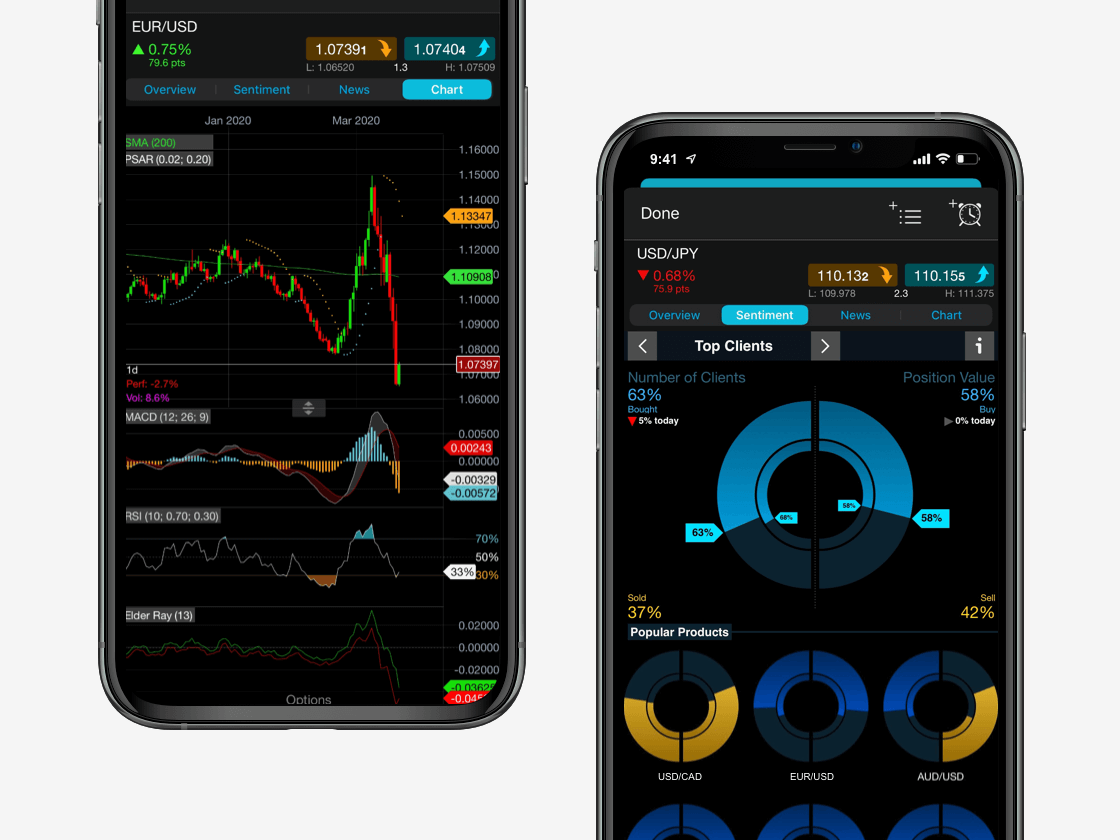

Spread betting forex is a tax-free* method of trading the currency markets. Traders are able to speculate on the price movements of currency pairs by opening a position based on whether they think the currency will appreciate or depreciate. If you expect the value to rise, you would open a long or ‘buy’ position, or if you expect the value to fall, you would open a short or ‘sell’ position.

With a spread betting account, you never own the underlying asset. If the market moves in your favour, this will lead to capital profits, but equally, if the market moves against your position, this will result in losses.

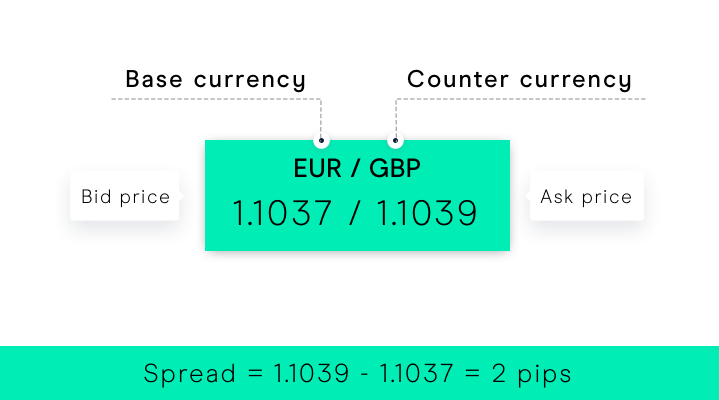

When trading currency pairs, there are usually two quotes given: the bid price and the ask price. The difference between the bid (sell) price and ask (buy) price of a currency pair is referred to as a spread in forex. In general, traders prefer currency pairs with tighter spreads, as this allows them to enter and exit trades more quickly with lower transaction costs.