The first earnings season of 2024 is out of the way, and some of the winners and losers, among them Nvidia, Meta and Eli Lilly, could be driving further action in the months ahead. Nvidia and Eli Lilly both outshone Microsoft, while Bristol-Myers Squibb weighed on overall earnings growth for the S&P 500 in Q1.

- TSMC expects Taiwan’s strongest earthquake in 25 years to have had minimal impact on Q2 revenue.

- Apple is bringing ChatGPT to its operating system, which could boost iPhone sales in Q3 and Q4.

- Bristol-Myers Squibb plans to cut costs by $1.5bn between now and the end of 2025.

The most recent corporate results have given Wall Street a boost.

Earlier this month, Goldman Sachs raised its end-of-year estimate for the S&P 500 to 5,600 — the index is up 14.6% year-to-date through 21 June, to 5,464.62.

In a note to clients, equity strategists led by David Kostin said their upbeat outlook was “driven by milder-than-average negative earnings revisions and a higher fair value P/E multiple”. If the mega-caps in the group deliver exceptional profit margins for the rest of the year, then the index could reach 6,300. On the flip side, they warned that if earnings estimates end up being too optimistic, then it could potentially fall to 4,700.

Here’s how some of the biggest stocks performed when they delivered their latest results, as well as an overview of what may be in store in the quarters ahead.

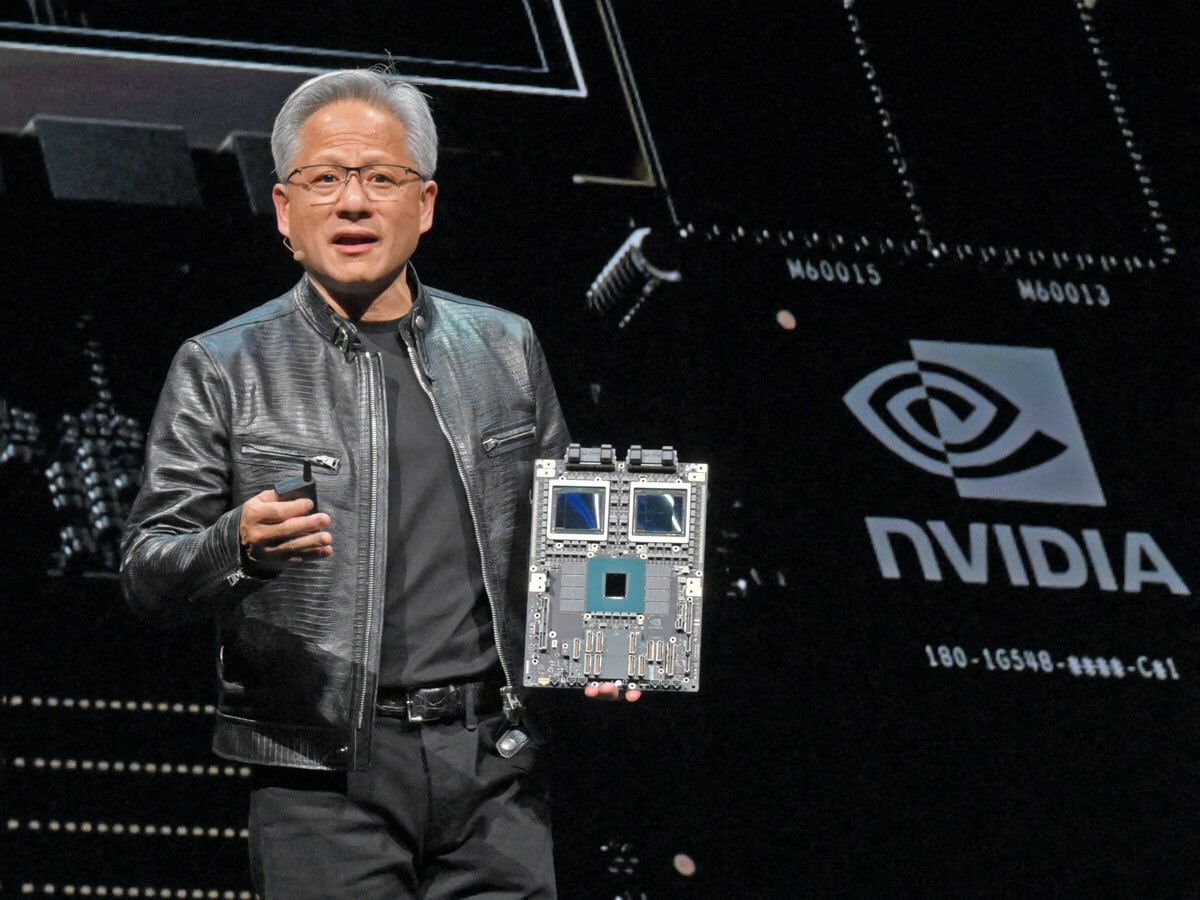

Nvidia’s Earnings Skyrocket as AI Frenzy Continues

All eyes are on Nvidia [NVDA], which briefly surpassed Microsoft [MSFT] to become the world’s most valuable company last week.

