The price of a market order, if larger than the level 1 price, will have a slightly wider bid-offer spread, depending on the size of your trade. As position size increases, so does the spread.

It’s possible to view up to 10 levels of price depth in your order ticket. Your chosen stake size is reflected on the right-hand side, so you can see how far down the ladder your position sits, between levels 1 and 10. The further down the price ladder, the wider the potential spread will be. Remember that this is still relative to the size of your position as the underlying liquidity in the market for this product.

As the price ladder uses real-time liquidity, your trade might jump between levels until you choose to execute your position. The rest of the order ticket will function as normal, so you can set your risk-management levels before executing your trade. The level 1 price level is still clearly visible, so you can compare it to your price depth. Once you are happy with your transaction, you can go ahead and execute your trade.

If you are setting a stop-entry or limit order of a larger size, a trade will be triggered once the product price reaches the level 1 price, but it will be executed using the relevant price depth. When closing out a trade with a position size greater than the level 1 price from the account section of the platform, the price ladder will display all 10 levels of depth again.

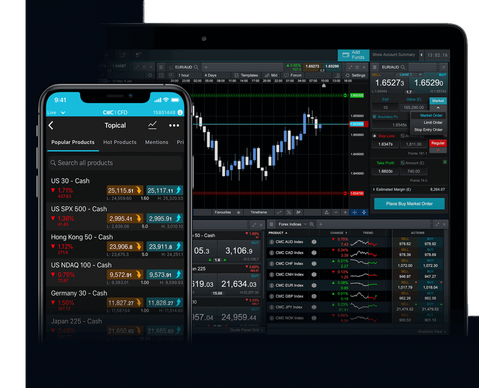

From here, you will see the position linked to a price depth level to execute your trade in one transaction. When looking in your history section, all trades executed using the price ladder are accompanied by the chart levels, as shown in the image above. You are able to see all 10 levels of price depth and the actual level you were executed at, relative to your position size.

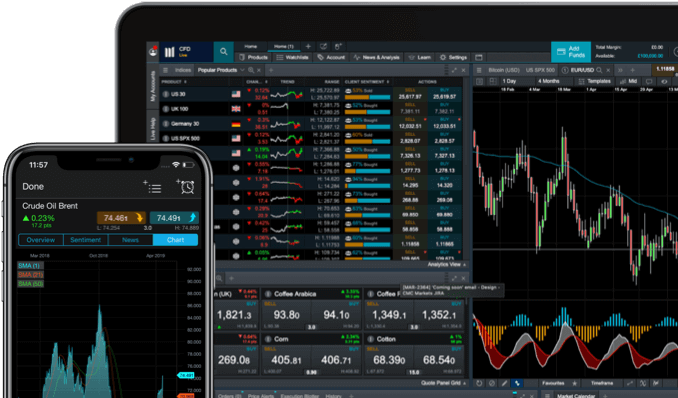

Remember that the price depth should only affect larger trade sizes. We offer price laddering for both spread betting and CFD trading accounts.