be placed in case the timing of the trading is wrong or the outlook changes. Additionally, consider how much account capital is allocated to each trade, keeping in mind these are longer-term trades that may take time to produce profits if the macro assessment is correct.

- Open a trading account and fund it to start potentially profiting from your macro strategy.

FAQ

How can I practice macro trading?

Sign up for a demo account to practice macro trading without risking real capital. Look at how different data points have affected asset prices. For example, look at interest rates and stocks. Plot interest rates along with a stock index and note what was happening at major stock index turning points. Consider how this interaction may be tradable.

What tools does the trading platform have to help me trade macro?

Our Next Generation trading platform offers a range of chart types for analysing price trends, a sentiment tracker to help assess whether other traders are bullish or bearish on an asset, Morningstar equity research reports, and a Reuters news feed in order to stay on top of all the latest economic data figures. Explore our platform features in more detail.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.