Nvidia’s share price skyrocketed in April after the chipmaking giant raked in $26bn in revenue, versus the $24.6bn expected by analysts polled by LSEG. Net income ballooned from $2bn in Q1 2023 to $14.9bn. Revenue is expected to hit $28bn in the current quarter.

Beyond Q2, Nvidia plans to start shipping Blackwell, the successor to its H100 GPU, used to train large language models, in the second half of the year. This is important, because CEO Jensen Huang expects “a lot of Blackwell revenue”, as he stated on the Q1 earnings call at the end of May.

Nvidia carried out a 10-for-1 stock split in early June. The move should enhance the stock’s liquidity: it has opened itself up to a wider pool of investors, some of whom may have previously been put off by the share price, which was north of $1,000 at the time.

TSMC Benefits from AI Demand

Taiwan Semiconductor Manufacturing Co (TSMC) [TSM], which manufactures Nvidia’s GPUs, reported that Q1 profits increased amid the need for high-end chips to power artificial intelligence (AI) software and applications. Net income was up 8.9% year-over-year, while revenue rose 16.5%. Second-quarter revenue is expected to jump 27.6% at the midway point, to a range of $19.6–20.4bn.

In April, the 7.2 magnitude earthquake that hit Taiwan impacted some wafers in the process, which had to be scrapped. TSMC’s Chief Financial Officer Wendell Huang said on the Q1 earnings call that “we expect most of the lost production to be recovered in Q2 and, thus, minimum impact to our Q2 revenue”.

The earthquake has highlighted vulnerabilities in TSMC’s supply chain. Future shocks and disruptions could impact its ability to meet demand, which would potentially have a knock-on effect on the likes of Nvidia.

Apple’s AI Push Could Drive iPhone Sales in Q3 and Q4

Apple [AAPL], another one of TSMC’s key customers, reported quarterly revenue dipping 4% year-over for the quarter ended in March, with iPhone sales slumping 10%. Investor enthusiasm was boosted by the announcement of a $110bn buyback, however.

There was some positive news at the end of May when data showed iPhone sales in China rose 52% year-over-year in April. Earlier this month, the Cupertino company unveiled its much-awaited AI strategy, dubbed ‘Apple Intelligence’, and a partnership with OpenAI, which will see ChatGPT integrated into iOS 18, to be released later this year alongside the iPhone 18.

Apple Intelligence features will only be available on the iPhone 15 or later, which could push people into upgrading their devices. Needham’s Senior Media and Internet Analyst Laura Martin told YahooFinance that the impact may be limited, though, as ChatGPT is banned in China, which accounts for a fifth of iPhone sales.

Meta’s Commitment to AI Will Be a Multi-Year Investment Cycle

It wasn’t all good news for tech’s mega-cap stocks. Shares in Meta [META] sank in April after Mark Zuckerberg doubled down on his AI investment, warning of higher expenses ahead, as well as lower-than-expected revenue.

“Smart investors see that the product is scaling and that there’s a clear monetisable opportunity there even before the revenue materialises,” Zuckerberg said on the earnings call in April.

Meta raised its full-year capital expenditure from a range of $30–37bn to a range of $35–$40bn. Zuckerberg indicated that he expects this to be the start of a “multi-year investment cycle”.

Eli Lilly’s Tech-Like Earnings Growth

Performing like a tech stock was Eli Lilly [LLY], with Q1 revenue growth of 26%. For comparison, Microsoft’s was 17%.

However, another pharma stock, Bristol-Myers Squibb [BMY], dragged the S&P 500 down. According to FactSet Senior Earnings Analyst John Butters, the index would have been reporting earnings growth of approximately 8% if Bristol-Myers Squibb’s results were excluded. Instead, Q1 growth was approximately 5.4%.

The pharma giant reported a quarterly loss due to one-time charges associated with “recently closed transactions”. Its full-year earnings forecast has been slashed from a range of $7.10–7.40 per share to a range of $0.40–0.70 per share.

The company has also announced that it is executing a “strategic productivity initiative” that should result in $1.5bn of cost-savings by the end of 2025 and will involve shedding 2,200 jobs.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy