The worldwide Covid-19 pandemic created a very volatile and uncertain stock market throughout 2020, which has continued into 2022. Whereas some traders are more risk-averse and prefer to invest in lower-risk shares such as blue-chips or those within a defensive sector, others may profit from trading quickly fluctuating share prices and choppy trading charts. If you are interested in trading on volatility, you should take caution and use risk-management controls in order to avoid losses as much as possible.

Most volatile UK stocks

Join us as we review the most volatile stocks in the UK from the FTSE 250 index over a 260-day period (from October 2020 to July 2021), and we cover some tips and strategies for trading on volatile stocks.

Why trade on stock market volatility?

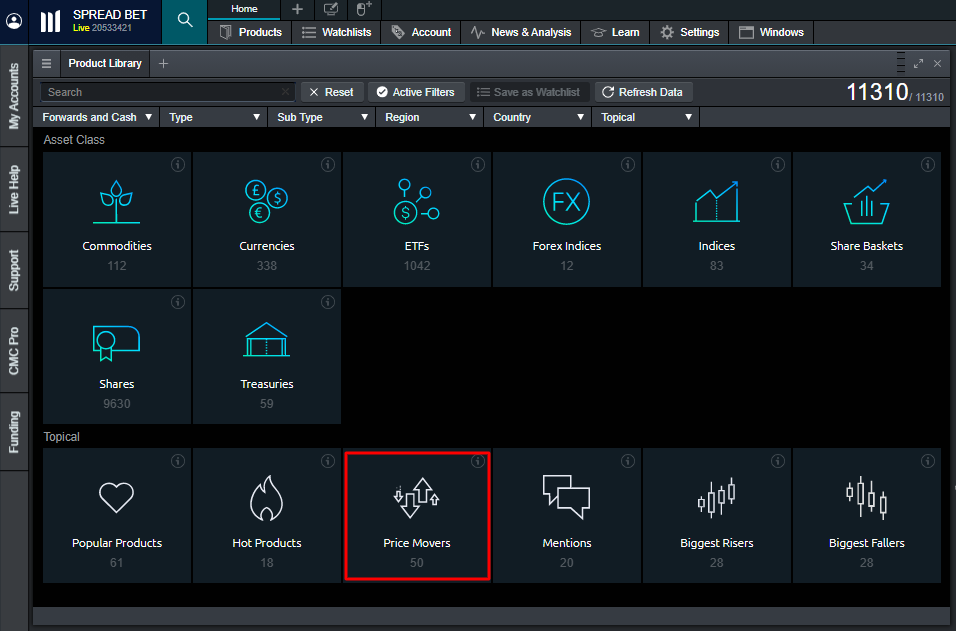

How to find volatile stocks on our platform

Our platform’s product library comes with a number of automated categories that gather information on stock data. One of them is the ‘price movers’ category, which displays products which have had unusual moves that are more than two standard deviations outside of their average daily price. This watchlist is updated in real time and takes the data from the last 30 days.

Once you access these volatile stocks, you can filter by industry (sub-type) and country. By selecting UK, for example, you may pull up some of the most volatile stocks mentioned in this article, or British shares based on more recent data.

Open an account to get started and browse our library of platform guides, which will help you to navigate the Next Generation trading platform.

How to measure a stock’s volatility

The most common way to measure a stock’s volatility is through the standard deviation or variance between returns from the same asset.

In this case, the values shown in the table below are the relative volatility in comparison to the FTSE 250 average, given by the standard deviation of logarithmic close to close returns over 260 trading days. Please note that the following information is taken from data on our Next Generation trading platform.

Most volatile stocks in the FTSE 250

| Company | Industry | 260-day volatility |

|---|---|---|

| Cineworld (CINE) | Entertainment | 330.3% |

| Tullow Oil (TLW) | Oil & Gas | 237.2% |

| SSP Group (SSPG) | Food & Beverage | 224.8% |

| Restaurant Group (RTN) | Hospitality | 224.6% |

| Network International (NETW) | Finance | 219.2% |

| Carnival (CCL) | Travel & Tourism | 215.1% |

| TUI Group (TUI) | Travel & Tourism | 202.8% |

| FirstGroup (FPG) | Travel & Tourism | 197.3% |

| Trainline (TRN) | Travel & Tourism | 196.7% |

| Micro Focus (MCRO) | Information Technology | 194.6% |

| Capita Group (CPI) | Outsourcing | 190.7% |

| EasyJet (EZJ) | Travel & Tourism | 188.5% |

| Indivior (INDV) | Pharmaceutical | 188.4% |

| Mitchells & Butlers (MAB) | Hospitality | 184.3% |

| WHSmith (SMWH) | Retail | 175.3% |

| AO World | Retail | 174.9% |

| Hochschild Mining (HOC) | Mining | 174.3% |

| National Express (NEX) | Travel & Tourism | 173.8% |

| Babcock (BAB) | Aerospace & Defense | 171.1% |

| Virgin Money (VMUK) | Finance | 164.0% |

Please note that the statistics included in the analysis below are taken from published company data, such as annual revenue reports and quarterly updates.

