The death cross and golden cross are simple technical analysis indicators that alert traders when a price trend may be turning bearish or bullish.

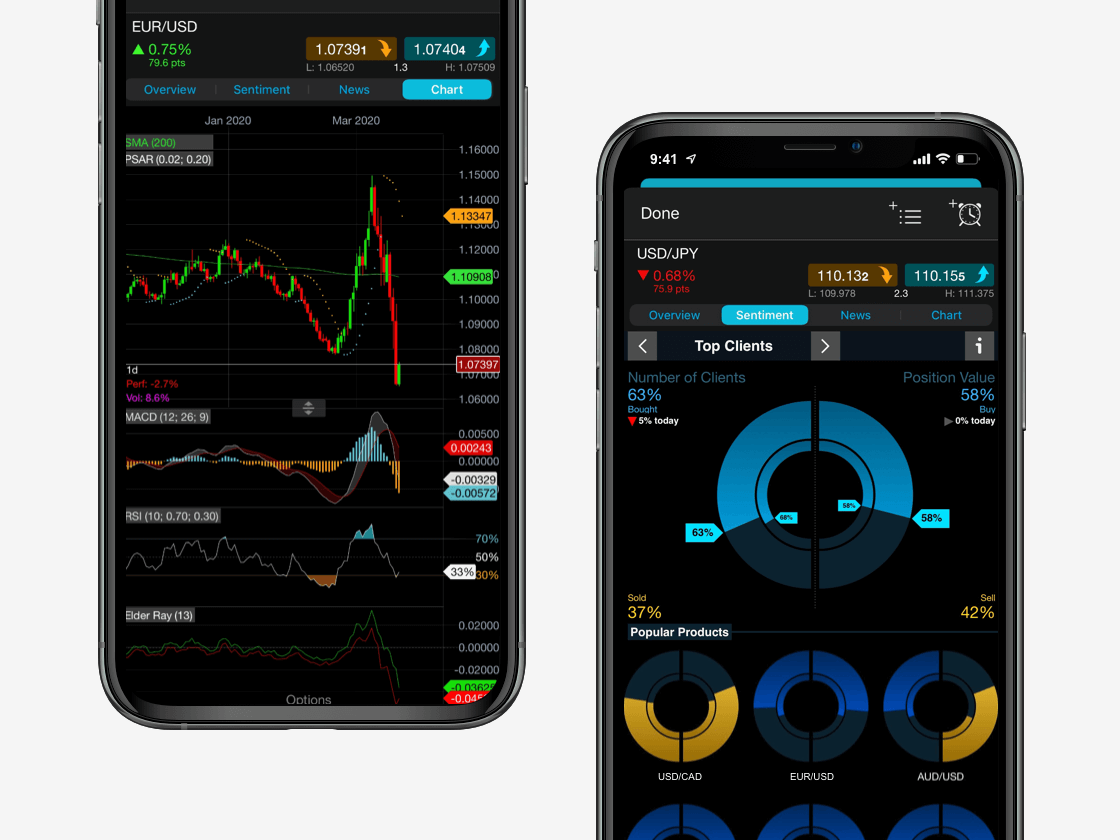

The indicators use both 200-day and 50-day MAs to signal whether a death cross or golden cross has occurred. When the 50-day MA crosses above the 200-day MA from below, this is a golden cross. Meanwhile, a death cross is when the 50-day MA is above the 200-day MA and then crosses below the 200-day MA.

A golden cross indicates that prices may be starting to rise in a new uptrend and, therefore, a long position may be preferred by traders. Once a death cross occurs, the price of the asset is potentially starting a new downtrend, which could mean that short selling or exiting long positions would be preferred by traders.

Since these are longer-term MAs, the signals are not typically used for day trading. However, the same concept could be applied to a one-minute chart with 200-minute and 50-minute MAs.

The 200-day and 50-day MAs are not set in stone. A trader may opt to use different MA time horizon lengths. In that case, a death cross is when the shorter timeframe moves below the longer timeframe, and the golden cross is when the shorter one moves above the longer one.