1. Cineworld

Given the nationwide restrictions placed in 2020, the world’s second-largest cinema chain remained closed for the majority of the year, only re-opening for brief breaks in-between lockdowns. Annual revenues declined to $852.3m, compared with $4.37bn for the previous year. The company’s debt currently sits at approximately $8bn and expectations for 2021 revenues were in the region of $2.5bn, with hopes that there will be no further pandemic induced setbacks.

As a result, Cineworld slashed its annual dividend in order to improve its cash flow and hasn’t yet announced a date for when it will start re-offering quarterly payouts to shareholders. Given this slumping performance, Cineworld stock has seen an increase in short sellers over the past year, although there is still hope that the re-opening of the world’s entertainment centres may have a positive effect on Cineworld’s share price, as lockdowns start to ease across the UK.

Mid-2020, the company also pulled out of its $2.3bn proposed Cineplex acquisition and in 2021, it has been the subject of takeover speculation, further adding to the company’s volatile price action. Therefore, it’s worth keeping an eye on company news when trading Cineworld shares.

2. Tullow Oil

A leading oil and gas exploration company in the UK, Tullow Oil has understandably made the list of most volatile UK stocks. Demand for crude oil fell in 2020 due to an over-supplied market and a halt on international travel, leading to a crash in oil prices. Brent Crude Oil was trading at an all-time low price of under $20 in April 2020, which was partially due to the pandemic and partially due to the oil price wars between Russia and Saudi Arabia.

As well as the past 260 days, Tullow Oil saw its share price fall in 2019 due to reduced oil production targets, a dividend suspension and the replacement of its CEO. It currently has a $3bn pile of debt and reported losses of $1.3bn in 2020 compared with a profit of just $103m. However, the company has revealed a new strategy to commit 90% of its investments to West African oilfields and reduce its focus on exploration. It expects to generate $7bn of operating cash flow over the next 10 years, which it plans to use to cut debts and re-introduce shareholder dividends.

3. SSP Group

SSP Group runs almost 3,000 food and beverage outlets across various transport locations, such as train stations and airports, in 35 countries. The company works through its own brands, such as Upper Crust and Camden Food Co, as well as third-party suppliers like Burger King and Starbucks. It is no surprise that SSP has made the list of most volatile stocks, given the halt on national and international travel from the UK over the past year, meaning that many of its outlets were forced to close or receive a much slower flow of customers than usual.

SSP Group announced in July 2021 that its CEO will step down at the end of the year, triggering a 5% share price fall. This stock could continue to stay volatile throughout 2022 while the company looks for a replacement. Furthermore, European restrictions on travel are starting to loosen and this may help to boost SSP’s revenue, even if only temporarily.

4. Restaurant Group

Restaurant Group is another victim within the food industry to have announced losses throughout 2020, as the likes of Frankie & Benny’s, Wagamama and Chiquito suffered due to the closure of restaurants and bar chains, only opening for takeaway or online orders. 10% of its sites didn’t re-open after the first lockdown in July 2020 where the footfall was expected to be considerably weak, such as airport locations. Its sales decreased by 57%.

The company has debts of around £470m but managed to raise over £175m in March 2021 through a funding round as it prepared to re-open the majority of its outlets. Management of the Restaurant Group is planning to expand the number of pubs and Wagamama restaurants across the country, as this is where the company sees the highest return on investment. Whether successful or not, this could make for a fluctuating stock price throughout the rest of 2022.

5. Network International

As a provider of technology-enabled payment solutions operating primarily in the Middle East, you may not expect this finance company to have had such a volatile year. Covid-19 impacted consumer spending and tourism across the region and the company saw a reduction in Total Processed Volume (TPV), causing revenue to fall by 15% in 2020. Despite this, the overall number of transactions rose by 0.8% and the company expected its total revenue in 2021 to return to the level recorded back in 2019. This stock was particularly popular for shorting throughout the pandemic, as it continually suffered setbacks.

In June 2021, Microsoft announced that it would be partnering with Network International to improve its omni-channel platform across the Middle Eastern region. This caused Network International’s share price to jump on the day. If further developments or projects are announced by the company, this may indicate a volatile year, or even a potentially promising one in terms of growth.

Volatile travel and tourism stocks

As shown in the table above, it is clear that the travel and tourism industries dominate the list of most volatile stocks. According to the Office of National Statistics (ONS), these were two of the hardest hit throughout the pandemic, as business turnover fell to its lowest level in May 2020 at just 26% of its original turnover, when compared with 73.6% in other industries. Accommodation and travel agency businesses saw the sharpest decline in turnover during the first national lockdown in the UK, falling to 9.3% of their original levels.

EasyJet and TUI

Popular flight operators and around-the-world tour providers such as STA Travel and Flybe were forced out of business within the first few months of lockdown. This caused panic within the airline industry and share prices began to tumble for the likes of EasyJet and TUI. Airline stocks can be particularly reactive to breaking news from the government and can rise upon the easing of lockdowns or fall upon new restrictions being made which cause a more negative than expected outlook for future profits. EasyJet recorded a £701m loss for the first half of 2021, with passenger numbers down 89.4%.

Read more about trading on news announcements.

Trainline, FirstGroup and National Express

Coach and train operators followed a similar pattern to airlines throughout 2020, as the government encouraged British citizens to stay at home and avoid public transport. Upon the announcement of a new vaccine being introduced in the UK in December 2020, share prices for FirstGroup and National Express soared. However, this was quickly overturned by new lockdown measures, causing the shares to drop back by 5% in January. Even as the country starts to re-introduce widespread travel, the rise in people working from home permanently has caused a strain on Trainline’s revenue. Operating loss for 2020 was at £43m compared to £8m in 2019, and group net ticket sales only reached 19% of the previous year.

Carnival

The world’s most popular cruise line based on annual numbers of passengers and fleet lost over 70% if its original value throughout 2020 as cruise trips were put on hold worldwide. It didn’t make matters easier that some of the earliest UK cases were discovered onboard the Diamond Princess cruise ship, which was docked in Japan in March 2020. These vessels quickly became an incubator for the virus, spreading doubt among investors that brands such as Carnival would fare well throughout the pandemic.

Volatile retail and hospitality stocks

As we have seen above, companies within the hospitality sector such as SSP Group and Restaurant Group have seen major losses over the past year, causing their share prices to tumble and rise at different points.

Mitchells & Butlers

Another company on the list of FTSE 250 most volatile stocks to replicate this performance is Mitchells & Butlers, which runs over 1,700 pubs, bars and restaurants throughout the UK. This is the operator of well-known brands such as Harvester, O’Neill’s, All Bar One, Toby Carvery and Nicholson’s, all of which have been closed for indefinite periods of time throughout 2020 and 2021. Mitchells & Butlers announced a 67% fall in total sales at the end of Q1 and the company had a monthly cash burn of £35m to £40m, leaving investors wondering if there would be a dilution to their shares in order to raise extra capital. The company announced plans to raise £350m in capital through a share offering in February 2021, pushing its stock price slightly higher.

WH Smith and AO World

The retail industry also took a tumble as all non-essential shops in the UK were forced to close. Companies such as WH Smith that are dependent on customer footfall saw major losses in 2020, leading to job cuts and a re-structuring of the business, while AO World’s share price plummeted way below its IPO valuation at 48p. Since then, it has bounced back by over 300% as the UK starts to open gradually.

Meanwhile, WH Smith has revealed its intention to expand its travel business after raising £325m in financing in the form of convertible bonds. It will open 100 new shops across the UK in locations that are gaining an increased footfall, such as airports and train stations, as this is where the company saw over 50% of sales driven before the pandemic struck.

How to trade on volatile stocks

- Open a live account.

- Find volatile stocks through our ‘price movers’ category on the platform or type the specific stock into the search bar.

- Fill in the order ticket to open a buy or sell position.

- Add risk-management controls, such as stop-loss and take-profit orders.

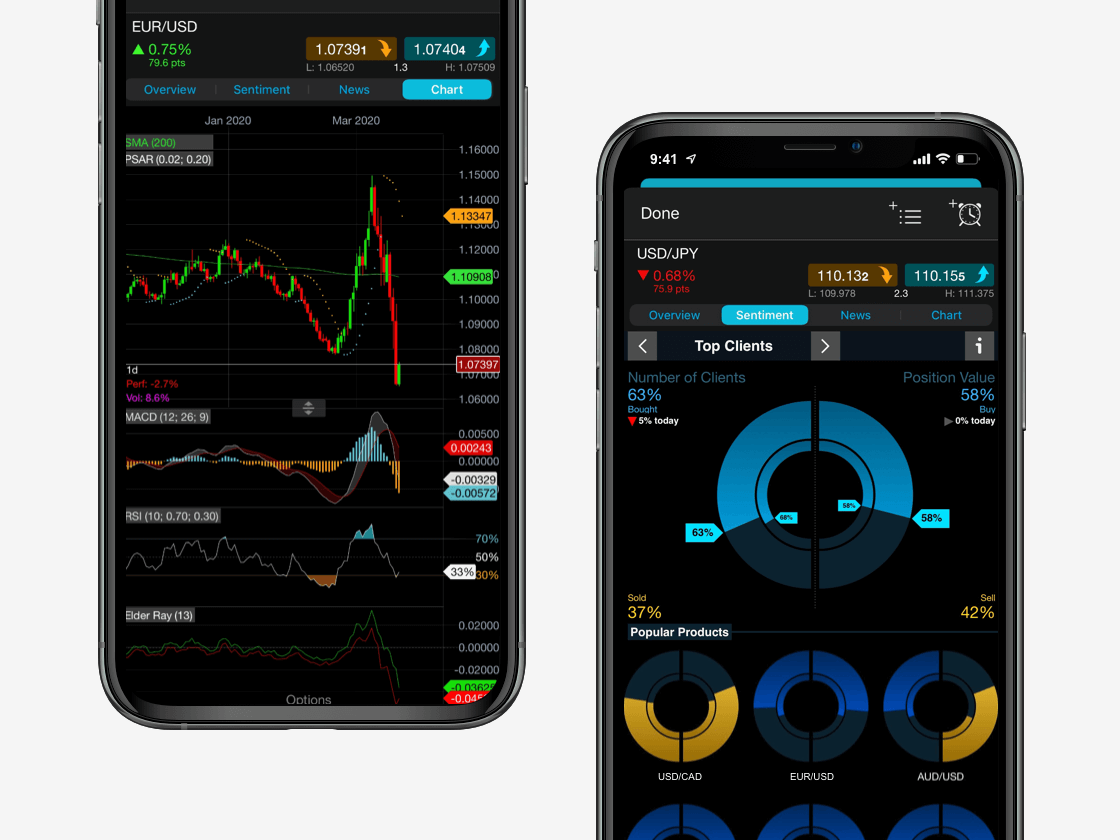

- Brush up your knowledge on technical analysis to effectively monitor fast-paced trading charts.

Our spreads and prices

Pricing is indicative. Past performance is not a reliable indicator of future results.

What are some strategies for trading on volatile stocks?

Short selling

When there’s investor doubt or negative sentiment for a stock, traders will often choose to short the asset by opening a sell position. By using this strategy, traders are aiming to take advantage of a stock’s rapid price fluctuations by selling the stock high and re-purchasing it again when it drops to a lower price. Volatile stocks may see this process repeat multiple times, allowing traders to lock in multiple profitable trades in a short time period. Learn how to short a stock.

Price action trading

Price action trading involves monitoring trading charts closely to spot a stock’s rapid price movements. This is an important part of technical analysis and most price action traders will ignore the use of technical indicators, instead aiming to spot momentum, trend reversals and breakouts on the chart, which are particularly prominent in volatile stocks. Learn about price action trading.

Trading breakouts

A stock breakout occurs when a share price moves beyond a level of support and resistance that it has struggled to move above or below in the past, often caused by buyer supply and demand. This can start with an initial breakout on a trading chart and turn into the stock seeing strong price momentum in a short period. Learn how to identify breakout stocks.

Seamlessly open and close trades, track your progress and set up alerts

FAQ

What are volatile stocks?

Volatile stocks are shares that see rapid and fluctuating price movements on a regular basis. This may be due to immediate events like news releases and company earnings reports, or it could be due to a long-term period of instability and uncertainty within the economy. Learn about different types of economic indicators that can have an effect on share prices.

How do I trade on volatile stocks?

To start trading on the price movements of the most volatile stocks, open a trading account and choose whether you want to spread bet or trade CFDs. Learn how to short a stock with our extensive guide.

What are some benefits of trading on volatile stocks?

Volatile stocks may be seen as a high-risk, high-reward product, meaning that it could increase profits by a large percentage if the trade is successful; however, it can magnify losses just as equally. Learn about risk-management tools to consider when trading on volatile stocks.

How can I view the most volatile stocks?

To view the most volatile stocks on our platform, create a trading account. Within the product library, select the topical category called ‘price movers’. You can also view more short-term assets that have risen in popularity through the ‘hot products’ feature, which is updated hourly.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.